Payor: Payments Admin Guide

- Last updated

- Save as PDF

General Availability in Select Markets (United States)

Procore Pay

Procore Pay Table of Contents

- Welcome

- Multi-Factor Authentication (MFA)

- Funding Accounts

- Payments Permissions

- Project Controls

- Workflow Settings

- Advanced Settings

- Change History

- Lien Waivers & Templates

- Sub-Tier Waivers

- Payment Requirements

- Subcontractor Invoices

- Disbursements

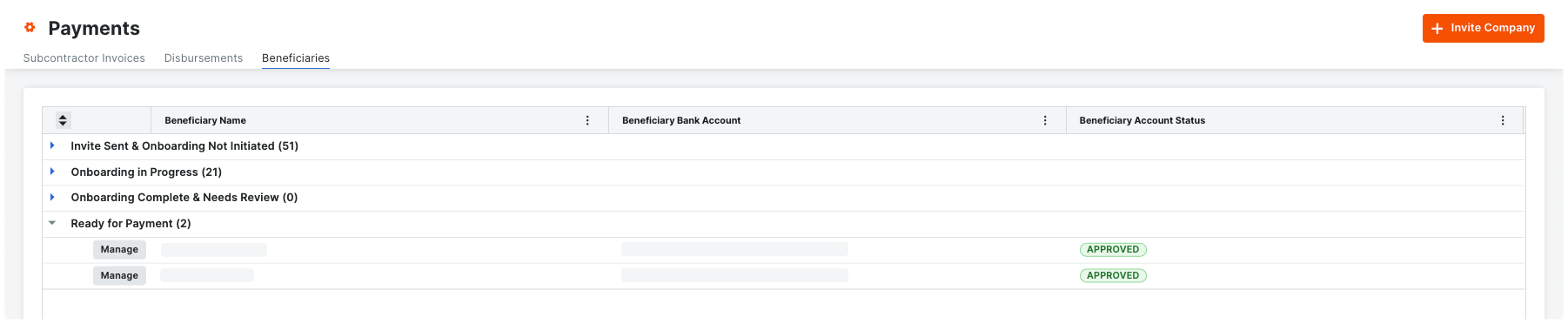

- Beneficiaries

Get Started as a Payments Admin

|

This Payments Admin Guide provides your team's designated Payments Admins with instructions for the actions they can perform with Procore Pay Learn how to configure the settings for Procore Pay:

Learn about the actions you can perform with the Payments tool:

|

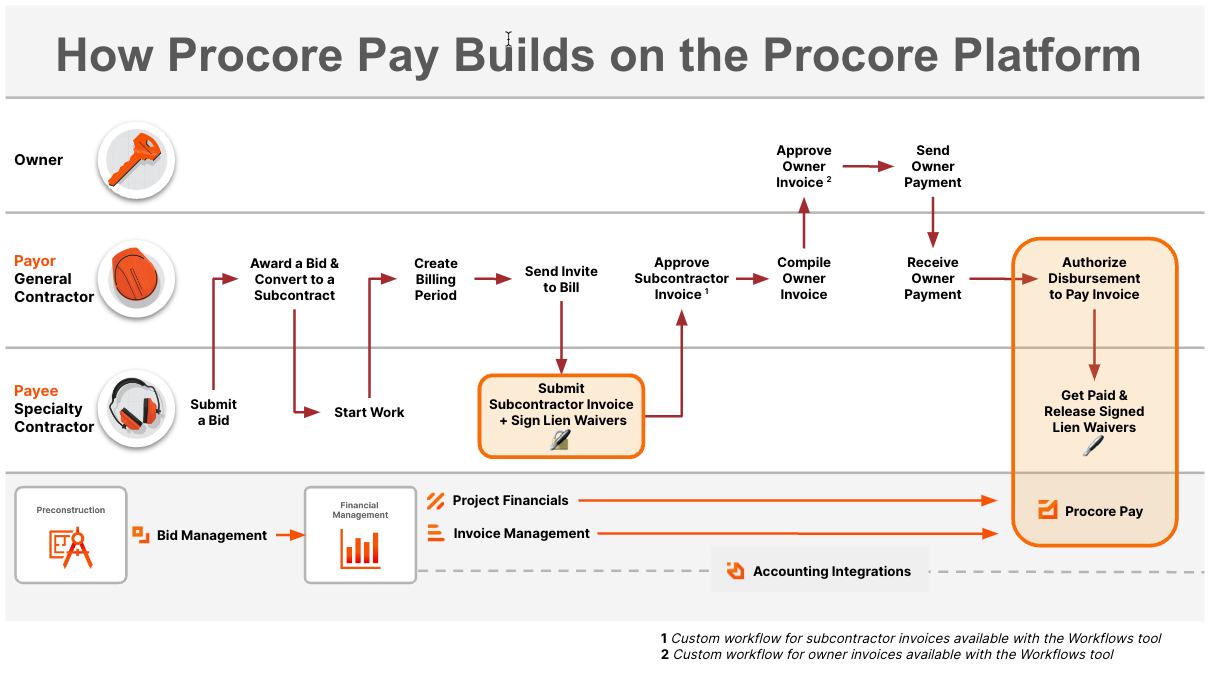

What is Pay?

Pay builds on the existing Project Financials and Invoice Management tools in Procore to streamline the subcontractor invoice payment process and automate the lien waiver exchange.

How do funds flow?

Only a Payments Admin or a Payments Disburser can Create Disbursements in Procore Pay. Once authorized, a disbursement initiates these actions depending on your service. Payors can choose one (1) of two (2) services:

Procore Pay with Procore Payment Services, Inc.'s Money Transmission Services

Click here to view the funds flow.

- A drawdown request is sent from Procore Payment Services, Inc.’s (PPS) For Benefit Of (FBO) account to initiate a drawdown of disbursement funds from the payor's funding account.

- PPS executes the wire transfer from the payor's funding account to the PPS FBO account.

- The PPS FBO account executes the payment orders in the disbursement.

- The individual payments in the disbursement are sent to the payee's bank accounts (a.k.a., the beneficiary accounts in the payor environment).

Procore Pay with Goldman Sachs Transaction Banking (TxB)

Click here to view the funds flow.

- A drawdown request is sent from the deposit account to initiate a drawdown of disbursement funds from the payor's funding account.

- The financial institution executes the wire transfer from the payor's funding account into the payor's deposit account.

- The deposit account executes the payment orders in the disbursement.

- The individual payments in the disbursement are sent to the payee's bank accounts (a.k.a., the beneficiary accounts in the payor environment).

What is a Payments Admin?

In Procore Pay, a Payments Admin is a designated Procore user who administers the Company level Payments tool for that company's Procore account. Typically, one (1) or a small number of trusted users are designated to perform the tasks associated with this role.

Tip

Are you the designated Payments Admin for your company? If your company pays invoices with Procore Pay and your company designated you as a Payments Admin (see Add Payments Admins as a Payor), you can learn about the actions you can perform in the Payor: Payments Admin Guide.

To learn more about the Payments Disburser role:

- What is the difference between a Payments Admin in Procore Pay and a Company Admin in Procore?

- Why do we need to designate a Payments Admin?

- How is the Payments Admin role assigned to Procore Pay users?

- Do Payment Admins in Procore Pay require Multi-Factor Authentication (MFA)?

- Does a Payments Admin in Procore Pay need additional permissions on Procore's tools?

- Who are my company's Payment Admins in Procore Pay?

What is the difference between a Payments Admin in Procore Pay and Company Admin in Procore?

- A Payments Admin is a designated role for Procore Pay and is responsible for the administration of the Company level Payments tool. To learn more about the Payments Admin role in Procore Pay, see Payor: Payments Admin Guide.

- A Company Admin is responsible for the overall administration of your company's Procore account. To learn more, see What is a Company Admin?. In Procore, a Company Admin is also called your Procore Administrator. For more information, see the Procore Administrator learning path.

Important

Due to the sensitive nature of financial transactions with Procore Pay, a Company Admin has limited access to the Payments tool. To provide a Company Admin with access to the Payments tool, an authorized signer at your company must also designate them as a Payments Admin. See Add or Remove Payments Admins as a Payor

Why do we need to designate a Payments Admin?

Your company must designate a Payments Admin to administer the features and settings governed by the Company level Payments tool. In addition to configuring settings that facilitate payment processing, the Payments Admin role is also responsible for managing your company-level lien waiver settings, configuring payment requirements, and managing custom workflow templates.

How is the Payments Admin role assigned to Procore Pay users?

An authorized signer at your company must sign and complete a Procore Pay Authorized Administrator Form. See Add or Remove Payments Admins as a Payor.

Do Payment Admins in Procore Pay require Multi-Factor Authentication (MFA)?

Yes. Users in this role are required verify their identities before gaining access to Procore Pay and before performing sensitive transactions. To learn more, see How does MFA work with Procore Pay and why is it required?

Does a Payments Admin in Procore Pay need additional permissions on Procore's tools?

At a minimum, a Payments Admin should be provided with the following permissions in Procore.

| Procore Tool | Required User Permissions | Description | Learn More |

|---|---|---|---|

| Company Level Permissions Tool | 'Admin' on Payments | Assign the user to a Company Permissions Template with 'Admin' level permissions on Payments. | Create a Company Permissions Template |

| Project Level Commitments Tools | 'Admin' on Commitments In Procore, users with this permission level are called invoice administrators. |

Assign the user to a Project Permissions Template with 'Admin' level permissions on the Project level Commitments tool. | Create a Project Permissions Template Assign Default Project Permissions Templates in the Permissions Tool |

Who are my company's Payment Admins in Procore Pay?

As a payor using Procore Pay, ask your company's Procore Administrator or your company's authorized signer about your Payments Admins.

Tip

Want to list your company's Payment Admins for your project users? Your team can add your company's designated Payments Admins to the 'Project Team' section on each project's Home page. For instructions and required user permissions, see Add the Project Team to the Project Home Page.How does MFA work with Procore Pay?

- Why does Procore Pay require MFA?

- How does MFA work?

- Which Procore Pay users are required to log in with MFA?

- Which one-time password applications are compatible with Procore Pay?

- What are the MFA account lockout settings?

- When are Procore Pay users challenged by MFA?

- Are MFA login attempts recorded?

- Is MFA required when testing the Payments tool in our company's Sandbox?

- How do Procore Pay users troubleshoot user issues with MFA?

Why does Procore Pay require MFA?

To provide Procore Pay with a trusted method to safeguard private data related to payment transactions, it is important for end users to ensure strong password management protections are in place in your environment. To help safeguard your most sensitive operations from unauthorized account access, Procore Pay requires users to complete a multi-step account login process. This process is called Multi-Factor Authentication (MFA). It is also commonly referred to as 2FA.

How does MFA work?

To provide Procore Pay with a trusted method to safeguard sensitive bank account information and payment transactions, it is important for Procore Pay customers to ensure your environment has strong password management protections in place. To help ensure your most sensitive operations are guarded against unauthorized account access, Procore Pay users must complete a multi-factor account login process to authenticate their identity.

These factors include:

- Enter your email address and password for your Procore user account. If you are an authorized user with access permission to Procore Pay, you will be prompted to enter your user name and password on the Procore login page.

- Enter a one-time password code generated by an MFA app on a mobile device. Next, a Time-Based One-Time Password (TOTP) code is sent to your mobile device. A TOTP code is a randomly generated secret code displayed on a user's mobile device using a TOTP-compliant app.

Which Procore Pay users are required to log in with MFA?

Authorized users who have been granted role-based permissions to the Company level Payments tool are required to log in using MFA before accessing the Company level Payments tool and before performing secure financial operations.

The table below details the roles and requirements for MFA:

| Role | Before logging in... | Before performing these tasks... |

|---|---|---|

| Payments Admin | ||

| Payments Disburser | ||

| Payments Beneficiary |

Which one-time password applications are compatible with Procore Pay?

Procore Pay has tested two applications that can be used in your company's environment: Google Authenticator and Auth0 Guardian. However, other TOTP-compliant applications can also be used, such as Microsoft Authenticator.

The application used in your company's environment is likely determined either by your company's owner and/or your IT department. Procore has tested these TOTP apps for compatibility with Procore Pay:

What are the MFA account lockout settings?

To prevent repeated MFA login attempts as part of an attack, designated Procore Pay users are subject to these account lockout settings:

- Number of failed login attempts to trigger account lockout: 10 (TOTP)

Notes:- Procore lockout settings configured in the Company level Admin tool do NOT apply with MFA enabled.

- If you are locked out of your account, contact Payment Operations to request an MFA reset.

When are Procore Pay Users challenged by MFA?

Your company's authorized Payments Admins and the Payments Disbursers designated by your Payments Admin are required to provide multiple verifications every time they perform one of these actions in the Procore web application:

- Log in to your company's account in the Procore web application.

- Navigate to the Company level Payments tool.

- Creating or submitting a disbursement:

- If using Procore Pay to send payments without the Workflows tool, before a Payments Disburser creates a disbursement in the Payments tool.

- If using Procore Pay with the Workflows tool, before the designated Workflow Approver submits a disbursement.

- When the Company level Payments tool is idle for more than 30 minutes in a user session.

Are MFA login attempts recorded?

Yes. Every attempted MFA login and its outcome is logged. Records are retained in the log for six (6) years.

Is MFA required when testing the Payments tool in our company's sandbox account?

Procore Pay is not available in your company's Sandbox account.

How do I troubleshoot user issues with MFA?

Below are tips for troubleshooting common issues with MFA as a Procore Pay user.

| Issue | How to troubleshoot... | How to escalate... | For assistance |

|---|---|---|---|

| Your account has been locked after multiple consecutive login attempts. | Number of failed login attempts to trigger account lockout: 10 | Contact Procore Pay Operations to verify your identity and request an MFA reset. | Contact Payment Operations |

| You do not have your mobile device with you or your device is powered OFF. | You can finish authentication using the recovery code that you were provided during setup. See Set Up MFA for Procore Pay on Your Device. | Contact Payment Operations | |

| You forgot your Procore password. | Reset your Procore password. After resetting your password, be sure to type in the new password manually when logging in. Your browser could autofill a previous password that is no longer valid, so manual entry is recommended. | Contact Support | |

| Your transaction expires. | When logging in with MFA, users must submit their first and second factor within five (5) minutes. If you exceed this time, you will need to log in again and obtain a new secret code (TOTP). | Contact Payment Operations | |

| You need to remove or delete a user from MFA |

You cannot remove MFA requirements for a user who has Payments Admin or Payments Disburser permissions. You must remove the user's permissions to Pay to remove the MFA requirement. To remove the MFA requirement for a Payments Admin user by removing their Payments Admin permission, contact Procore Pay Support. |

Contact Payment Operations | |

| Your account shows an 'incorrect code' message. | Make sure you entered the correct code, and check that the date/time settings on your mobile device are correct:

|

Contact Payment Operations |

Set Up MFA for Procore Pay

- Install an Authenticator App on Your Mobile Device

- Log in to the Procore Web Application

- Log in to the Procore Web Application with MFA

Install an Authenticator App on Your Mobile Device

Before you begin the login steps, install an authenticator app on your mobile device. Procore Pay's MFA solution is compatible with TOTP-compliant Authenticator apps.

Important

- You must be located in the United States. Access to Procore Pay is NOT available to users outside of the United States.

- If your device is managed by your company, you may need permission to download the TOTP-compliant password application on your Android or iOS mobile device.

Log in to the Procore Web Application

Authorized Procore Pay users will use these steps to log in to Procore Pay for the first time and enroll their device in MFA.

- On your computer, go to the Procore web application at: https://app.procore.com.

- At the login screen, enter your Procore email address and password. Then, click Log In.

If you are a designated 'Payments Admin', 'Payments Disburser', or 'Payments Beneficiary Approver' in the payor environment, the MFA solution requires you to complete the steps below. See Log in to Procore Pay with Multi-Factor Authentication.

Log in to the Procore Web Application with MFA

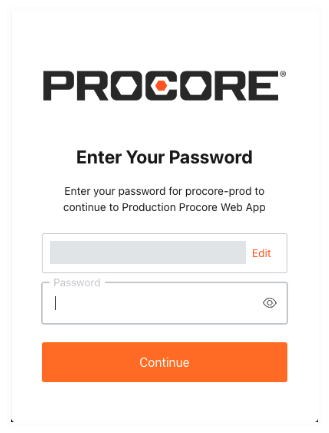

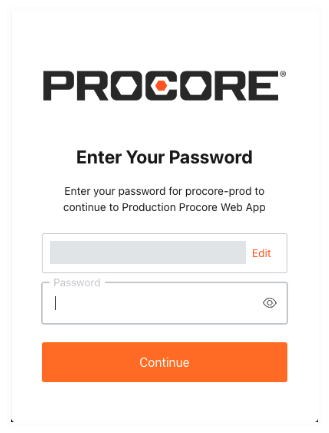

- On the Enter Your Password page, enter your Procore Email Address and Password again.

- After entering your login credentials, follow the appropriate steps below:

Examples

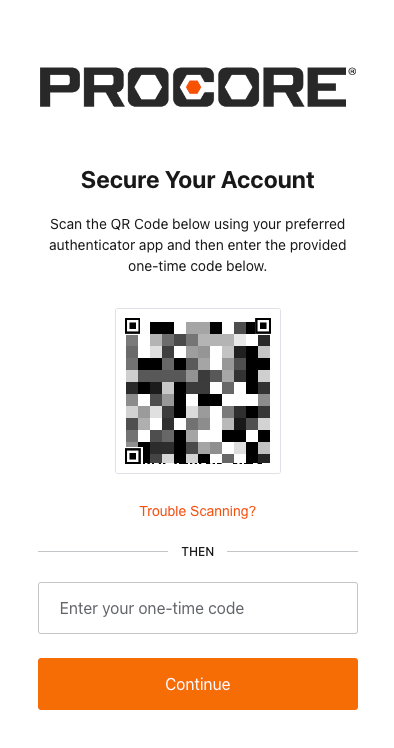

If Your Device is Not Enrolled in MFA

If your mobile device is NOT enrolled in MFA, the Secure Your Account page appears. You must download and install an authenticator app to scan the QR code. You will not be able to secure your account if scanning a QR code with your device's camera. Contact your company's IT department for guidance on the app to use in your environment.

Important

- The example steps below show you how to download and install the free Google Authenticator app.

- Your company may require you to use a different authenticator app. To confirm the app to use in your environment, contact your company's IT department.

Do the following:

- With your mobile device, open your authenticator app and scan the QR code displayed on your computer's screen.

Tip

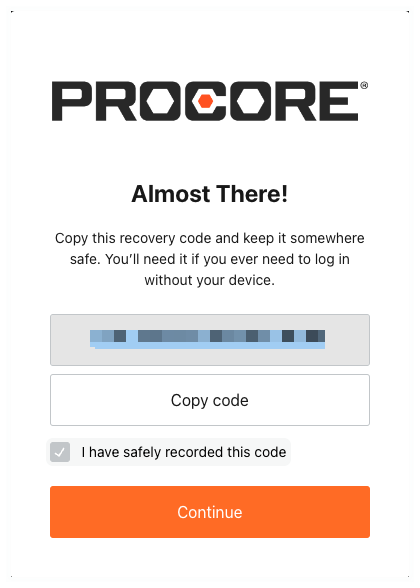

Why isn't my phone's camera scanning the QR code? To use the Scan a QR Code function, you must scan the QR code with the Authenticator app. If you are trying to scan the code using your phone's built-in camera software, it will NOT work. Instead, open the Authenticator app and then use the app's built-in scanning function. - At the Almost There page, click Copy Code and mark the I have safely recorded this code check box.

- Click Continue.

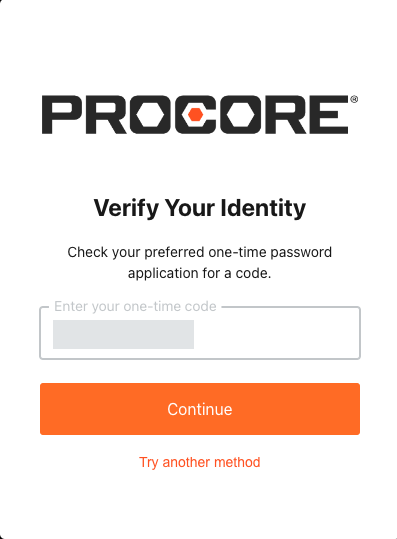

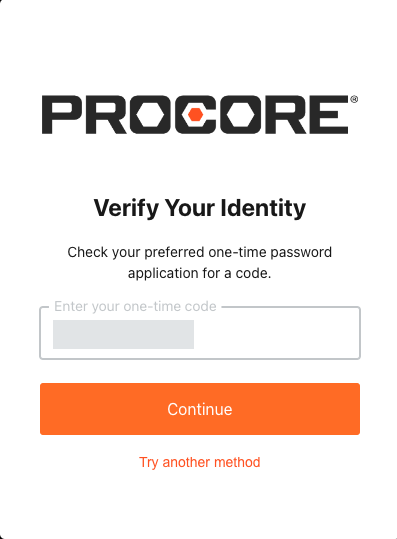

If Your Device is Enrolled in MFA

If your device has already been enrolled in MFA, the Verify Your Identity page appears. Check your mobile device's preferred one-time password application for your secret code. Then type that code in the Enter Your One-Time Code box and click Continue.

Important

If your company has implemented its own Single Sign-On (SSO) or MFA requirements, you may be required to enter additional login credentials to access Procore Pay. For assistance with those steps, contact your IT department.

Log in to Procore Pay with MFA

- Go to the Procore web application at: https://app.procore.com.

- Enter your Procore email address and password. Then, click Log In.

- Open the one-time password application on your mobile device and select your account.

Tip

Are you seeing the 'Set Up Your First Account' screen? To learn how to log in for the first time, see Set Up MFA for Procore Pay on Your Device instead of the steps below. - At the Enter Your Password screen shown below, do the following:

- Accept the email address or click Edit to modify the email address.

- Type your Password.

- Click Continue.

- Check the one-time password application on your mobile device for your secret code.

Tip

- What is a one-time password application? A One-Time Password (OTP) application is an app that is installed on a hardware device that helps to safeguard your Procore Pay account from unauthorized access. It generates a random code that you enter when challenged, to verify your identity. The code is randomly generated and changes each time you are challenged by MFA to verify your identity.

- What is an MFA device? An MFA device is an electronic device (such as a mobile phone or another device) on which you have installed the one-time password application.

- At the Verify Your Identity page, choose from these options:

- Recommended. Type your secret code in the Enter Your One-Time Code box.

OR - Click Try Another Method. Then select one of the available options. Typically, you can choose between using one of the listed authenticator apps or you can enter the recovery code that you recorded in Set Up MFA for Procore Pay on Your Device.

Tip

Why are my options different? The options that appear for you depend on the authenticator app that you installed.

- Recommended. Type your secret code in the Enter Your One-Time Code box.

- Click Continue.

If you successfully pass the login challenge, you are logged in to the Procore web application.Important

If your company has implemented its own Single Sign-On (SSO) or MFA requirements, you may be required to enter additional login credentials to access Procore Pay. For assistance with those steps, contact your IT department.Tip

Seeing a blocked account message? To safeguard your company's sensitive information, your account is automatically blocked after multiple consecutive login attempts. For assistance with resetting or recovering your account access, contact your company's Procore Administrator. Your administrator can submit an MFA reset request with Procore's Payments Operations team. See Contact Support.

Complete the Transactional MFA Challenge

- At the Verify Your Identity page, open your Authenticator app on your mobile device to retrieve your one-time-code.

Tip

Don't have an Authenticator app on your device? To learn more, see Set Up MFA for Procore Pay on Your Device. - In the Enter your one-time code box, enter the code provided by the Authenticator app.

Note: After 10 failed attempts at completing the MFA challenge, you will be logged out of Procore. You must log in again and successfully pass the MFA challenge at login to be able to navigate back to the disbursement and re-try authorization. - Click Confirm.

About Bank Accounts

With Procore Pay, payors and payees require different types of bank accounts to send and receive payments. See How do funds flow between bank accounts with Procore Pay?

Important

In Procore Pay, all bank accounts must be verified to send or receive payments. See What is a verified bank account in Procore Pay? and What do I do if my bank account is not automatically verified?This table details the different types of required bank accounts for Procore Pay.

| Account Type | Account Owner | Description | Notes | Learn More |

|---|---|---|---|---|

| Funding Account | Payor |

In Procore Pay, a funding account is a bank account where money is held by a financial institution and controlled by the payor. This is the 'Pay From' account. How does it work? After the account owner authorizes the disbursement in Procore Pay, the financial institution for the deposit account:

|

|

Add Funding Accounts as a Payor |

| Deposit Account | Payor |

In Procore Pay, a deposit account is a bank account where money is held by a financial institution to process the payor's authorized transactions. This is the transaction banking account. How does it work? After the drawdown of funds, the deposit account:

|

|

Open a Deposit Account as a Payor Add Funding Accounts as a Payor |

| Beneficiary Account | Payee |

In Procore Pay, a beneficiary account is a bank account where money is held by a financial institution and controlled by the payee. This is the 'Pay To' bank account. How does it work? After the invoice payment is withdrawn from the deposit account, each payee on the disbursement:

|

|

Add Funding Accounts

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The 'Business Entities' page in the 'Payments Processing' tab is active by default and lists the business entities that pay invoices for your company's Procore Pay software. - Go to the desired business entity and click Add Funding Account.

This opens the Add Funding Account panel.

- In the Add Funding Account panel, do the following:

- Nickname. Enter a unique nickname for the account. Nicknames quickly identify the bank account for disbursements while helping to protect the privacy of its account number.

- Business Entity. Shows the name of the current business entity.

- Account Number. Enter the full account number in this field. See Where do I find my routing and account number?

- Reenter Account Number. Reenter the full account number in this field.

- Routing Number. Enter the routing number for this account. See Where do I find my routing and account number?

- Account Type. Choose Checking or Savings.

- Bank ID. Enter a bank identifier. Procore uses the bank ID as a prefix for a payment's check number. You can change this number at any time. However, any new changes only impact new check numbers.

Important

For companies using the ERP Integrations tool: The bank identifier must match the funding account's 'Bank ID' in your integrated ERP system.

ERP Integrations tool: The bank identifier must match the funding account's 'Bank ID' in your integrated ERP system. - Check Number. Enter a check number for the next invoice payment. This provides each check a unique identification number for this account. See How does Procore assign numbers to disbursement payouts? It also helps users who Manage Disbursements to identify transactions.

Important

For companies using the

ERP Integrations tool:

ERP Integrations tool:- After Procore Pay processes an invoice payment in a disbursement, the 'Bank ID' and 'Check Number' combination is exported to your integrated ERP system.

- To avoid potential ERP synchronization errors, ensure the Check Number entered is higher than the last check number in your ERP system to prevent duplication in your integrated ERP system. See How do payments made in Procore Pay sync with an integrated ERP system?

- Preview. Verify that the 'Bank ID' and 'Next Check Number' are correct.

- Click Continue.

This launches the account verification steps.

Get Started with Account Verification

To protect your company's personal and financial information, verification is required. To learn more, see What is a verified bank account in Procore Pay?

- At the verification prompt, click Get Started.

- In Business Details:

- Company Name. Enter your company's name.

- Address 1*. Enter your company's street address.

- Optional. Address 2. Enter your company's additional address information, such as suite number or floor level.

- City. Enter the city.

- State. Enter a valid state or territory abbreviation.

- ZIP Code. Enter a valid ZIP code.

- Phone Number. Enter a telephone number with an area code.

- Optional. Website. Enter your company's primary website URL.

- Click Continue.

- In Taxpayer Identification Number, enter your ten-digit Business EIN for the Internal Revenue Service (IRS).

- Click Continue.

- On the Bank Account Details page:

- Account Type. Choose Checking or Savings.

- Account Number. Enter your bank account number. Entries have a 17 digit maximum. See Where do I find my routing and account number?

- Routing Number. Enter your account's nine (9) digit American Banking Association (ABA) routing transit number. See Where do I find my routing and account number

- On the Congratulations page, click Complete to start verification.

Procore Pay adds the funding account to the business entity and updates its status to Pending. Once Verified, the account can be used to create disbursements to send invoice payments. See What are the default verification statuses for bank accounts in Procore Pay?Tip

- What if verification fails? See What do I do if my bank account is not automatically verified?

Edit Funding Accounts

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.This opens the Payments Settings page.

icon.This opens the Payments Settings page.

The 'Business Entities' page in the 'Payments Processing' tab is active by default and lists the business entities that pay invoices for your company's Procore Pay software. - Locate the business entity to modify and click its funding account link.

- Locate the account to modify.

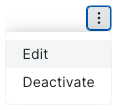

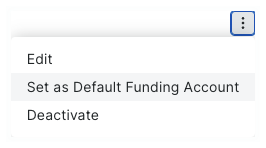

- Click the Overflow menu and choose Edit from the drop-down menu.

This opens the Edit Account Details page. - In the Edit Account Details page, do the following:

- Nickname. Enter a unique nickname for the account. Nicknames quickly identify the bank account for disbursements while helping to protect the privacy of its account number.

- Business Entity. Shows the name of the current business entity.

- Bank ID. Enter a bank identifier. Procore uses the bank ID as a prefix for a payment's check number. You can change this number at any time. However, any new changes only impact new check numbers.

Important

For companies using the ERP Integrations tool: The bank identifier must match the funding account's 'Bank ID' in your integrated ERP system.

ERP Integrations tool: The bank identifier must match the funding account's 'Bank ID' in your integrated ERP system. - Check Number. Enter a check number for the next invoice payment. This provides each check a unique identification number for this account. See How does Procore assign numbers to disbursement payouts? It also helps users who Manage Disbursements to identify transactions.

Important

For companies using the

ERP Integrations tool:

ERP Integrations tool:- After Procore Pay processes an invoice payment in a disbursement, the 'Bank ID' and 'Check Number' combination is exported to your integrated ERP system.

- To avoid potential ERP synchronization errors, ensure the Check Number entered is higher than the last check number in your ERP system to prevent duplication in your integrated ERP system. See How do payments made in Procore Pay sync with an integrated ERP system?

- Preview. Verify that the 'Bank ID' and 'Next Check Number' are correct.

- Click Save.

Set a Default Funding Account

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

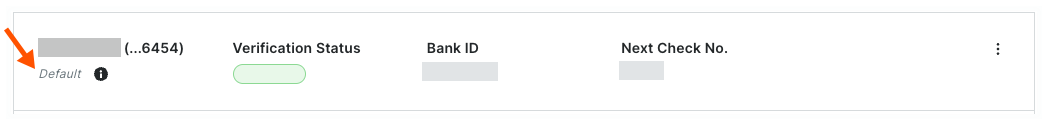

This opens the Payments Settings page. The Funding Accounts tab is active by default. - Locate the bank account to designate as your company's default funding account.

- Click the Overflow menu and choose Set as Default Funding Account.

The account is marked Default and moves to the top of the Funding Accounts list.

Tip

Can I deactivate our default account at a later time? No. The default account cannot be deactivated in Procore. To deactivate an account, you must first remove the account's default designation by assigning it to a different account. See Deactivate Funding Accounts.

Deactivate a Funding Account

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

This opens the Payments Settings page. The 'Business Entities' page in the 'Payments Processing' tab is active by default. This page lists the business entities configured to pay invoices in your company's Procore Pay software. - Locate the business entity to modify and click its funding account(s) link.

- Locate the funding account to edit.

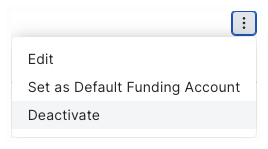

- Click the Overflow menu and choose Deactivate from the drop-down menu.

Tip

Can I deactivate a default account? No. A default account cannot be deactivated unless you first designate another account as the default. See Set a Default Funding Account as a Payor.

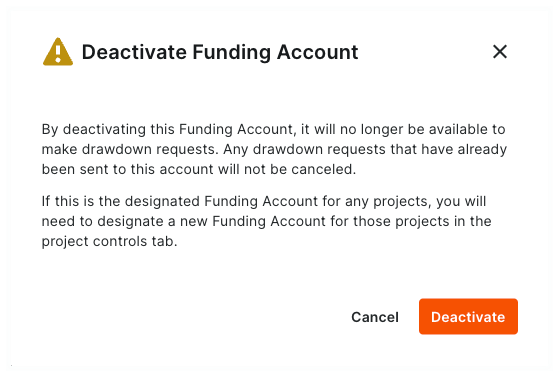

- In the 'Deactivate Funding Account' confirmation prompt, review the message.

Important

Before you deactivate the funding account, be aware of the following:

- If the account being deactivated is also your default funding account, a Payments Admin must first set a new default account for those projects. See Update Your Project's Bank Accounts.

- Once deactivated, Payments Disbursers can no longer select the funding account when creating new disbursements.

- Drawdown requests for existing disbursements are NOT canceled. If the existing disbursement's funds request is successful, Procore Pay withdraws the aggregate disbursement amount from your funding account and transfers it to your deposit account to process invoice payments.

- If you agree, click Deactivate.

Procore Pay marks the account Deactivated.

View Funding Accounts

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The 'Business Entities' page in the 'Payments Processing' tab is active by default. This page lists all of your company's business entities that have been configured to pay invoices. - For each business entity, click the funding account(s) link to view the account information.

Funding Accounts Table

The table below details the elements for the Funding Accounts table. Verified funding accounts can receive drawdown requests when creating disbursements.

| Element | Type | Description | Learn more... |

|---|---|---|---|

| Nickname | Field | A Payments Admin enters the account nickname when linking an account. The nickname allows Payment Disbursers to identify an account when creating disbursements. It also protects your financial privacy by eliminating the need to provide disbursers with the full bank account number. | Add Funding Accounts as a Payor |

| Verification Status | Field | Shows the current verification status of the account. Procore Pay is powered by Modern Treasury with payments provided by Goldman Sachs TxB. Verification occurs after a Payments Admin links an account. | Add Funding Accounts as a Payor What are the default verification statuses for bank accounts in Procore Pay? |

| Bank ID | Field | A Payments Admin enters a unique Bank ID portion to be part of the unique check number issued to the next invoice payout from this account. A payout is an invoice payment in a disbursement. | Add Funding Accounts as a Payor |

| Next Check No. | Field | A Payments Admin enters a unique Next Check No to be part of the unique check number issued to the next invoice payout from this account. A payout is an invoice payment in a disbursement. | Add Funding Accounts as a Payor |

| Default | Field | Indicates the account is the default withdrawal account for Procore Pay in the payor environment. | Set a Default Funding Account as a Payor |

| Deactivated | Field | Indicates the account has been deactivated. | Deactivate Funding Accounts as a Payor |

| Overflow | Menu | Click the vertical ellipsis and choose one of the menu options. The available options in this menu are: Edit, Set as Default Funding Account, and Deactivate. On the Default account, only Edit and Deactivate are available. On a Deactivated account, only Edit is available. | Manage Business Entities as a Payor |

Add or Remove Payments Admins

Submit a Request to Procore

If you are implementing Procore Pay as a payor, your team attends an alignment call and discusses the requirements to add Payment Admins. If Procore Pay is already live, the authorized signer on your company's transaction banking agreement must send a request to your Procore point of contact or Contact Support.

When contacting support:

- Please don't include any sensitive financial information, such as routing or bank account numbers.

- Please include your name, company name, and inquiry.

Complete the Procore Pay Authorized Administrator Form

Upon receipt of a request, a member of the Procore Payments Operations team provides you with the required Procore Pay Authorized Administrator Form. An authorized signer must complete and sign it. This is usually the owner of your company or an executive to whom the owner has granted signature authority. Once signed, return to the form to Procore Payment Operations.

Add or Remove Payments Admins in the Payor Environment

An authorized member of the Procore Payments Operations team adds your designated Payments Admin(s) to Procore Pay for you.

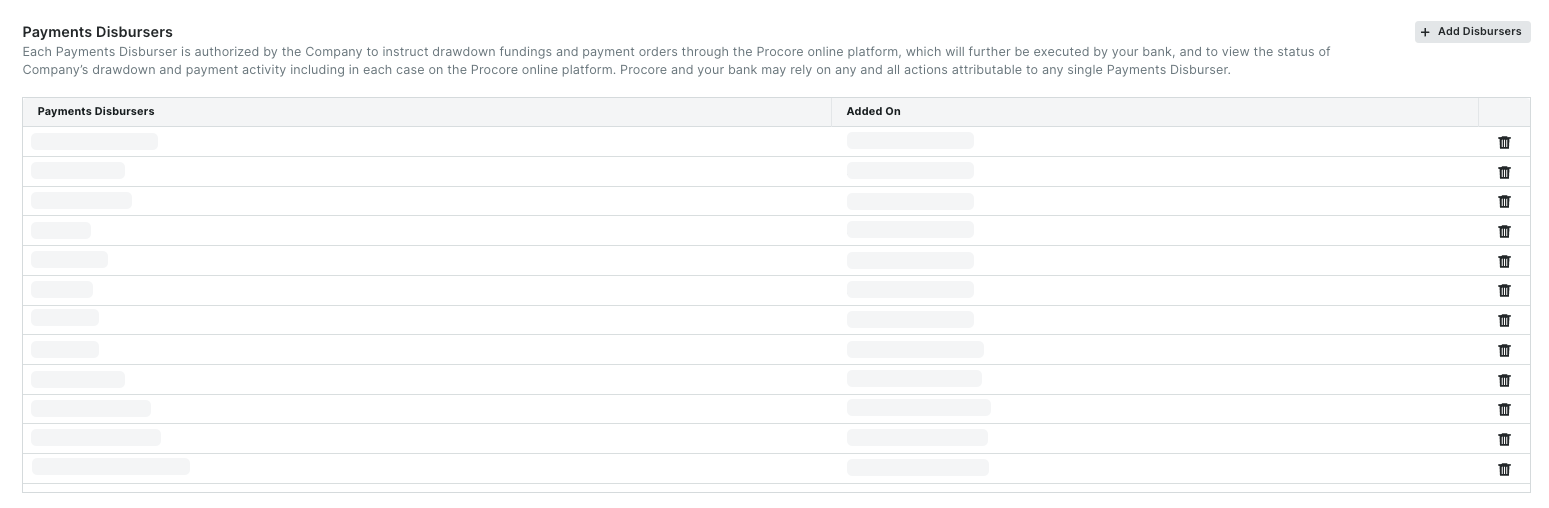

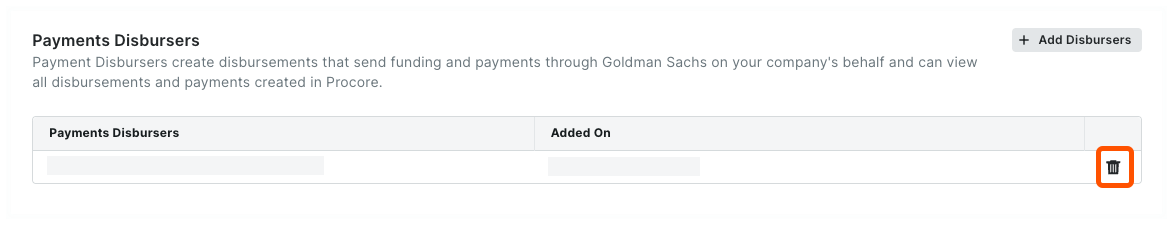

Add Payments Disbursers

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payment Settings page. The Funding Accounts page is active by default. - Click the Payment Processing tab.

This is the active tab by default. - Click the Payments Permissions link.

- Scroll to Payments Disbursers.

- Click the Add Disbursers button.

This opens the Add Disbursers window. - In the Add Disbursers window, add one (1) or more employees from your company as follows:

Tip

Which users are available in the Search People list? Any Procore user account marked as an employee of your company in the Company level Directory tool. Payment Disbursers must be employees of your company. See How do I add someone as an employee of my company?- Start typing the name of the user to add in the Search People list.

- Select the matching user name(s) from the drop-down list.

- Click Continue.

- Review the names in the Payments Disbursers list.

- Click Add Disbursers.

A GREEN banner indicates the action was successful. Procore also logs the 'User added as Disburser' action in the Change History.

Add Payments Beneficiary Approvers

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payment Settings page. The External Bank Accounts page is active by default. - Click the Payment Processing tab.

This is the active tab by default. - Click Payments Permissions.

- Scroll to Payments Beneficiary Approvers.

- Click Add Beneficiary Approvers.

This opens the Add Beneficiary Approvers window. - In the Add Beneficiary Approvers window, add one (1) or more employees from your company as follows:

Tip

Which users are available in the Search People list? Any Procore user account marked as an employee of your company in the Company level Directory tool. Payment Beneficiary Approvers must be employees of your company. See How do I add someone as an employee of my company?- Start typing the user's name in the Search People list.

- Select the matching user from the drop-down list.

- Click Continue.

- Review the names in the Payments Beneficiary Approvers list.

- Click Add Approver.

A GREEN banner indicates the action was successful. Procore also logs the 'User added as Approver' action in the Change History.

Remove Payments Disbursers

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon. - Click the Payment Processing tab.

- Click Payments Permissions.

- Scroll to Payments Disbursers.

- Review the names in the Payments Disbursers list.

- Click the trash can icon.

A GREEN banner indicates the action was successful. Procore also logs the 'User removed as Disburser' action in the Change History. The user no longer has access permission to create or view disbursements.

Remove Payments Beneficiary Approvers

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon. - Click the Payment Processing tab.

- Click Payments Permissions.

- Scroll to Payments Beneficiary Approvers.

- Review the names in the Payments Beneficiary Approvers list.

- Click the trash can icon.

- In the Remove Beneficiary Approver? prompt, click Remove Beneficiary Approver.

A GREEN banner indicates the action was successful. Procore also logs the 'User removed as Approver' action in the Change History. The user can no longer manage or approve beneficiary bank accounts.

View Payment Permissions

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. - Click the Payment Processing tab.

- Click Payments Permissions.

This reveals a list of Payments Admins, Payments Disbursers, and Payments Beneficiary Approvers who have been granted access permissions to the Company level Payments tool.

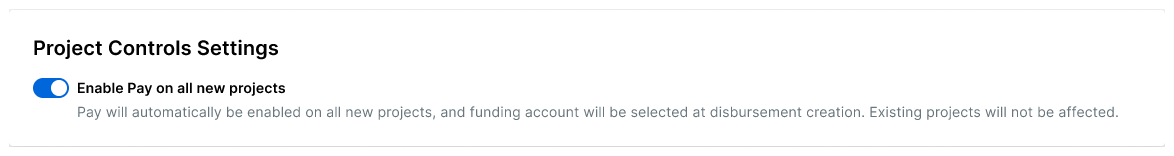

Enable or Disable Pay on Projects

Enable Procore Pay on All Projects by Default

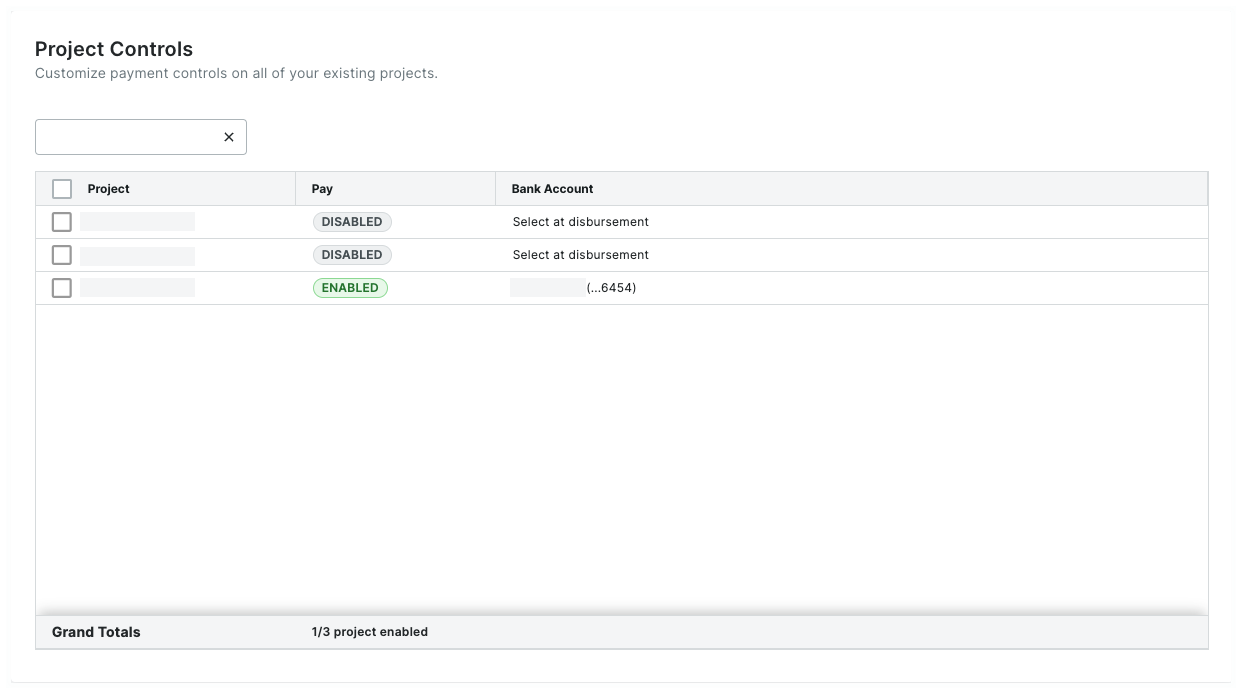

To enable Procore Pay on all new Procore projects by default, move the Enable Pay on All New Projects toggle to the right. Existing projects are not affected. Any changes to this setting are logged in the Change History under the Payment Processing tab.

By default, the 'Select at Disbursement' option is enabled on the project row in the Project Controls table. This allows authorized users to select a funding account when creating disbursements to pay subcontractor invoices. See Create Disbursements. Authorized users can also change this setting under Project Controls. To learn how, see Customize the Payment Controls for Your Active Projects.

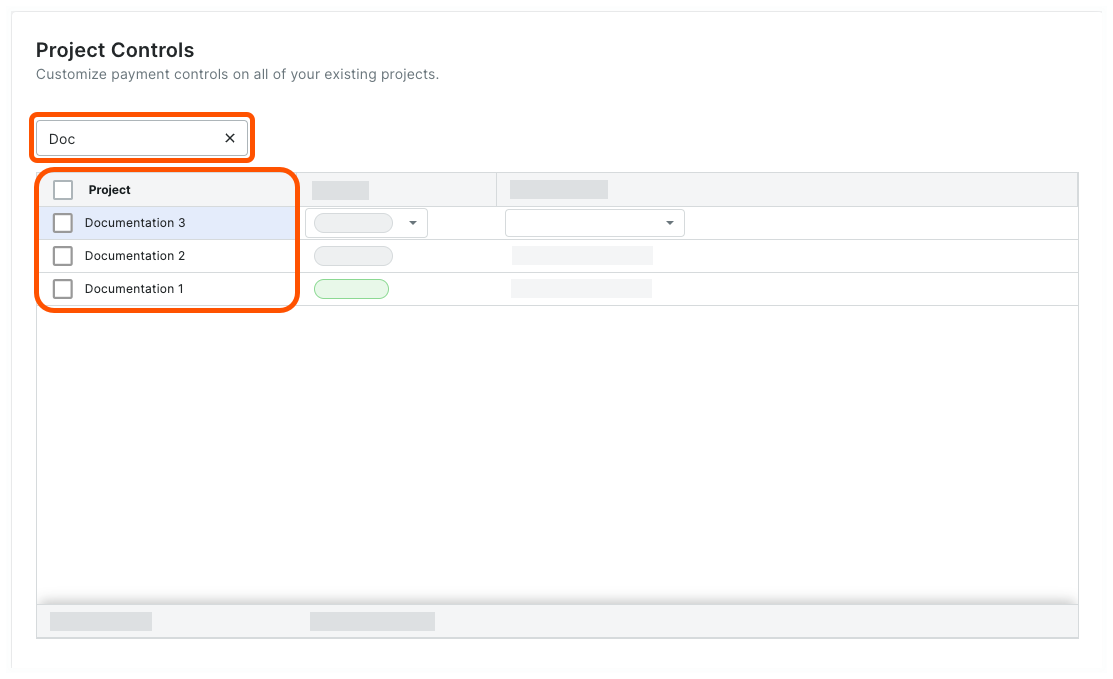

Enable or Disable Procore Pay on Specific Projects

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. - Click Project Controls.

This opens the Project Controls page shown below. - Optional. Start typing a project name or number in the Search box to narrow the projects in the list.

- In the table, select one or multiple projects:

- To select one or multiple projects, mark the checkbox(es) that correspond to the desired projects.

OR - To select all projects, mark the checkbox in the heading of the Project column.

- To select one or multiple projects, mark the checkbox(es) that correspond to the desired projects.

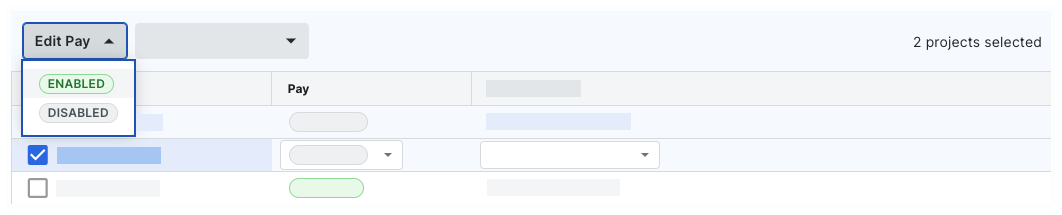

- Click Edit Pay and choose the desired option from the drop-down list.

Tip

Want to change the selected projects' bank accounts? You can change both settings in the same action. For instructions, see Customize the Payment Controls for Your Active Projects.

- Enabled. Turns Procore Pay features ON in the selected projects.

- Disabled. Turns Procore Pay features OFF in the selected projects.

- In the Enable Pay or Disable Pay prompt, read the informational message.

- Depending on your selected option, click the Enable or Disable button.

Any changes to this setting are logged in the Change History under the Payment Processing tab.

Update Project Controls in Bulk

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The External Bank Accounts page is active by default. - Click Project Controls.

This opens the Projects Controls page shown below. - Optional. Start typing a project name in the Search box to narrow the projects in the list.

- In the table, select one or multiple projects:

- To select one or multiple projects, mark the checkbox(es) that correspond to the desired projects.

OR - To select all projects, mark the checkbox in the heading of the Project column.

- To select one or multiple projects, mark the checkbox(es) that correspond to the desired projects.

- Choose from these options:

- Optional. To change the setting of the Procore Pay features on the selected projects, click Edit Pay. Then choose the Enabled or Disabled setting from the drop-down list.

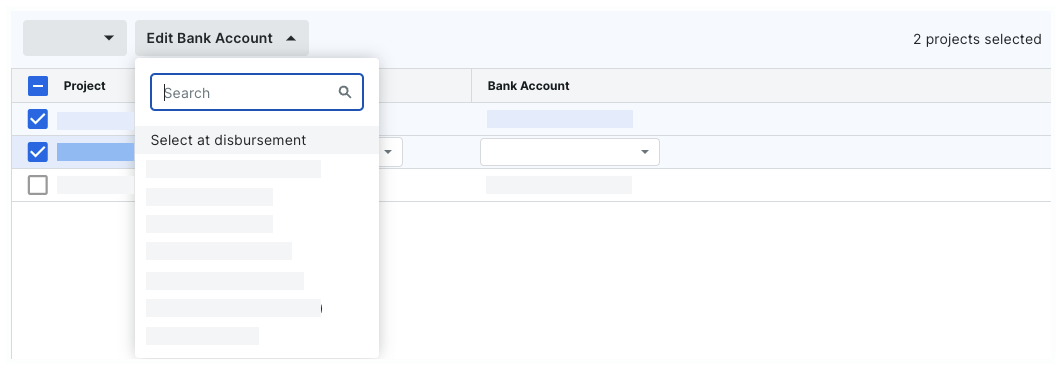

- Optional. To change the default bank account setting on the selected projects, click Edit Bank Account. Then choose one of your company's linked external accounts or the Select at Disbursement option.

Changes are saved automatically. A GREEN success banner confirms the action.

Update Bank Accounts on Projects

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Funding Accounts page is active by default. - Click Project Controls.

- In the table, do the following:

- To select one or more projects, mark the checkbox(es) to the desired projects.

OR - To select all projects, mark the checkbox in the Project column header.

- To select one or more projects, mark the checkbox(es) to the desired projects.

- Click Edit Bank Account and choose an option from the drop-down list.

Tips

- Looking for a specific account? Start typing the account nickname in the Search box to narrow the accounts in the list.

- Want to change the selected 'Pay' status? You can change both settings in the same action. To learn more, see Enable or Disable Procore Pay on Your Projects.

- Select at disbursement. Choose this option to force your Payments Disbursers to select the funding account. A funding account is the verified bank account from which a drawdown request for funds is made to complete the payments in a disbursement. To learn more, see Create Disbursements.

- One of your existing accounts. Choose one of your company's existing funding accounts from the drop-down list. To learn how to add an account to the list, see Add Funding Accounts.

Best Practices

When Procore Pay customers enable the Company level Workflows tool, an authorized team member can create a custom workflow template to approve/reject your disbursements. Your company can create any number of Payments workflow templates. However, only one (1) of those template(s) can be assigned as the default template for Procore Pay.

1. Create and Configure Your Templates |

| Who will be your company's Workflow Manager and who must complete the workflow steps? | How do you manage end-user permissions for Procore Pay + Workflows? | How do you create a Payments Workflow Template? | How do you configure the Payments Workflow Template? |

|

Ready to learn more? |

Ready to learn more? |

Ready to learn more? |

Ready to learn more? |

2. Start Using Your Default Payments Workflow |

| How do you start the Payments workflow? | Need to submit an approve/reject response to a workflow? | Need to start, restart, or return to a previous step in a workflow? |

|

A Payments Admin or a Payments Disburser follows the steps in Create Disbursements. After selecting the funding account, Procore Pay automatically starts the Payments workflow for the disbursement when the Workflow tool is enabled. |

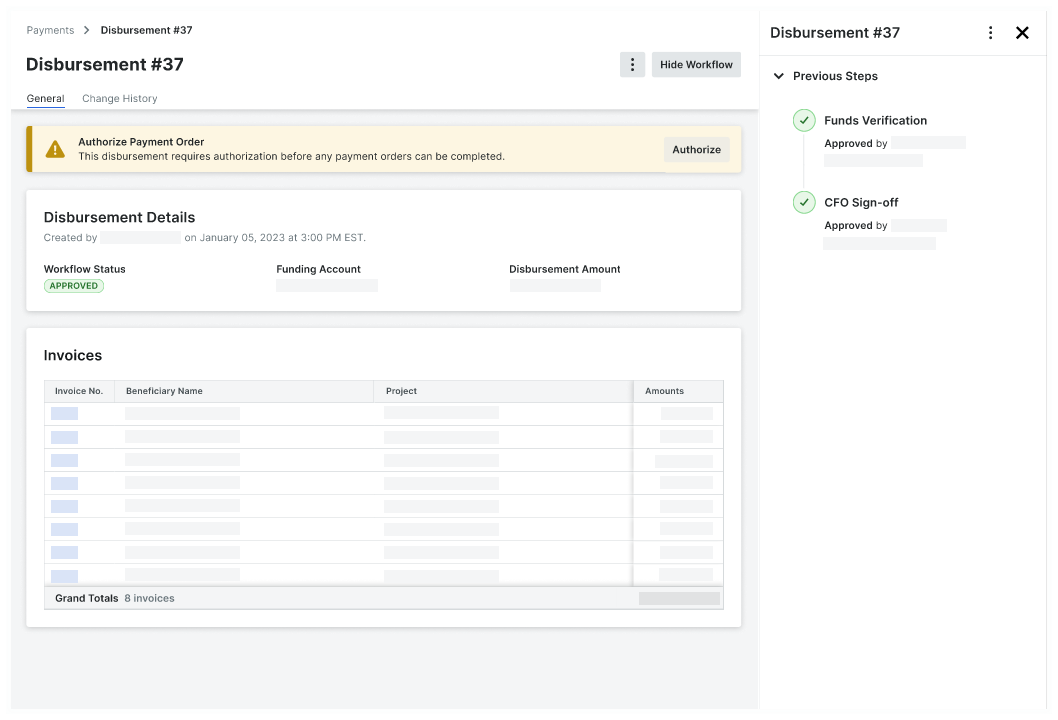

If you are assigned to review a disbursement, submit a response before the due date. To learn more, see Approve or Reject a Disbursement. After submitting an 'Approve' response, an Action Required banner prompts the final reviewer to Authorize the disbursement. Funds are only withdrawn after authorization. See Create Disbursements. |

If you are the designated Workflow Manager for your company's Payments Workflow, learn how to Start a Custom Workflow, Restart a Custom Workflow, or Return a Workflow to a Previous Step. You can also Add Additional Assignees when the existing assignees are unavailable. |

Important

- Invoice approval and disbursement authorization must be completed by two (2) different Procore users.

- If you are the Payments Admin or Payments Disburser who placed any of the invoices on the disbursement into the 'Approved' or 'Approved as Noted' status, Procore Pay will not permit you to approve the disbursement.

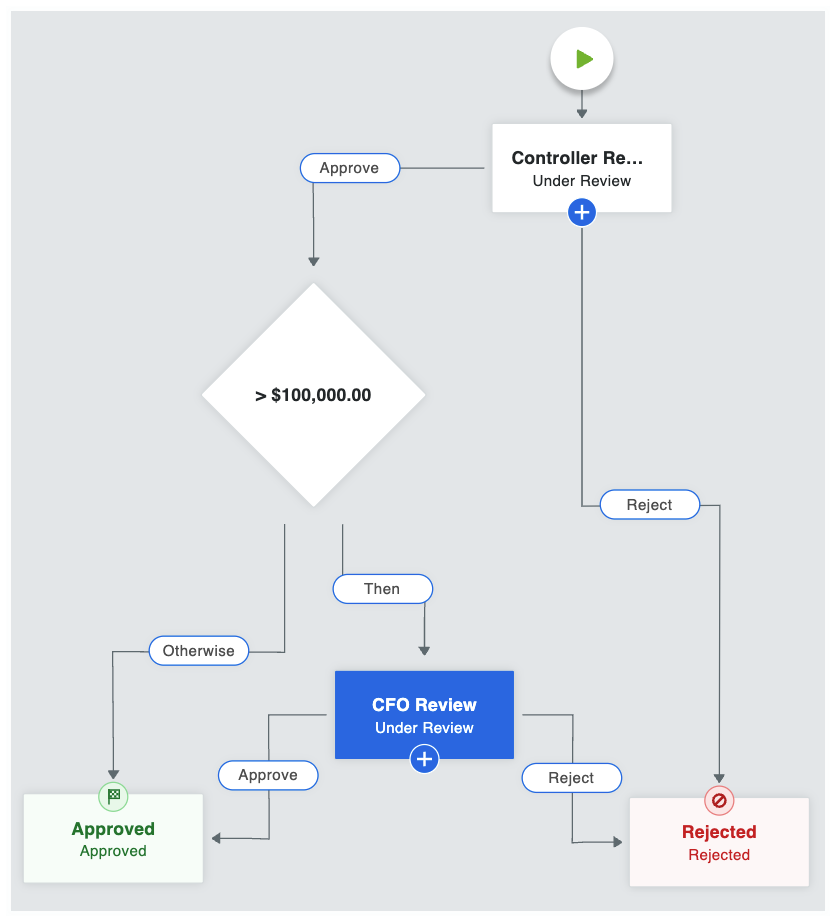

Example Payments Workflow

This is an example of a Payments workflow that starts automatically when a disbursement is created. You can use this example to create your company's Payments Workflow or you can create your own custom workflow to suit your specific business needs. For step-by-step instructions, see Create a Custom Workflow Template.

Example

This table shows you the workflow steps and step details for the example workflow. You can customize the steps and details as needed. To learn more, see What are the different types of steps in a custom workflow?

| Step Name | Step Details | What does it do? |

|---|---|---|

| Controller Review |

|

When a disbursement is created, the workflow is placed into the Under Review status and automatically assigned to the Controller. Emails are sent to the Controller, Workflow Manager & Item Creator. The Controller has five (5) days to provide an approve or reject response. |

| > $100,000.00 |

|

When a controller approves a disbursement and the aggregate disbursement amount is $100,000.00 or greater, the system requires secondary approval by the CFO. If the disbursement amount is less than $100,000, the system automatically moves the disbursement to the Approved step. To learn more about condition steps, see Optional Condition Steps for the Payments Tool. |

| CFO Review |

|

When the aggregate disbursement amount is greater than $100,00.00, the workflow remains in the Under Review status and is automatically assigned to the CFO. Emails are sent to the CFO, Workflow Manager, and Item Creator. The CFO has five (5) days to provide a response. |

| Approved |

|

When the Controller or CFO (only if secondary approval was a required condition), an 'Approve' response updates the disbursement's status to Approved. Emails are sent to the Assignees (Controller and CFO), Workflow Manager, and Item Creator. |

| Rejected |

|

When the Controller and/or CFO submit a Reject response, the system updates the disbursement's status to 'Rejected.' Emails are sent to the Assignees (Controller and CFO), Workflow Manager, and Item Creator. |

Optional Condition Steps for the Payments Tool

When creating conditional statements for the Payments tool, Workflow Managers have these options:

Payments... Show/Hide

| Condition | Definition | Example |

| Disbursement Amount | The total amount of the disbursement is greater than the amount set in the workflow. | If the total amount of a disbursement is greater than or equal to $10,000,000.00, route the disbursement to the CFO for approval. |

| Highest Invoice Amount | The total amount of any project invoice is greater than the amount set in the workflow. | If the amount on any project invoice is greater than $5,000,000.00, route the disbursement to the CFO for approval. |

| Highest Retainage Release | The total amount of retainage release is greater than the amount set in the workflow. | If the amount of retainage released on an invoice payment is greater than $0.00, route the disbursement to the CFO for approval. |

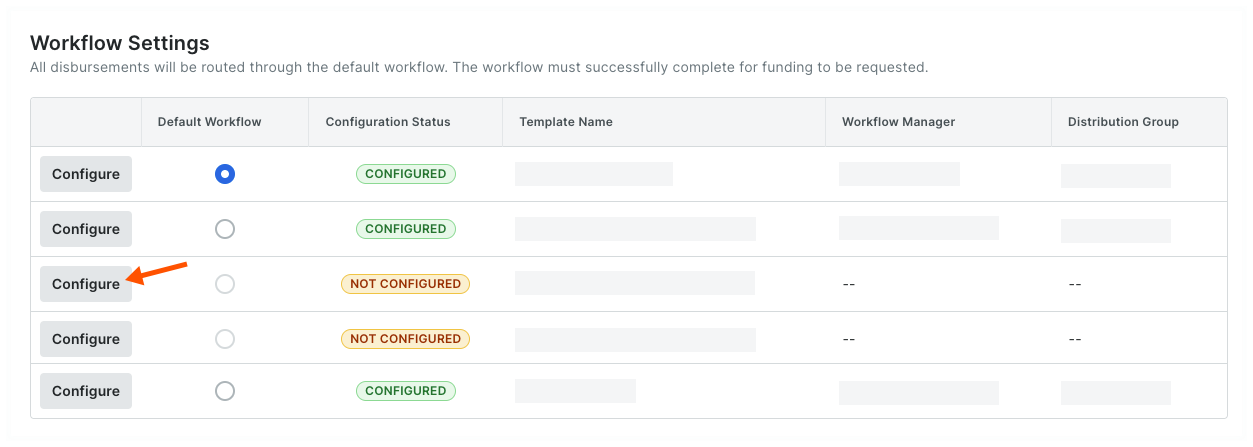

Configure Workflow Settings

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Funding Accounts tab is active by default. - Click Workflow Settings.

- Under Workflow Settings, toggle Enable Workflows on Disbursements to the ON setting.

- Under Workflow Templates, locate the workflow template to configure:

- If you are configuring a new workflow template, the configuration status will be Not Configured.

- If you want to reconfigure an existing template, the configuration status will be Configured. You can change the configuration as needed.

- Click the template's Configure button.

This launches the Company level Workflows tool and opens the selected workflow template. - View the step details to configure by clicking the Show Details button.

- Complete the workflow configuration.

Example

In this tutorial, the details are configured using the example workflow from Best Practices for Creating a Payments Workflow, so you'll need to assign the following roles to perform the steps:

- A Payments Admin to be the Workflow Manager. A workflow is only considered complete when a Workflow Manager is assigned to it.

- A Payments Admin or Disburser to be an Assignee for the Controller Review step. Each unique response step in a workflow requires one or more assignees. When there are multiple assignees on a step, the first response given will move the workflow to the next step.

- A Payments Admin or Disburser to be an Assignee for the CFO Review step. Each unique response step in a workflow requires one or more assignees. When there are multiple assignees on a step, the first response given will move the workflow to the next step.

If you have created a custom workflow template, the details you configure will be unique to your environment.

- Click the Save button.

Tip

Can I edit the workflow template later? Yes. You can add or remove steps from your workflow template at a later time. See Edit a Custom Workflow Template. Once editing is complete, you will also need to perform the steps above to re-configure the workflow's details.

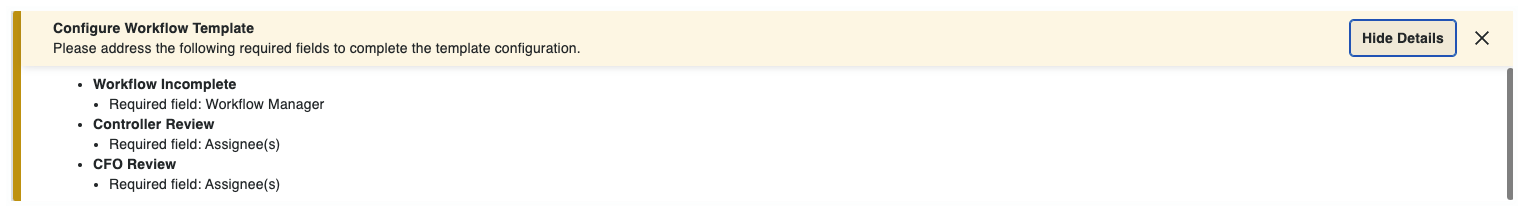

Assign a Default Template

- Navigate to the Company level Payments tool.

- Click the Payment Processing tab.

- Click the Workflow Settings link.

This opens a list of workflows that have been created for the Payments tool. It also shows the configuration status of each workflow.Tip

Do you have existing workflows in the Not Configured status? To learn how to configure an existing workflow, see Configure the Settings for a Payments Workflow Template. - In the Default Workflow column, choose the option button that corresponds to the workflow that will be used as the system's default. You can create up to five (5) workflows, but can only assign one (1) default workflow.

Tip

What happens if I change the default workflow? If you decide to change the default workflow, all new disbursements created in the Payments tool will automatically use the new default workflow. Any disbursements that have already started a workflow process will be unaffected by this change.

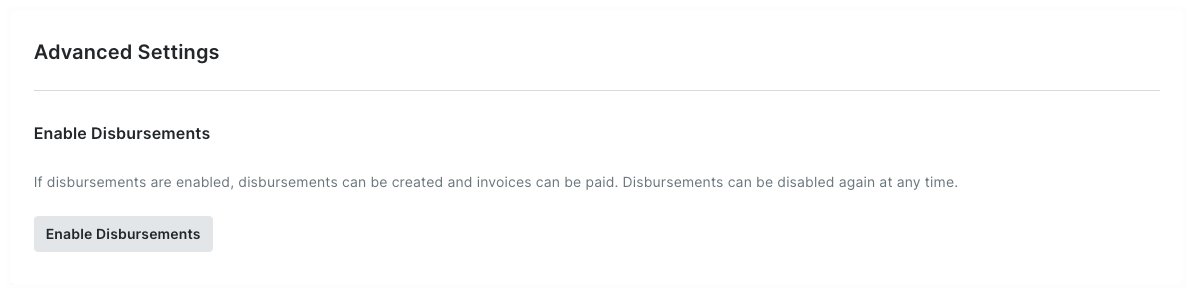

Enable Disbursements

- Navigate to the Company level Payments tool.

- Click the Configure Settings

icon.

icon. - Click the Payment Processing tab.

- Click Advanced Settings.

- On the Advanced Settings page, review the informational statement under Enable Disbursements.

- Click the Enable Disbursements button.

Once enabled:- A GREEN success banner appears to confirm your action.

- Your company's Payments Disbursers can now create new disbursements in the Company level Payments tool.

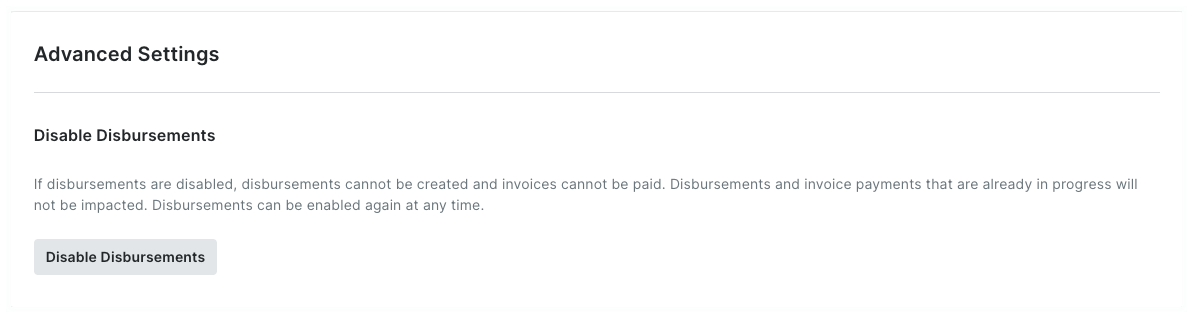

Disable Disbursements

- Navigate to the Company level Payments tool.

- Click the Configure Settings

icon.

icon. - Click the Payment Processing tab.

- Click Advanced Settings.

- On the Advanced Settings page, review the informational statement under Disable Disbursements.

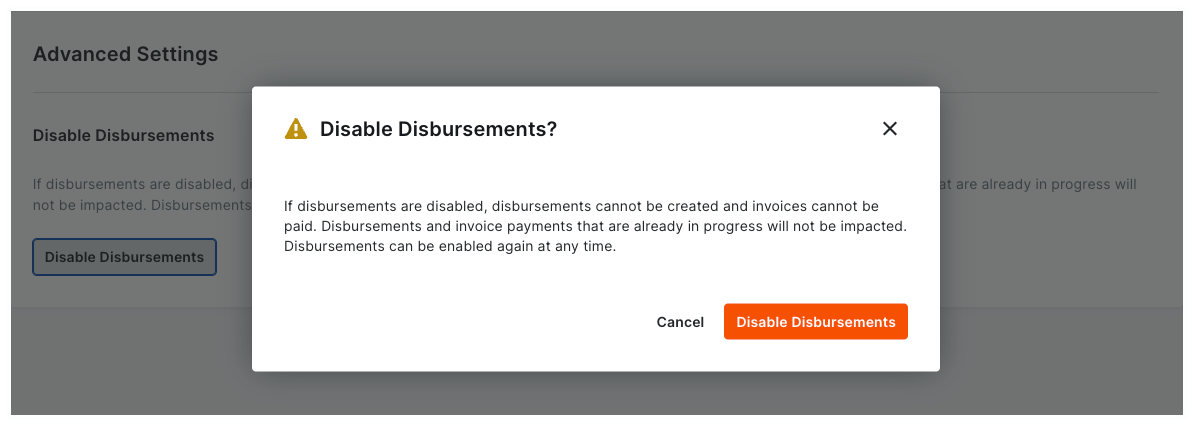

- Click Disable Disbursements.

The following confirmation prompt appears.

- Confirm that you want to disable disbursements by clicking the Disable Disbursements button.

Once disabled:- A GREEN success banner appears to confirm your action.

- A YELLOW banner appears at the top of the page to alert Payment Admins that the feature is turned OFF.

- Your company's Payments Disbursers can no longer create new disbursements in the Company level Payments tool.

- Procore Pay continues to process any existing disbursements and invoice payments that are in progress.

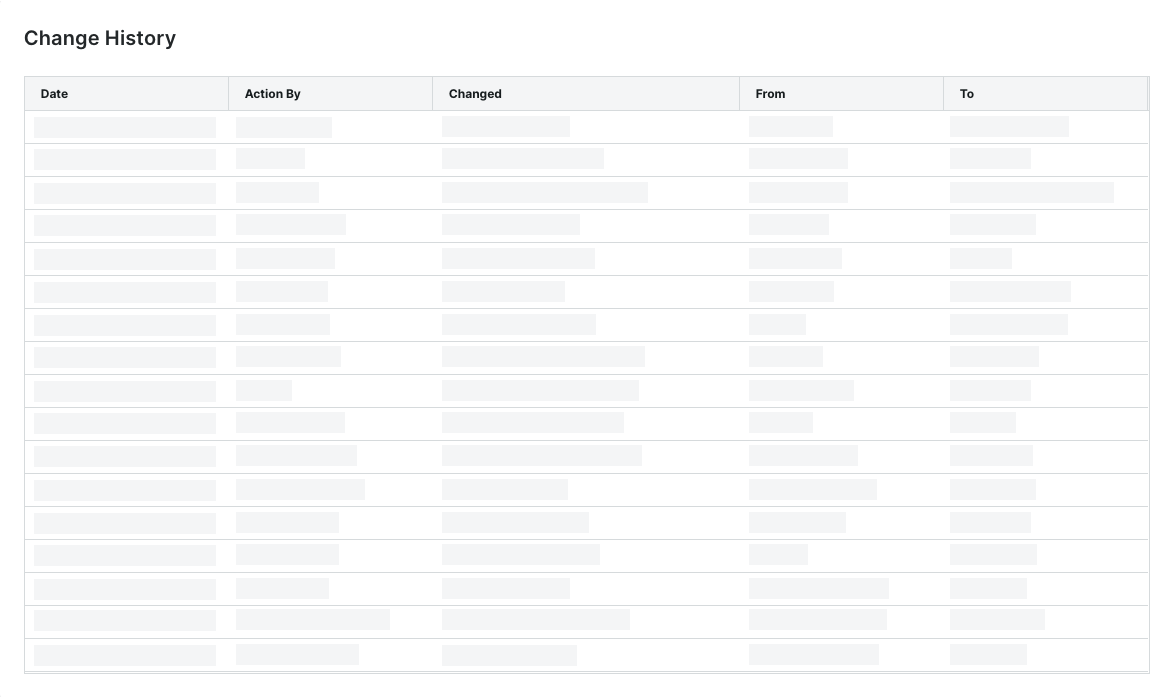

View Change History

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. - Click the Payment Processing tab.

- Click the Change History link.

This opens the Change History page.Only a Payments Admin has access to view the Payments tool's Change History. The table on the Change History page logs the actions performed by Payments Admins and Payments Disbursers with the Company level Payments tool. For step-by-step instructions, see View the Payments Tool Change History.

Click here to learn about the table.

Change History Page

The table below describes the default columns on the Change History page.

Column Description Date Shows the date and timestamp of the action. Action By Shows the first and last name of the Procore user as their name appears in the Company Directory.

Note: Only a member of Procore's Payments Operations Team can add Payments Admins to your account. This requires an authorized user at your company to complete and sign Procore's Payment Administrator Designation Form. Once added, this entry indicates the user was added by 'Procore Support'. For details, see Add or Remove Payments Admins as a Payor.Changed Provides a brief description of the action. From Shows the value that the action changed from.

Note: If the action originated from a setting with a blank or null value, Procore shows the double dash symbol (--).To Shows the To value that the action changed to.

Note: If the action resulted in a setting with a blank or null value, Procore shows the double dash symbol (--).

Enable Lien Waivers

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Payment Processing tab is active by default. - Click the Payment Requirements tab.

The Lien Waivers page is active by default. - Under Lien Waiver Settings, move the Allow Lien Waivers to be Enabled on All Projects toggle to the ON or OFF setting:

Option Setting Description

ON - Invoice administrators can complete the steps in Enable Lien Waivers & Set Default Templates on Projects, Preview Lien Waivers on Subcontractor Invoices, and View Lien Waivers on Project Invoices.

- Invoice contacts in the payee environment can complete the steps in Sign Lien Waivers on Subcontractor Invoices and View Signed Lien Waivers on a Project.

OFF - Invoice administrators cannot perform the above steps.

- Turning the setting OFF does:

- NOT remove any existing lien waiver data from Procore.

- NOT hide the 'Lien Waiver Templates' table in the Company level Payments tool.

- NOT hide any lien waivers that were signed on project invoices before this setting was disabled.

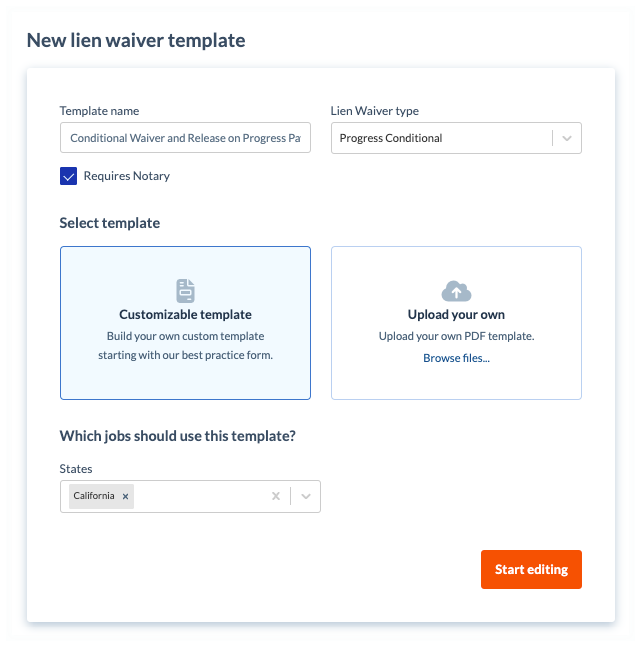

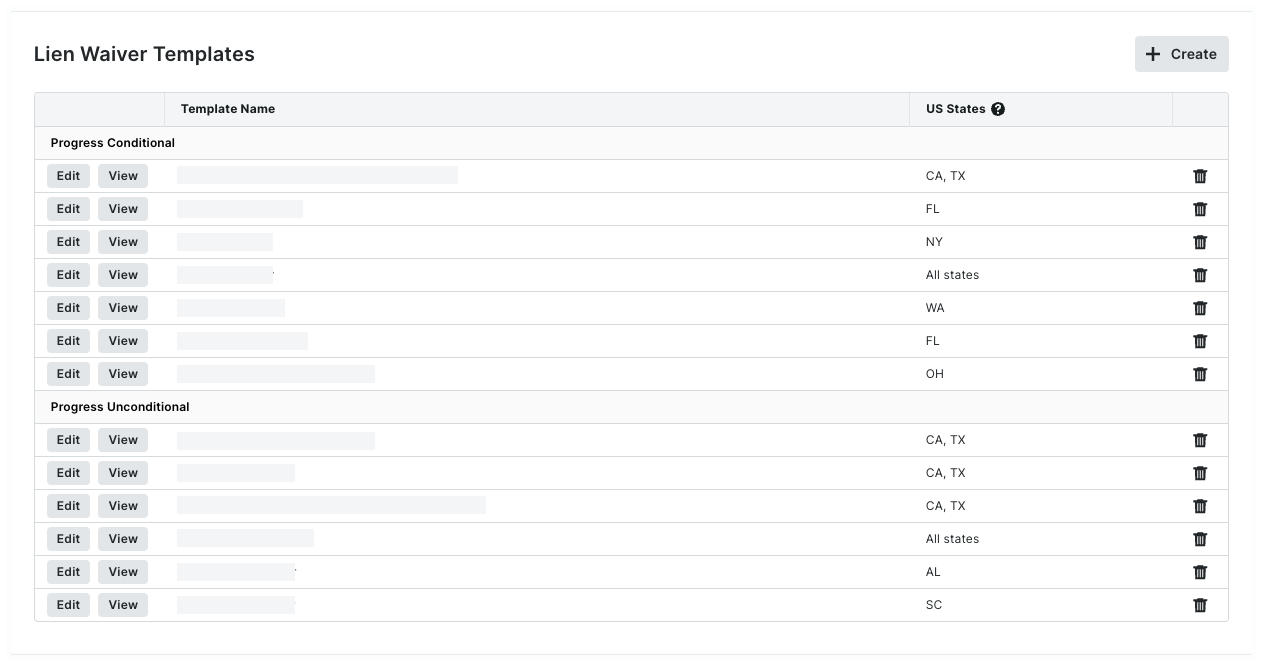

Create Templates

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payment Settings page. The External Bank Accounts tab is active by default. - Click the Payment Requirements tab.

- Click the Lien Waivers page.

- Click Create.

This opens the Create Lien Waiver Template panel. - Under New Lien Waiver Template, do the following:

Note

An asterisk (*) below indicates a required field.- Template Name*

Type a name for the template. - Lien Waiver Type*

Select the type of lien waiver.Tip

What does each type mean? To learn about each option, see What types of lien waiver templates can you create? - Optional: Requires Notary.

Mark the checkbox to include space for a notary public's signature and legal seal. Clear the checkbox to omit this space.

- Template Name*

- In the Select Template area, choose one of these options:

- Customizable Template

Click this option to build your own custom template using our best practice form. - Upload Your Own

Click this option and then click the Browse Files button to select a PDF file to upload from your computer or network.Note

If your PDF file contains pre-built form fields, the placeholders for those form fields are NOT imported.

- Customizable Template

- Under Which jobs should use this template? do the following:

- States. Choose from these options in the drop-down list:

- To apply the template to all states and territories, select All States. This is the default setting.

- Select the applicable options to apply the template to specific states and territories. You can select one (1) or multiple options.

Tip

Does the list of states include all of the states and territories of the United States? Procore's States list includes all 50 states, the Federal District (Washington D.C.), and three (3) major territories (Guam, Puerto Rico, and the U.S. Virgin Islands).

- States. Choose from these options in the drop-down list:

- Click Start Editing.

- In the template, use the controls in the text editor to add content and adjust the formatting and layout of the template.

- Optional: Under Variables, click and drag any variable into the appropriate position on the template.

- Optional: To preview the template, click Preview.

Note

As you build your template, Procore recommends previewing it to ensure that the finished template provides you with the desired result. To quit the Preview Template window, click the Close button. - Click Create.

Procore adds your template to the Lien Waiver Templates table.

Edit Templates

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Payment Processing tab is active by default. - Click the Payment Requirements tab.

The Lien Waivers page is active by default. - In the Lien Waiver Templates table, locate the template to update. Then click Edit.

This opens the Edit Lien Waiver Template panel. - Review the template and make the desired changes.

- To change the copy, update the body of the template as needed.

- To remove a variable placeholder, click the placeholder in the body of the template and press DELETE.

- To add a variable placeholder, click a field in the Variables list and use a drag-and-drop operation to move the variable into the desired placeholder position.

Tip

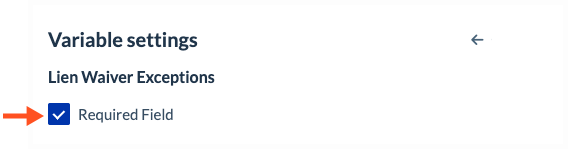

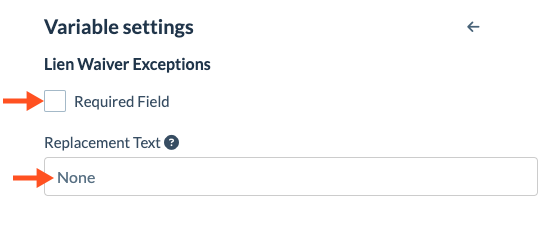

Want to make a field required or include replacement text for blank values? Certain variable placeholders have these options:

- To make the field required, place a mark in the Required Field checkbox as shown below.

- To make a field optional, remove the mark from the Required Field checkbox. For optional fields, you can also enter a word or phrase, so the text you enter appears when a value isn't available. For example, if there are no Lien Waiver Exceptions to include, the word 'None' will appear on the lien waiver instead of a blank field.

- To make the field required, place a mark in the Required Field checkbox as shown below.

- Optional. To preview your changes, click Preview.

- Click Save.

Any updates that you make go into effect only go into effect on the next project lien waiver. Updates have no effect on existing lien waivers.

Delete Templates

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Payment Processing tab is active by default. - Click the Payment Requirements tab.

The Lien Waivers page is active by default. - Locate the template to delete in the table.

Tip

How is the data grouped? By default, Procore groups lien waiver templates by type. To learn more, see What types of lien waiver templates can you create in Procore? - Click the

trash can icon to delete the template.

trash can icon to delete the template.

- In the Delete Lien Waiver Template? message, choose an option:

- To keep the template, click Cancel.

- To permanently remove the template, click Delete.

Once deleted, the template no longer appears as a selection in the Invoice Settings. See Enable Lien Waivers & Set Default Templates on Projects. Any previous lien waivers generated from the template on the project's existing invoices can continue to be previewed, signed, and viewed.

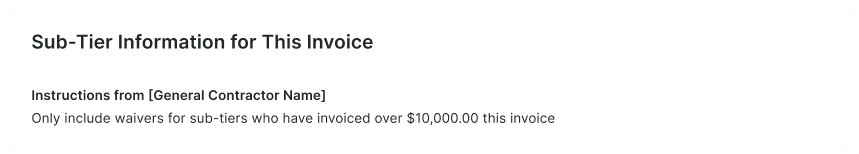

About the Sub-Tiers Card on a Subcontractor Invoice

Invoice administrators can show or hide the 'Sub-Tiers' card on the 'Lien Rights' tab on the subcontractor invoices in a Procore project. The 'Sub-Tiers' card lets an invoice administrators and/or invoice contacts add billing data for each sub-tier subcontractor on an invoice. See Add Sub-Tiers to a Project Invoice. To clarify data entry guidelines, you can also add instructions. For example, you can add instructions indiciating that you are collecting waivers from sub-tiers that billed over $10,000 on the current invoice. Once enabled on a project, invoice contacts can also sub-tier billing data, upload signed sub-tier lien waivers and submit them to invoice administrators for review in a subcontractor invoice.

Tip

A sub-tier is any subcontractor (for example, a subcontractor, supplier, or vendor) who furnishes materials, supplies, or services connected to the first-tier subcontractor's obligations on a commitment. In Procore Pay, a first-tier subcontractor is the 'Contract Company' who enters into a commitment contract with a General Contractor. Both first-tier and sub-tier contractors might hire additional sub-tiers (for example, third-tier, fourth-tier, and so on).

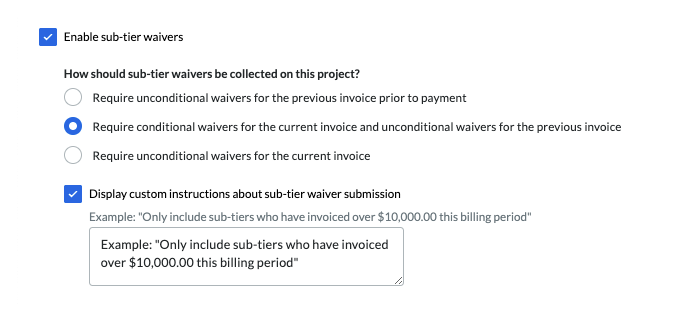

Enable Sub-Tier Waivers on Projects

- Navigate to the Project level Invoicing tool.

- Click the Settings

icon.

icon. - Scroll to the Lien Waivers section.

Tips

- Don't see any options? Lien waivers must enabled for Procore Pay. See Enable Lien Waivers in the Company Payments Tool.

- Mark the Enable Sub-Tier Waivers check box to show the 'Sub-Tiers' card on the 'Lien Rights' tab of the project's subcontractor invoices. Clear the checkbox to hide the sub-tier card.

- Under the How should sub-tier waivers be collected on this project? section, you have these options to collect signed waivers from sub-tier contractors:

Note

Invoice contacts must collect signatures from their sub-tier contractors outside of Procore. Next, they upload and submit the signed waivers with their subcontractor invoice for the Open billing period. See Upload Sub-Tier Waivers to a Subcontractor Invoice as an Invoice Contact.- Require unconditional waivers for the previous invoice prior to payment

Most payors collect unconditional waivers for the previous invoice's billing period. This is the most frequently implemented setting. - Require conditional waivers for the current invoice and unconditional waivers for the previous invoice

Some payors collect conditional waivers for the current invoice's Open billing period and unconditional waivers for the previous invoice's billing period. - Require unconditional waivers for the current invoice

Some payors collect only unconditional sub-tier waivers for the current Open billing period.

- Require unconditional waivers for the previous invoice prior to payment

- Mark the Display Custom Instructions About Sub-Tier Waiver Submission checkbox to type a custom instruction message about sub-tier waiver submissions in the Enter Custom Instructions box.

Example

If you only want to collect sub-tier waiver signatures from sub-tier subcontractors who invoiced over a certain amount (for example,$10,000.00), type the instructions and the amount in the text box. If you require notarized signatures on sub-tier waivers, include that in the instructions.

The 'Instructions from [General Contractor Name]' area on the sub-tiers card. If you are NOT required to collect waiver information on an invoice, the 'Sub-Tier Information for This Invoice' card appears on the invoice. If you are required to collect waivers for the current invoice or a previous invoice, the card name(s) match the project's waiver collection requirements set on the Invoicing tool by an invoice administrator. See Enable Sub-Tier Waivers on Subcontractor Invoices as an Invoice Administrator.

- Click Save.

Configure Company Requirements

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. - Click the Payment Requirements tab.

- Click Payment Requirements.

- Choose one (1) option for each requirement:

- Not Required. Doesn't track the payment requirement.

- Required but Allows Payment. Notifies users when a payment requirement isn't satisfied and allows users to send payments.

- Required and Prevents Payment. Notifies users when a payment requirement isn't satisfied and prevents users from sending payments.

- Configure the options in each section as desired:

Available Payment Requirements

| Option | When ON... | When OFF... | Learn More |

|---|---|---|---|

| Holds Released | Tracks the status of any payment holds applied to invoices. Holds must be released before payment. | Doesn't track invoices for payment holds. | Manage Payment Holds as a Payor |

| Commitment Executed | Tracks the commitment associated with the invoice to ensure a check mark appears in the 'Executed' box. | Doesn't track the 'Executed' state on the commitment. | Create a Commitment Edit a Commitment |

|

Contract Compliant |

Tracks the status of the contract compliance documents for the commitment. | Doesn't track the compliance status of the insurance certificates | Manage Contract Compliance Documents & Statuses for a Commitment |

| Change Orders Executed | Tracks change orders that impact the contract associated with the invoice and require them to be in the 'Executed' state. | Doesn't track change orders. | Create a Change Order |

|

Insurance Compliant |

Tracks the status of the insurance certifications for the commitment. | Doesn't track the compliance status of the insurance certificates. | Manage Insurance & Compliance Statuses for a Commitment |

| Invoice Approved | Tracks invoices to ensure they are in one of these statuses: Approved, Approved as Noted, and Pending Owner Approval. See What are the default statuses for Procore invoices? | Doesn't track invoice status. | Bulk Edit the Status of Subcontractor Invoices with the Invoicing Tool |

| Owner Funding Received | Ensures the owner invoice is shown as fully paid on the 'Payment Received' tab. | Doesn't track 'Payment Received' entries on owner invoices or compare values on the subcontractor invoice. | Create a Record for a Payment Received |

| Sync to ERP | Tracks the invoice to ensure it is synced with an integrated ERP system. | Doesn't track invoice syncing with ERP | ERP Integrations |

| First-Tier Conditional Lien Waiver Signed | Tracks first-tier signatures on conditional lien waivers on your invoices. Note: Only appears on an invoice when the requirement is enabled on its project. See Enable Lien Waiver Templates on a Project. |

Doesn't track signatures | Create Lien Waiver Templates |

| First-Tier Unconditional Lien Waiver Signed | Tracks first-tier signatures on unconditional lien waivers for your invoices. Note: Only appears on an invoice when the requirement is enabled on its project. See Enable Lien Waiver Templates on a Project. |

Doesn't track signatures | Create Lien Waiver Templates |

|

|

Tracks first-tier signatures on unlocked unconditional lien waivers for the commitment's previous invoices. Notes: Only appears on an invoice when the requirement is enabled on its project. See Enable Lien Waiver Templates on a Project. |

Doesn't track signatures | An invoice administrator can Send a Request to Unlock a Signed Unconditional Lien Waiver. An unconditional lien waiver can only be unlocked by an invoice contact. See Unlock a Signed Unconditional Lien Waiver as an Invoice Contact. |

| Sub-Tier Waivers | Tracks when sub-tier waivers are in the 'Approved' status. This requirement will not exist on projects that has disabled sub-tier waivers. Note: If sub-tier waivers are disabled on a project, this requirement won't appear. See Enable the Sub-Tiers Card & Add Instructions on Project Invoices. |

Doesn't track signatures | Manage Sub-Tier Waivers |

View Payment Requirements

Open the Payment Readiness Panel

- Navigate to the Company level Payments tool.

The Subcontractor Invoices tab is active by default. - In the Subcontractor Invoices table, locate the invoice.

- Under the Payment Readiness group, click the unit fraction link under Requirements.

This opens the Payment Readiness panel on the right side of the page.

About the Overview Tab

The Overview tab of the Payment Readiness panel shows the following information.

The table below describes the elements pictured above. To learn more, see Configure Payment Requirements as a Payor.

| Item | Description | Example (See Above) |

|---|---|---|

| Information Banner | If any holds are applied to the invoice, a YELLOW banner appears at the top of the Overview tab above the Summary. Click View Holds to jump to the Holds tab. | There are one or more holds on this invoice |

| Company Name | Shows the name of the 'Contract Company' on the commitment. | Earthwork Jim |

| Project Number | Shows the name of the Procore project associated with the invoice. | Demo Project |

| Invoice Link | Click the hyperlink to open the subcontractor invoice with the Invoicing tool in a separate browser window. | SC-018: Invoice #001 |

| Requirements Complete | Displays a pie chart and unit fraction to show the number of completed payment requirements. See Manage Payment Requirements as a Payor. | 5/10 Requirements Complete Note: The numerator (5) indicates that five requirements are complete. The denominator (10) corresponds to the total number of requirements. To learn more, see View the Invoice Details below. |

| Total | The total amount, including retainage (if any), for the invoice. | $4,5000.00 |

| Invoice Status | Shows the invoice's current status. See What are the default statuses for Procore invoices? | Revise and Resubmit |

| Payment Status | Shows the payment status of the invoice: Paid or Unpaid. | Unpaid |

| Billing Period | Shows the billing period for the invoice. See Create Automatic Billing Periods or Create Manual Billing Periods. | 12/01/21 - 12/31/21 |

| Requirements | Displays the tracking requirements and status of your company's subcontractor invoices. This helps your team determine payment readiness on invoices. To configure the tracking requirements, see Configure Payment Requirements as a Payor. | View Payment Requirements |

| View | Click this button to perform requirement-specific actions: Commitments

Invoice

|

Configure Payment Requirements as a Payor |

| Visible to Payors: View, Request, or Manage |

Click the available button to perform requirement-specific actions: Lien Waivers

|

Send a Request to Unlock a Signed Unconditional Lien Waiver |

| Visible to Payees: View, Unlock, or Manage |

Click the available button to perform requirement-specific actions: Lien Waivers

|

Unlock a Signed Unconditional Lien Waiver as an Invoice Contact |

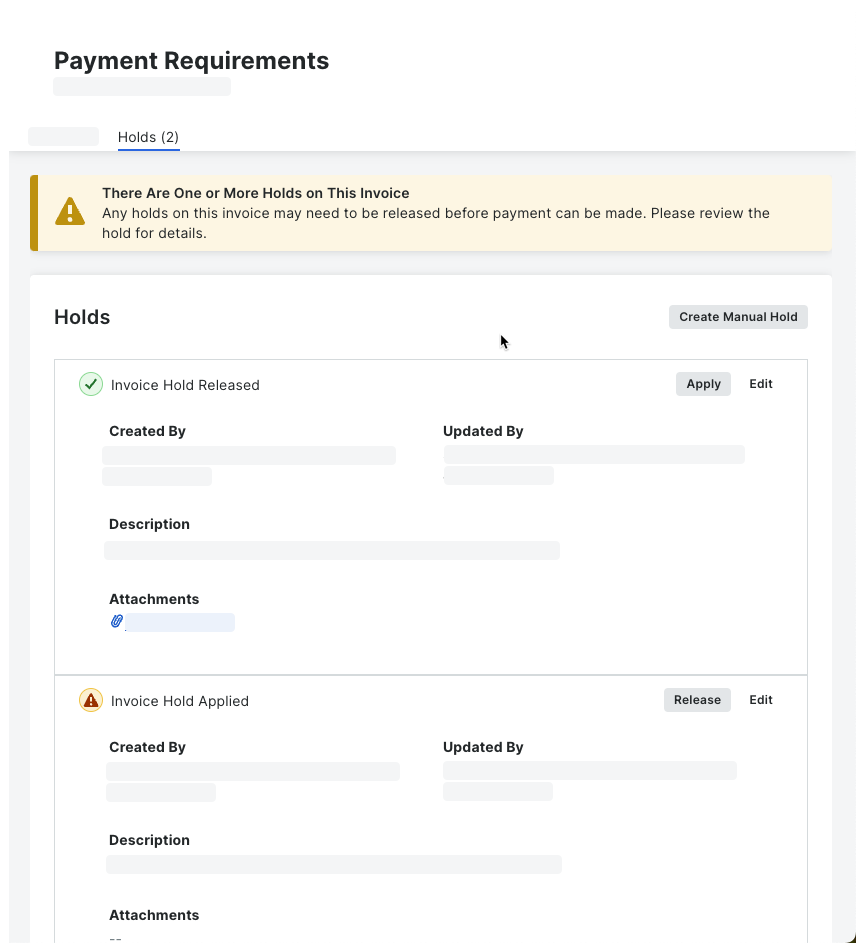

About the Holds Tab

The Holds tab shows the following information.

The table below describes the features in the Holds tab. To learn more, see Manage Payment Holds as a Payor.

| Label | Element | Description |

|---|---|---|

| Status | Icon |

|

| Create Hold | Button | Click this button to create a new hold. |

| Release | Button | Click this button to release an existing hold. |

| Edit | Button | Click this button to modify an existing hold. |

| Created By | Field | Shows the name of the user who created the hold. |

| Last Modified By | Field | Shows the name of the user who last updated the hold. |

| Description | Text | Shows any information entered by the person who created or edited the hold. |

| Attachments | File | Shows any attachments added to the hold. Click the file link to download a copy of the file(s). |

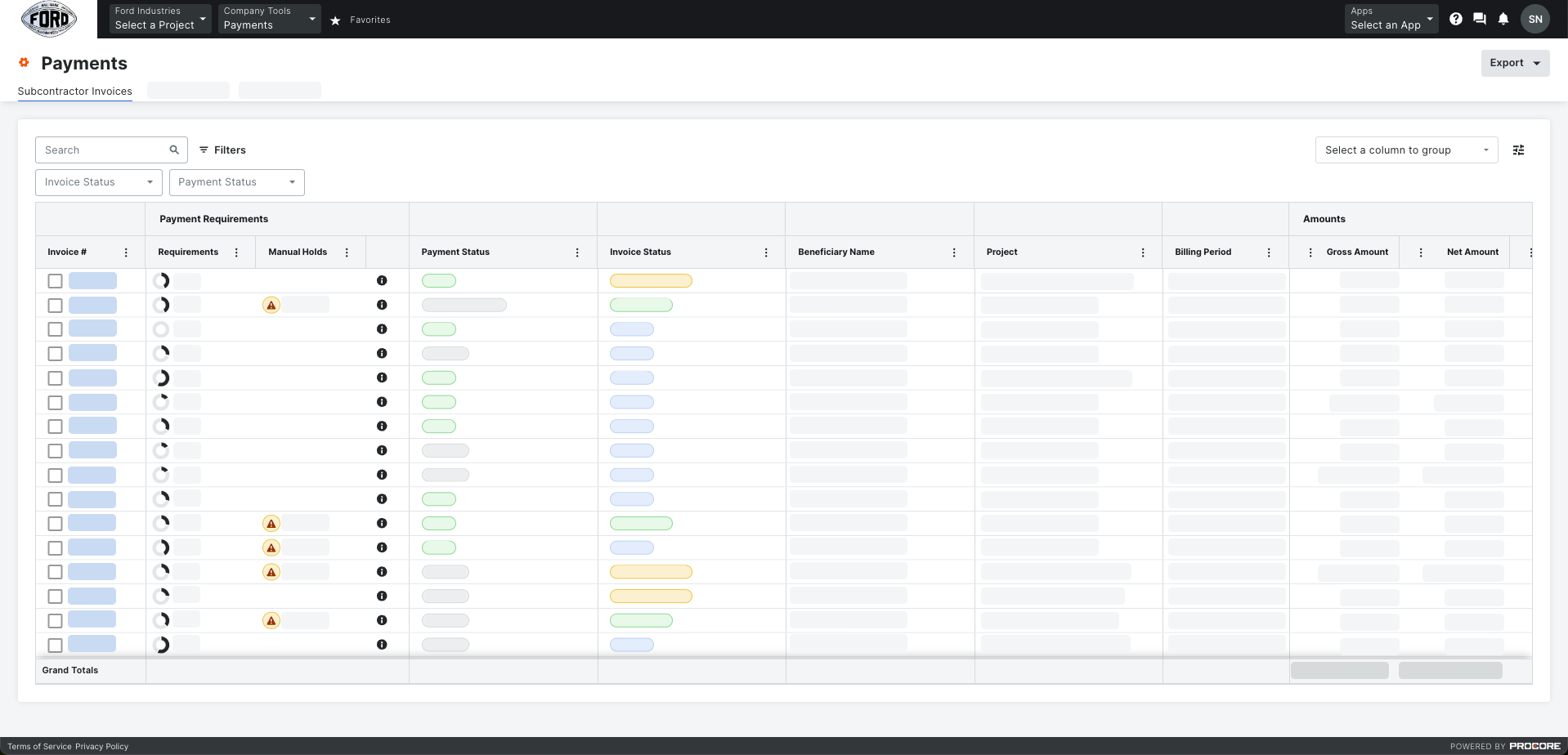

About the Subcontractor Invoices Tab

- Subcontractor Invoices Table

- Default Columns

- Create Disbursement

- Manage Rows & Columns

- Apply Search & Filter Options

- Export a List

Subcontractor Invoices Table

The key feature in the Subcontractor Invoices tab is the table, which lets you view all of the invoices in your Procore projects that you have been granted permission to see. To learn about the recommended permissions, see What is a Payments Admin? and What is a Payments Disburser?

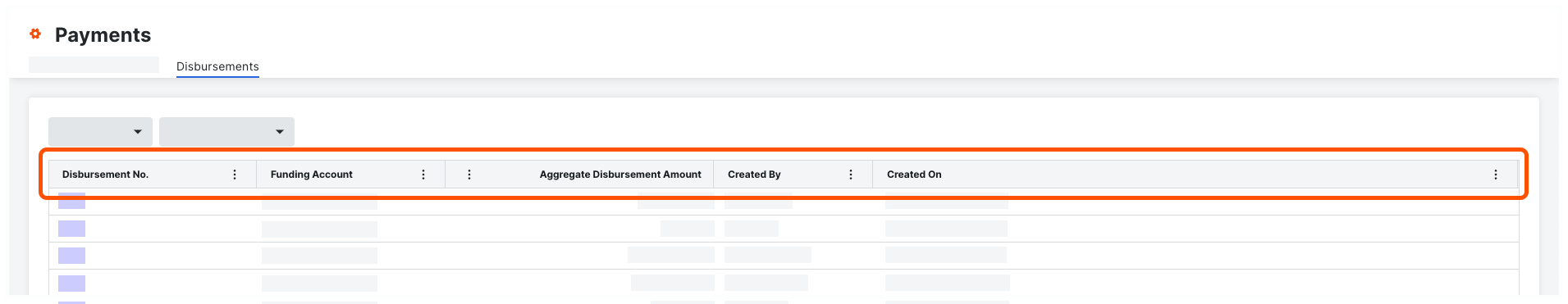

Default Columns

This table details the default columns.

| Column | Description | Default Setting | Learn More |

|---|---|---|---|

| Invoice # | Click a hyperlink to open the corresponding invoice number at the Project level. Procore assigns an Invoice # at creation. | ON | Create Subcontractor Invoices |

| Pie Chart Icon | Shows the current state of the invoice's payment requirements as a pie chart. When BLACK, requirements are met. When GRAY, requirements are incomplete. | ON | Manage Payment Requirements |

| Requirements | A unit fraction shows how many active payment requirements are complete for each invoice. | ||

| Manual Holds | Shows the number of holds applied to an invoice. See What is a manual payment hold on a project invoice? | ON | Manage Payment Holds |

| Information Icon | Click |

||

| Payment Status | Shows the current payment status of each invoice. The status options include: Paid, Partially Paid, or Unpaid | ON | - |

| Invoice Status | Shows the current status of each invoice. Use the Project level Invoicing tool to change status. See What are the default statuses for Procore invoices? | ON | Bulk Edit the Status of Subcontractor Invoices with the Invoicing Tool |

| Beneficiary Name | Shows the name of the payee. This corresponds to the 'Contract Company' set on the invoice's commitment contract. To change the company name, edit the Name field under the company's account profile in the Company level Directory tool. | OFF | Edit a Company in the Company Directory |

| Project | Shows the name of the Procore project associated with each invoice. | ON | Change the Name of a Procore Project |

| Billing Period | Shows the invoice billing period. An invoice administrator creates billing periods. | ON | Manage Billing Periods |

| Amounts Group | Groups the 'Amount' columns in the table | ON | - |

| Gross Amount | Shows the total amount of the invoice before subtracting retainage. | ON | Create a Commitment |

| Net Amount | Shows the actual cost of the invoice after subtracting retainage. | ON | Create a Commitment |

| Paid Amount | Shows the amount paid against the invoice to date. | ON | Create Subcontractor Invoices |

| Invoice Dates | Shows the dates entered as the Period Start and Period End on the invoice. These show the Billing Period Dates by default. You can change the dates. | ON | Create Subcontractor Invoices |

| Payment Date | Shows the Payment Date entered on the invoice. | ON | Create Subcontractor Invoices |

| Submitted Date | Shows the Submitted Date entered on the invoice. | ON | Create Subcontractor Invoices |

| Contract | Click the hyperlink to launch the Project level Commitments tool and open the commitment. | ON | View Commitments |

| Total Contract Amount | Shows the commitment contract's total amount. | ON | Create a Commitment |

| % Complete | Shows the percentage of Total Completed and Stored to Date as a % of the Total Amount of the Commitment Contract for the invoice. | ON | Create Subcontractor Invoices |

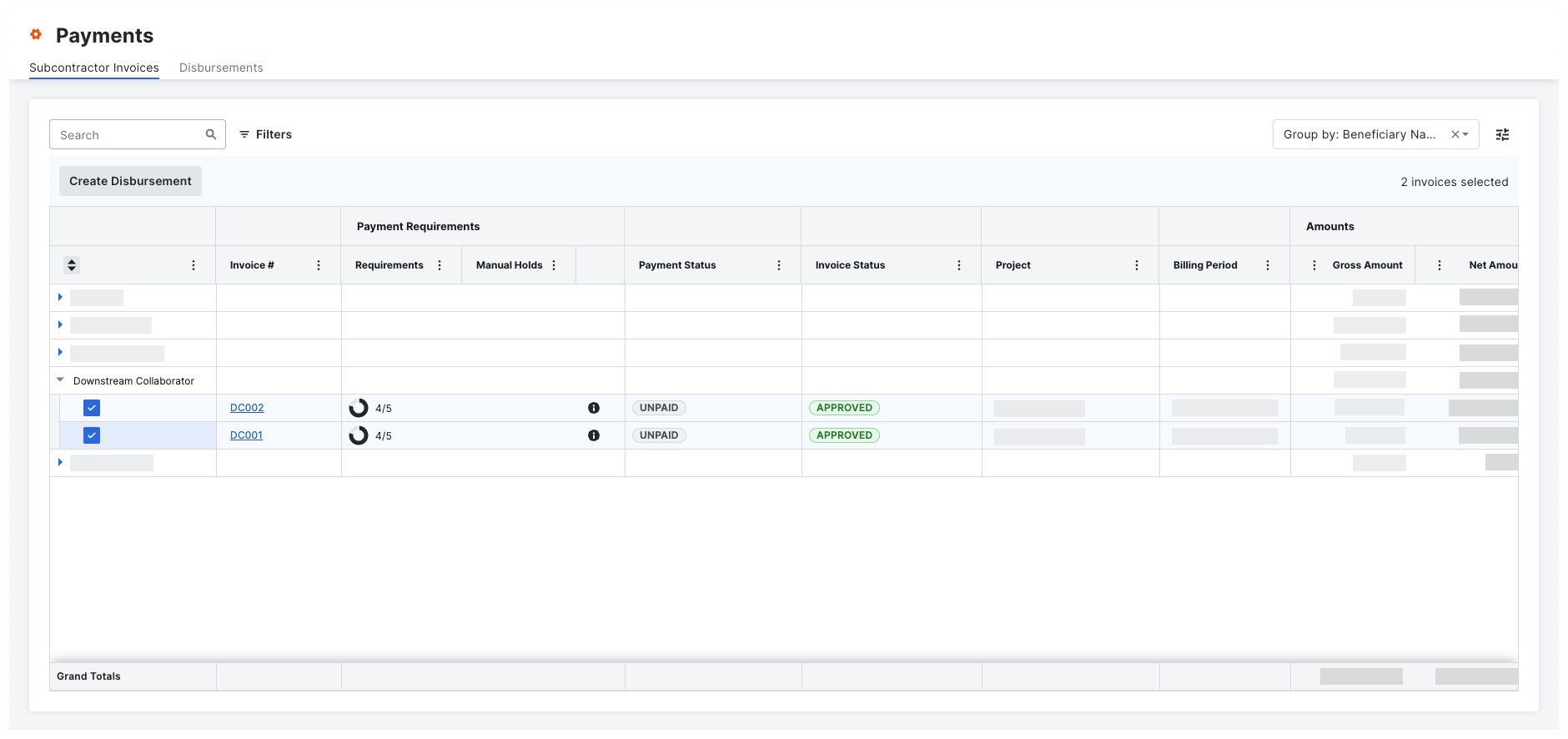

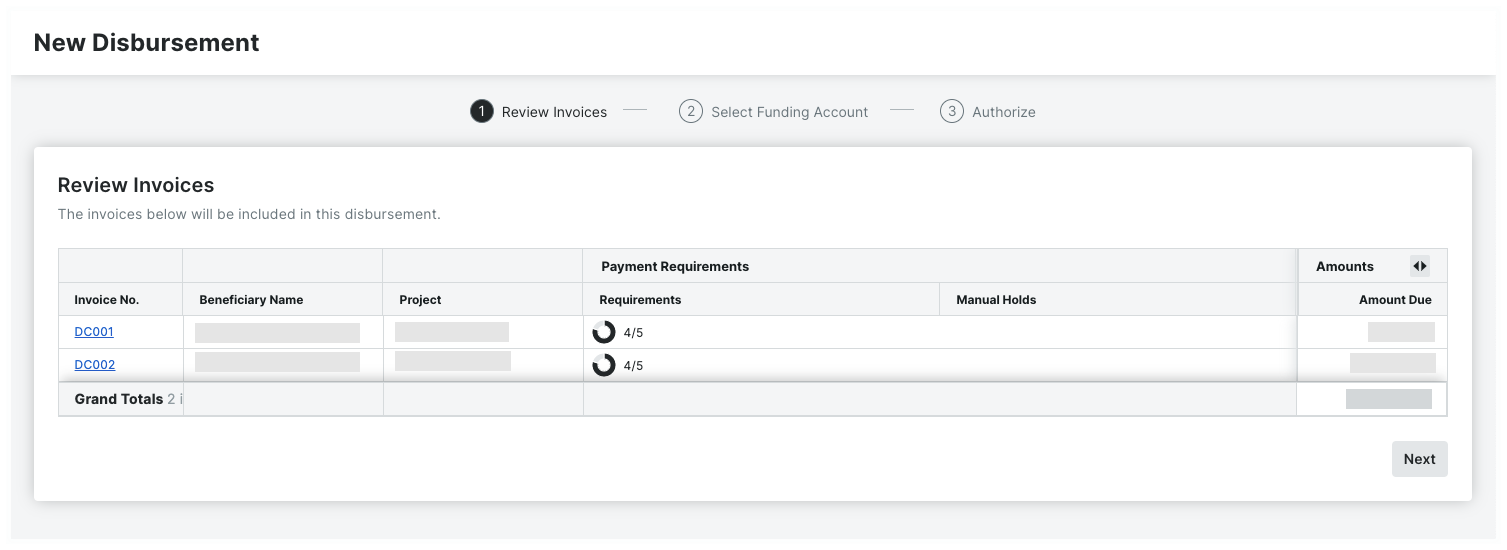

Create Disbursement

When you select more than one (1) checkbox as pictured above, the Create Disbursement button appears. To learn more, see Create Disbursements.

Manage Rows & Columns

To learn how to manage the rows and columns, see Manage Rows & Columns on the Subcontractor Invoices Tab.

Apply Search & Filter Options

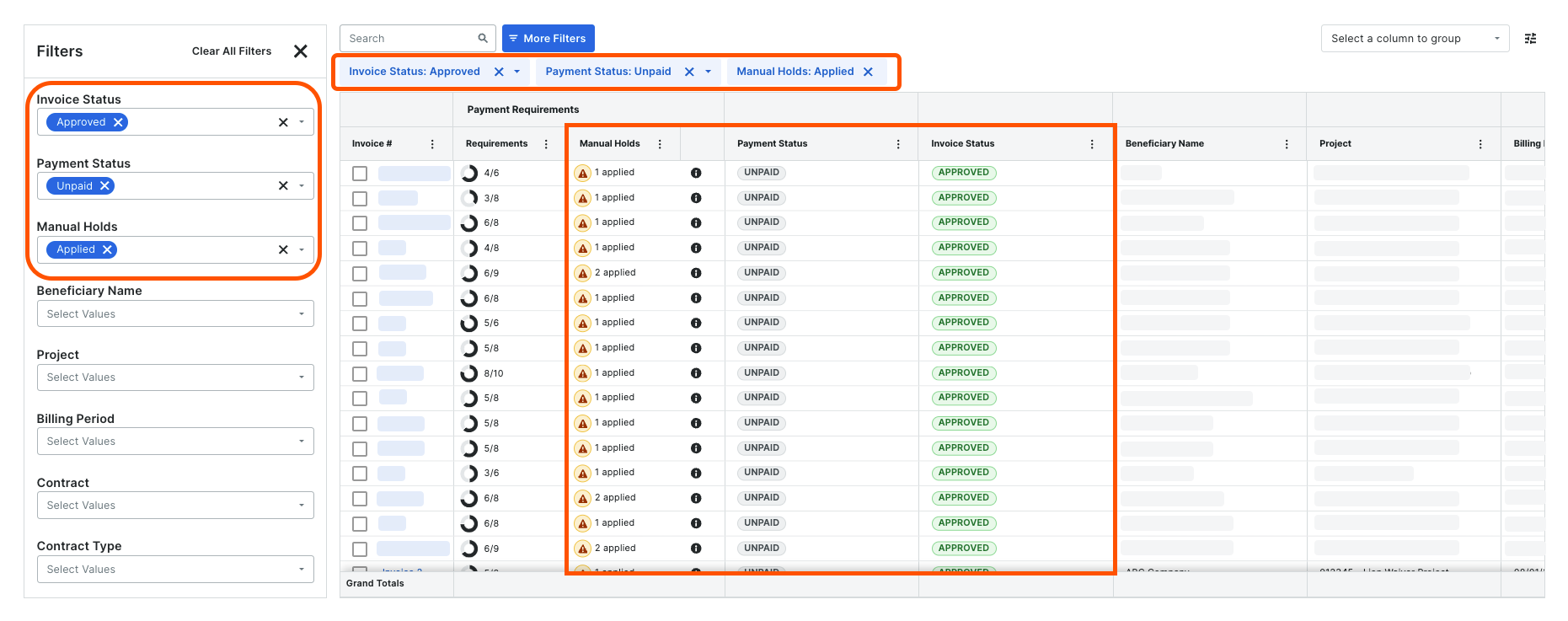

To learn how to apply the search and filter options, see Search for and Apply Filters on the Subcontractor Invoices Tab.

Export a List

To learn how to export a list of subcontractor invoices, see Export Subcontractor Invoices from the Payments Tool.

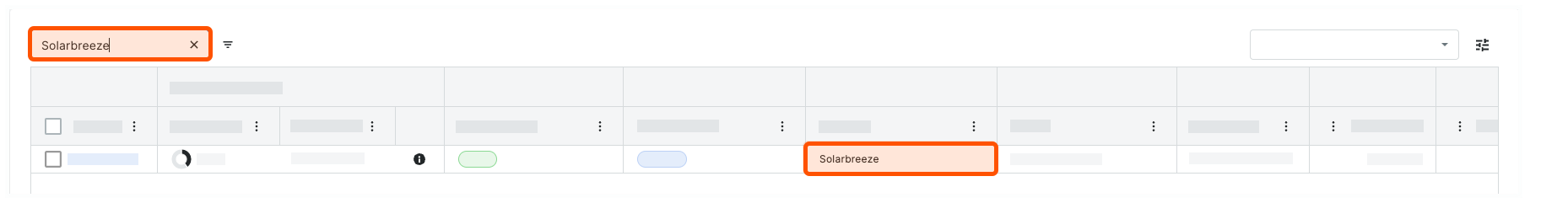

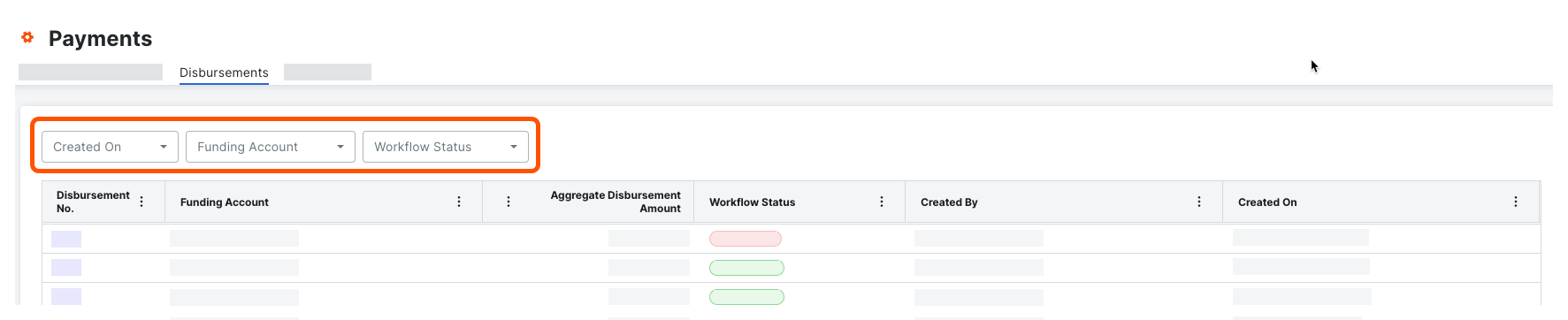

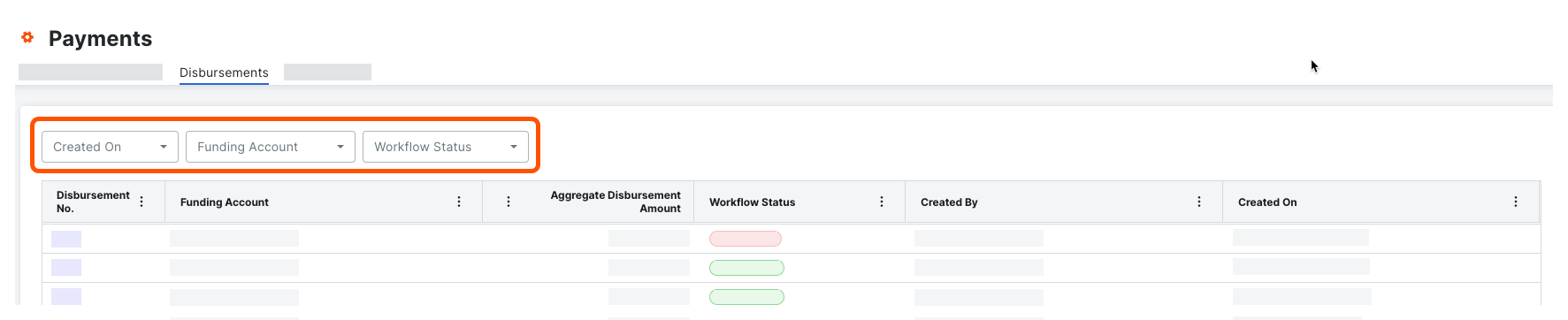

Apply Search & Filter Options

Search for Subcontractor Invoices

- Navigate to the Company level Payments tool.

- Click the Subcontractor Invoices tab.

- Enter keywords in the Search

field. Then press ENTER or press the TAB key to move the system's focus away from the Search field.

field. Then press ENTER or press the TAB key to move the system's focus away from the Search field.

Tip

What is the scope of the search? Procore searches these data columns: Invoice #, Beneficiary Name, Project, and Contract No.

Notes

- If matches are found, Procore displays the matching items.