What are the default verification statuses for bank accounts in Procore Pay?

Answer

Procore Pay gives companies the ability to send and receive invoice payments. In order to pay invoices, both the payor and payee must link at least one (1) external bank account to the Procore Pay product. Who and where you link the bank account depends on whether you are working in the payor or payee environment. To learn how to link an account, see:

- For Payors. A Payments Admin must follow the steps in Add Funding Accounts as a Payor.

- For Payees. A Payments Admin (for paid Procore accounts) or System Admin (for free Procore accounts) must follow the steps in Add a Bank Account as a Payee.

Once your account is linked, the 'Verification Status' status pill shows the status of the identity verification process for that account. See View Funding Accounts as Payor or View Bank Accounts as a Payee.

Verification Status

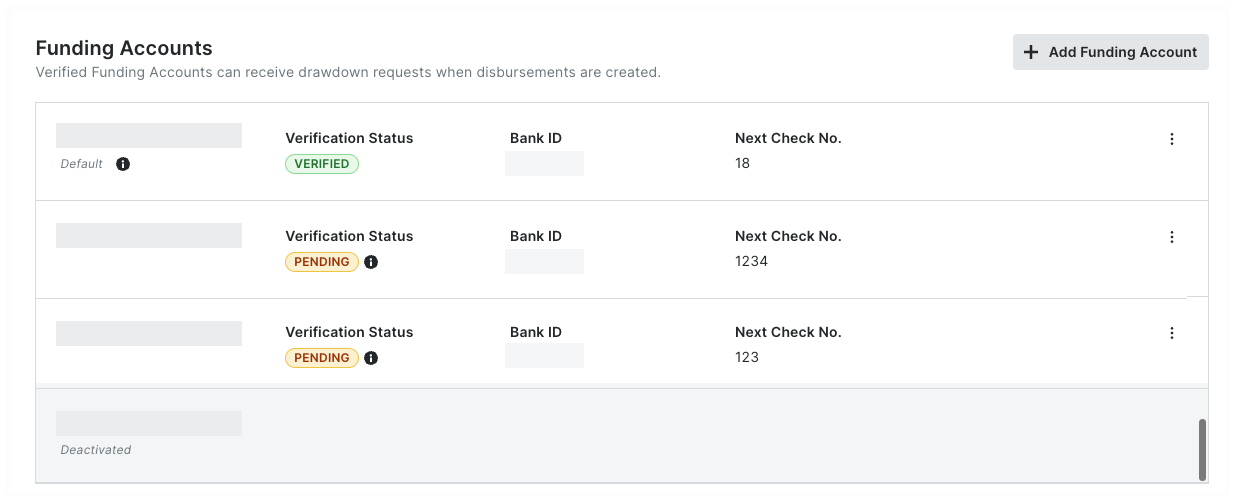

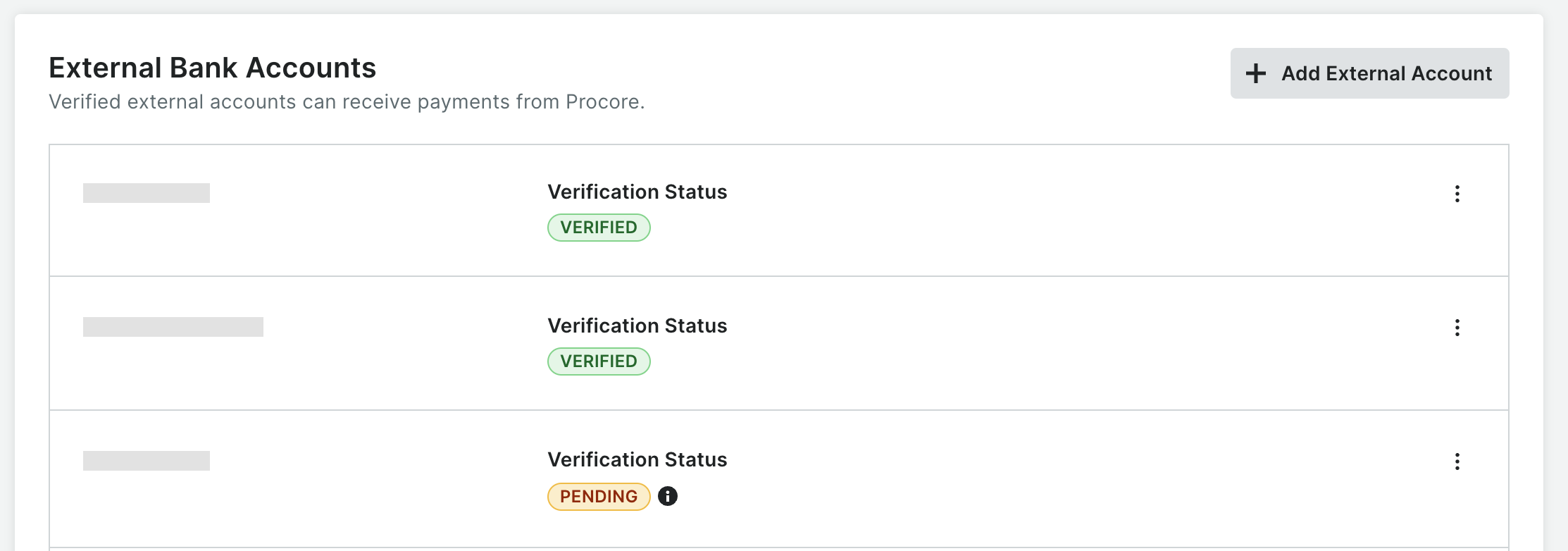

When a bank accounts are added, the verification status of each account appears as a status pill as illustrated below.

Example

This illustration shows you the Verification Status in the payor environment. See View Funding Accounts as a Payor.

This illustration shows you the Verification Status in the payee environment. See View Bank Accounts as a Payee.

This table defines each status. To learn how Payment Admins verify accounts, see Add Funding Accounts as a Payor and Add Bank Accounts as a Payee.

| Status | Definition |

|---|---|

| Verified | The verification process was successful. |

| Pending | The verification process is in progress. The Payment Operations will reach out within two (2) business days if additional documentation is required to complete the verification process. For assistance, contact Payment Operations. |

| Failed | The verification process failed because the additional documents were not received or the documents received couldn't be verified. For assistance, contact Payment Operations. |