Sign Lien Waivers on Project Invoices

NOTE: This page is linked in the Procore web app

Location: Commitments > Contract > Invoice > Lien Rights > Lien Waivers. This page is the Learn More link in the "Signing Unconditional Lien Waivers is Safe" banner. See PAYMENTS-2303.

Important

Author note:

- Log changes to this page on JIRA ILR board: https://procoretech.atlassian.net/browse/ILR-72

- Content is being reused in the Payee User Guide.

Objective

To sign a lien waiver on a subcontractor invoice as an invoice contact.

Background

Only an invoice contact can sign lien waivers on a subcontractor invoice. The payor must invite the invoice contact to submit an invoice. See Send an 'Invite to Bill' to an Invoice Contact. Before submitting the invoice, the invoice contact can sign a lien waiver in the 'Pending Signature' state. If multiple invoice contacts are assigned on a contract, the first signature from any invoice contact is accepted.

Tips

- Is it safe to sign an unconditional lien waiver before receiving this invoice payment? Yes. For unconditional lien waivers, a GRAY banner indicates that your signature is hidden from the payor until the corresponding invoice is paid in full. Although it is uncommon to provide the payor with a signed lien waiver before receiving payment, you do have the option to manually unlock a signed unconditional lien waiver. For instructions, see Unlock a Signed Unconditional Lien Waiver as an Invoice Contact.

- What if I don't have legal authority to sign lien waivers for my company? As an invoice contact, you can share signature authority with the appropriate person. To learn more, see Share Lien Waiver Signature Authority.

Things to Consider

- Required User Permissions:

- You must be an invoice contact on the commitment.

Prerequisites

Steps

- Open the invoice with the lien waiver to sign.

Tip

How to open an invoice? If you are an invoice contact, you can open the invoices using one of these methods:

- Navigate to the Project level Commitments tool. Next, locate your commitment and click the Number link. In the contract, click the Invoices tab. Locate the invoice and click its Invoice # link.

- If you received an invite to bill for the Procore project, open the message in your email program's Inbox and click the View Online link.

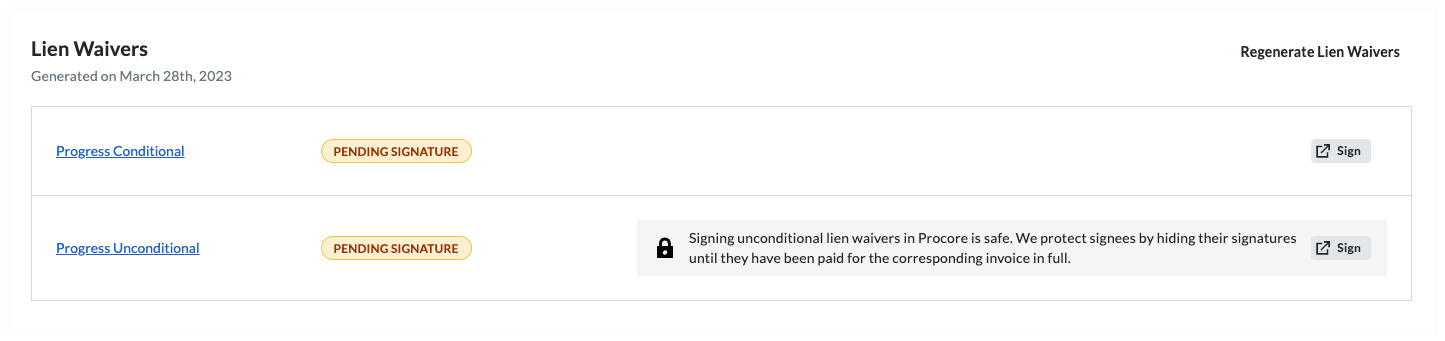

- Scroll to the Lien Waivers card.

- Click Sign.

Tips

- Where is the Sign button? The Sign button only appears when the lien is in the Pending Signature state.

- Is it safe to sign an unconditional lien waiver before receiving this invoice payment? Yes. For unconditional lien waivers, a GRAY banner indicates that your signature is hidden from the payor until the corresponding invoice is paid in full. Although it is uncommon to provide the payor with a signed lien waiver before receiving payment, you do have the option to manually unlock a signed unconditional lien waiver. For instructions, see Unlock a Signed Unconditional Lien Waiver as an Invoice Contact.

- What if I don't have legal authority to sign lien waivers for my company? As an invoice contact, you can share signature authority with the appropriate person. To learn more, see Share Lien Waiver Signature Authority.

- In the [Company Name] is Requesting a Lien Waiver window, click Fill Out & Sign.

This opens the Fill Out Document window. - Conditional. Choose from these options, depending on the type of lien waiver you are signing:

Caution

- Before signing a lien waiver, it is important to understand the different lien waiver types. See What is a lien waiver?

- A signed lien waiver is your legal acknowledgment that payment has been received. When you receive a progress and/or final payment, a signed lien waiver may be required by your general contractor. Depending on the job location, the State government may also require a mandatory lien waiver form, which is included with your invoice.

- To protect your legal and financial interests, it is important to understand what you are signing and when you furnish a signed lien waiver.

- Conditional. A conditional lien waiver should be signed when you expect to receive a progress or final payment. Signing a conditional lien waiver only waives your lien rights for the amount specified through a specific date on the condition that payment through that date is received.

- Unconditional. An unconditional lien waiver is not conditioned on actual payments. Because signing an unconditional lien waiver waives your lien rights immediately, note that Procore Pay protects signees by hiding their signatures until they have been paid for the corresponding invoice in full. A lock is placed on the signed lien waiver until you unlock it.

- Click Next.

- Under Who should receive this document? prompt, choose your signature options:

Notes

- If the lien waiver template allows e-signatures, the eSign tab appears.

- If the lien waiver template has the 'requires Notary' setting, the Print + Sign tab appears.

- Use the controls in the eSign or Print + Sign tab:

- Signature. The signature block includes a default signature for use when signing a lien waiver. To change your signature, click Update Signature. Then type, draw, or upload a new signature.

- Requester. To add new recipients, click the Add Recipient list to select one of your existing contacts or add a new recipient. When adding a new recipient, be sure to assign the contact a Contact Role and enter as much information for the contact as possible and click Save.

- Email Options: To add a note to accompany the email, enter a message in the Add a Note box. To send a copy to yourself, type your email address in the Send a Copy To box.

Notes

- If the lien waiver template allows e-signatures, click the Fill Out and Sign button to sign the lien waiver. Once signed, Procore Pay appends a Certificate of Signature to the lien waiver when users compile or download the waiver. Click here for an example.

- If the lien waiver template has the 'requires Notary' setting, you must print the waiver, sign it, and then click Upload Signed PDF to upload your signed copy.

-

When you are ready to send the lien waiver to your recipients, read the Terms of Service provided and click Accept Terms and Send Document.

-

Once you are done signing the lien waivers you will come back into the Procore Invoice and you will need to click one of these buttons:

-

To save a Draft invoice, click Save as Draft. You can complete it later before the Due Date.

OR -

To send your completed invoice for review, click Send. This changes the invoice's status to Under Review and sends the invoice administrator an email.