Payor: Payments Disburser Guide

- Last updated

- Save as PDF

General Availability in Select Markets (United States)

Procore Pay

Procore Pay Table of Contents

- Welcome

- Setup Multi-Factor Authentication

- Subcontractor Invoices Tab

- Disbursements Tab

- Lien Waivers & Templates

Get Started as a Payments Disburser

|

This Payments Disburser Guide provides project teams who collect invoices and manage payments with helpful information about how Procore Pay It provides an overview of Procore Pay and includes these topics:

|

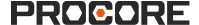

What is Procore Pay?

Pay builds on the existing Project Financials and Invoice Management tools in Procore to streamline the subcontractor invoice payment process and automate the lien waiver exchange.

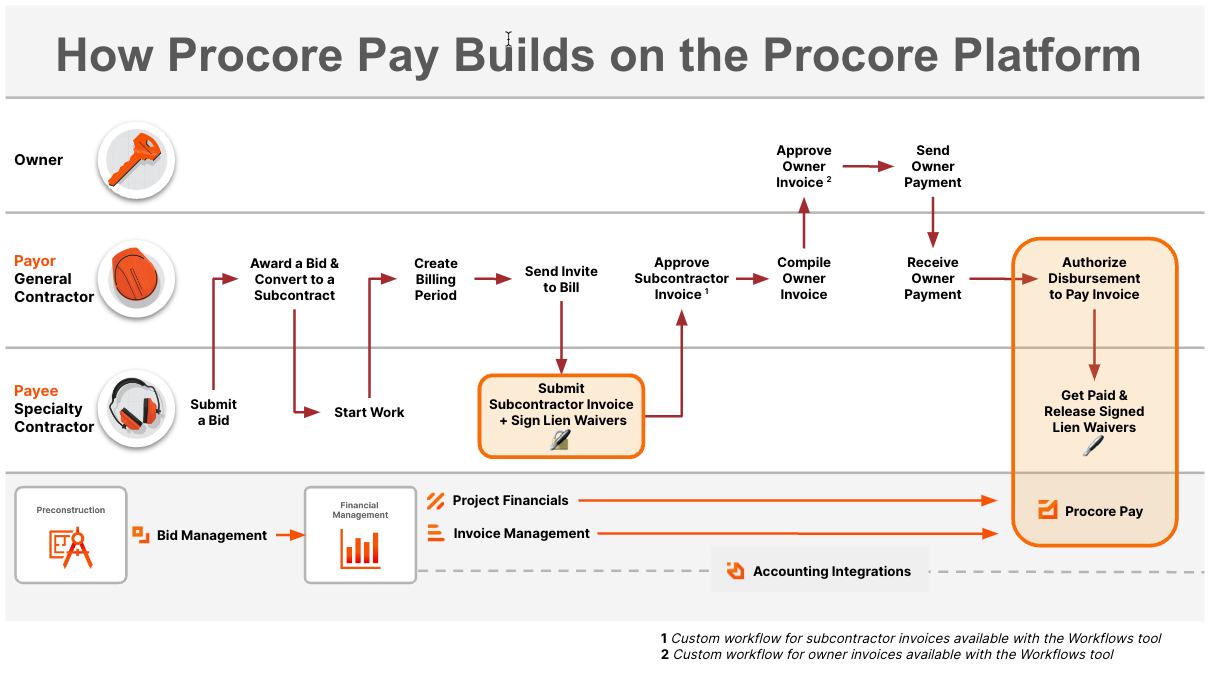

How do funds flow?

Only a Payments Admin or a Payments Disburser can Create Disbursements in Procore Pay. Once authorized, a disbursement initiates these actions:

- A funding request is sent from the deposit account to initiate a drawdown of disbursement funds from the payor's funding account.

- The financial institution executes the drawdown from the payor's funding account into the payor's deposit account.

- The deposit account executes the payment orders in the disbursement.

- The individual payments in the disbursement are sent to the payee's bank accounts (a.k.a., the beneficiary accounts).

What is a Payments Disburser?

In Procore Pay, a Payments Disburser is a Procore user granted permission to create and view disbursements in the Company level Payments tool. Because of the sensitive nature of payments, only a Payments Admin can add/remove disbursers.

To learn more about the Payments Disburser role:

- How is the Payments Disburser role assigned to Procore users?

- Do Payment Disbursers require Multi-Factor Authentication (MFA)?

- Does a Payments Disburser need additional permissions on Procore's tools?

- Are there any limitations that Payments Disbursers need to be aware of?

- Who are my company's Payments Disbursers?

How is the Payments Disburser role assigned to Procore users?

There are two (2) steps:

- Mark the user as an employee in the Company Directory. See How do I add someone as an employee of my company?

- Grant the user 'Read-Only' level permissions or higher to the Payments tool. Procore recommends creating a permissions template for your Payments Disbursers. To learn how, see Create a Company Permissions Template.

- Add the user as a disburser. See Add Payments Disbursers.

Do Payments Disbursers require Multi-Factor Authentication (MFA)?

Yes. Payment Disbursers are required to verify their identities before gaining access to Procore Pay and before performing sensitive transactions. To learn more, see How does MFA work with Procore Pay and why is it required?

Does a Payments Disburser need additional permissions on Procore's tools?

A Payments Disburser should also be an invoice administrator. This ensures they can view all the subcontractor invoices for the appropriate projects. Your Procore Administrator can provide your disburser(s) with invoice administrator access to one project, specific projects, or all projects.

| Procore Tool | Required User Permissions | Description | Learn More |

|---|---|---|---|

| Project Level Commitments Tools | 'Admin' on the Commitments tool | Assign the user invoice administrator permissions on a project permissions template. | What is an invoice administrator? |

Are there any limitations that Payments Disbursers need to be aware of?

If a Payment Disburser changes the status of a subcontractor invoice to one of the GREEN statuses (for example, 'Approved', 'Approved as Noted', or 'Pending Owner Approval') that disburser is NOT permitted to create a disbursement if the disbursement contains a payment for the approved invoice. Invoice approval and disbursement creation must be performed by two (2) different authorized users.

Who are my company's Payments Disbursers?

As a general contractor using Procore Pay, ask your company's Payments Admins about Payments Disbursers. A Payment Admin must assign the Payments Disburser role to a Procore user. See Add Payments Disbursers. Your Procore Administrator can identify your disbursers in the 'Project Team' section on each project's Home page. For details, see Add the Project Team to the Project Home Page.

How does MFA work with Procore Pay?

- Why does Procore Pay require MFA?

- How does MFA work?

- Which Procore Pay users are required to log in with MFA?

- Which one-time password applications are compatible with Procore Pay?

- What are the MFA account lockout settings?

- When are Procore Pay users challenged by MFA?

- Are MFA login attempts recorded?

- Is MFA required when testing the Payments tool in our company's Sandbox?

- How do Procore Pay users troubleshoot user issues with MFA?

Why does Procore Pay require MFA?

To provide Procore Pay with a trusted method to safeguard private data related to payment transactions, it is important for end users to ensure strong password management protections are in place in your environment. To help safeguard your most sensitive operations from unauthorized account access, Procore Pay requires users to complete a multi-step account login process. This process is called Multi-Factor Authentication (MFA). It is also commonly referred to as 2FA.

How does MFA work?

To provide Procore Pay with a trusted method to safeguard sensitive bank account information and payment transactions, it is important for Procore Pay customers to ensure your environment has strong password management protections in place. To help ensure your most sensitive operations are guarded against unauthorized account access, Procore Pay users must complete a multi-factor account login process to authenticate their identity.

These factors include:

- Enter your email address and password for your Procore user account. If you are an authorized user with access permission to Procore Pay, you will be prompted to enter your user name and password on the Procore login page.

- Enter a one-time password code generated by an MFA app on a mobile device. Next, a Time-Based One-Time Password (TOTP) code is sent to your mobile device. A TOTP code is a randomly generated secret code displayed on a user's mobile device using a TOTP-compliant app.

Which Procore Pay users are required to log in with MFA?

Authorized users who have been granted role-based permissions to the Company level Payments tool are required to log in using MFA before accessing the Company level Payments tool and before performing secure financial operations.

The table below details the roles and requirements for MFA:

| Role | Before logging in... | Before performing these tasks... |

|---|---|---|

| Payments Admin | ||

| Payments Disburser | ||

| Payments Beneficiary |

Which one-time password applications are compatible with Procore Pay?

Procore Pay has tested two applications that can be used in your company's environment: Google Authenticator and Auth0 Guardian. However, other TOTP-compliant applications can also be used, such as Microsoft Authenticator.

The application used in your company's environment is likely determined either by your company's owner and/or your IT department. Procore has tested these TOTP apps for compatibility with Procore Pay:

What are the MFA account lockout settings?

To prevent repeated MFA login attempts as part of an attack, designated Procore Pay users are subject to these account lockout settings:

- Number of failed login attempts to trigger account lockout: 10 (TOTP)

Notes:- Procore lockout settings configured in the Company level Admin tool do NOT apply with MFA enabled.

- If you are locked out of your account, contact Payment Operations to request an MFA reset.

When are Procore Pay Users challenged by MFA?

Your company's authorized Payments Admins and the Payments Disbursers designated by your Payments Admin are required to provide multiple verifications every time they perform one of these actions in the Procore web application:

- Log in to your company's account in the Procore web application.

- Navigate to the Company level Payments tool.

- Creating or submitting a disbursement:

- If using Procore Pay to send payments without the Workflows tool, before a Payments Disburser creates a disbursement in the Payments tool.

- If using Procore Pay with the Workflows tool, before the designated Workflow Approver submits a disbursement.

- When the Company level Payments tool is idle for more than 30 minutes in a user session.

Are MFA login attempts recorded?

Yes. Every attempted MFA login and its outcome is logged. Records are retained in the log for six (6) years.

Is MFA required when testing the Payments tool in our company's sandbox account?

Procore Pay is not available in your company's Sandbox account.

How do I troubleshoot user issues with MFA?

Below are tips for troubleshooting common issues with MFA as a Procore Pay user.

| Issue | How to troubleshoot... | How to escalate... | For assistance |

|---|---|---|---|

| Your account has been locked after multiple consecutive login attempts. | Number of failed login attempts to trigger account lockout: 10 | Contact Procore Pay Operations to verify your identity and request an MFA reset. | Contact Payment Operations |

| You do not have your mobile device with you or your device is powered OFF. | You can finish authentication using the recovery code that you were provided during setup. See Set Up MFA for Procore Pay on Your Device. | Contact Payment Operations | |

| You forgot your Procore password. | Reset your Procore password. After resetting your password, be sure to type in the new password manually when logging in. Your browser could autofill a previous password that is no longer valid, so manual entry is recommended. | Contact Support | |

| Your transaction expires. | When logging in with MFA, users must submit their first and second factor within five (5) minutes. If you exceed this time, you will need to log in again and obtain a new secret code (TOTP). | Contact Payment Operations | |

| You need to remove or delete a user from MFA |

You cannot remove MFA requirements for a user who has Payments Admin or Payments Disburser permissions. You must remove the user's permissions to Pay to remove the MFA requirement. To remove the MFA requirement for a Payments Admin user by removing their Payments Admin permission, contact Procore Pay Support. |

Contact Payment Operations | |

| Your account shows an 'incorrect code' message. | Make sure you entered the correct code, and check that the date/time settings on your mobile device are correct:

|

Contact Payment Operations |

Set Up MFA for Procore Pay

- Install an Authenticator App on Your Mobile Device

- Log in to the Procore Web Application

- Log in to the Procore Web Application with MFA

Install an Authenticator App on Your Mobile Device

Before you begin the login steps, install an authenticator app on your mobile device. Procore Pay's MFA solution is compatible with TOTP-compliant Authenticator apps.

Important

- You must be located in the United States. Access to Procore Pay is NOT available to users outside of the United States.

- If your device is managed by your company, you may need permission to download the TOTP-compliant password application on your Android or iOS mobile device.

Log in to the Procore Web Application

Authorized Procore Pay users will use these steps to log in to Procore Pay for the first time and enroll their device in MFA.

- On your computer, go to the Procore web application at: https://app.procore.com.

- At the login screen, enter your Procore email address and password. Then, click Log In.

If you are a designated 'Payments Admin', 'Payments Disburser', or 'Payments Beneficiary Approver' in the payor environment, the MFA solution requires you to complete the steps below. See Log in to Procore Pay with Multi-Factor Authentication.

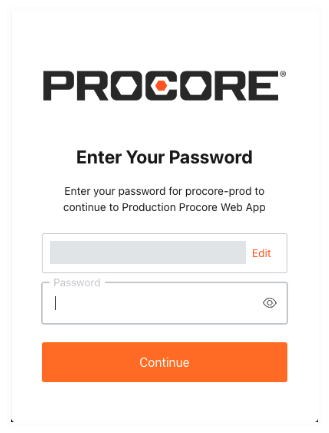

Log in to the Procore Web Application with MFA

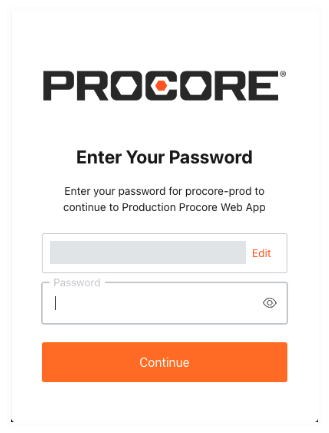

- On the Enter Your Password page, enter your Procore Email Address and Password again.

- After entering your login credentials, follow the appropriate steps below:

Examples

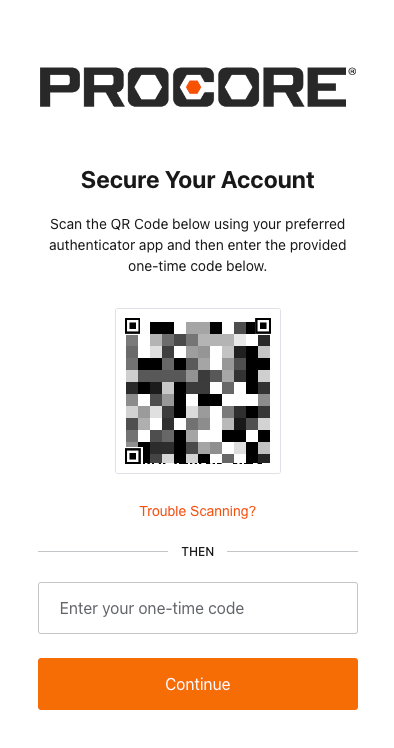

If Your Device is Not Enrolled in MFA

If your mobile device is NOT enrolled in MFA, the Secure Your Account page appears. You must download and install an authenticator app to scan the QR code. You will not be able to secure your account if scanning a QR code with your device's camera. Contact your company's IT department for guidance on the app to use in your environment.

Important

- The example steps below show you how to download and install the free Google Authenticator app.

- Your company may require you to use a different authenticator app. To confirm the app to use in your environment, contact your company's IT department.

Do the following:

- With your mobile device, open your authenticator app and scan the QR code displayed on your computer's screen.

Tip

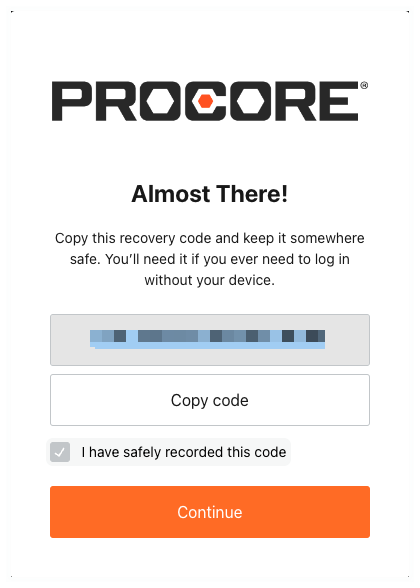

Why isn't my phone's camera scanning the QR code? To use the Scan a QR Code function, you must scan the QR code with the Authenticator app. If you are trying to scan the code using your phone's built-in camera software, it will NOT work. Instead, open the Authenticator app and then use the app's built-in scanning function. - At the Almost There page, click Copy Code and mark the I have safely recorded this code check box.

- Click Continue.

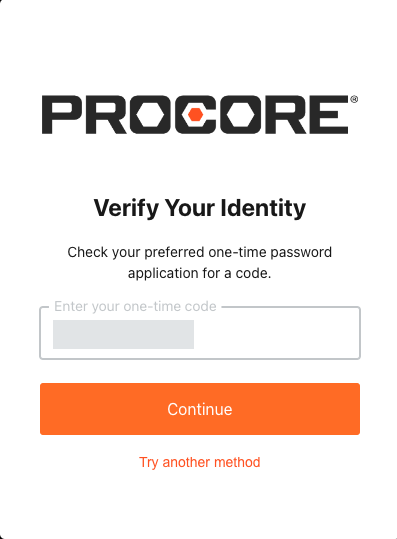

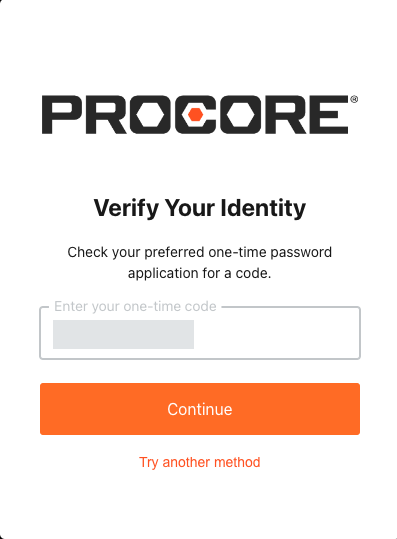

If Your Device is Enrolled in MFA

If your device has already been enrolled in MFA, the Verify Your Identity page appears. Check your mobile device's preferred one-time password application for your secret code. Then type that code in the Enter Your One-Time Code box and click Continue.

Important

If your company has implemented its own Single Sign-On (SSO) or MFA requirements, you may be required to enter additional login credentials to access Procore Pay. For assistance with those steps, contact your IT department.

Log In to Procore Pay with MFA

- Go to the Procore web application at: https://app.procore.com.

- Enter your Procore email address and password. Then, click Log In.

- Open the one-time password application on your mobile device and select your account.

Tip

Are you seeing the 'Set Up Your First Account' screen? To learn how to log in for the first time, see Set Up MFA for Procore Pay on Your Device instead of the steps below. - At the Enter Your Password screen shown below, do the following:

- Accept the email address or click Edit to modify the email address.

- Type your Password.

- Click Continue.

- Check the one-time password application on your mobile device for your secret code.

Tip

- What is a one-time password application? A One-Time Password (OTP) application is an app that is installed on a hardware device that helps to safeguard your Procore Pay account from unauthorized access. It generates a random code that you enter when challenged, to verify your identity. The code is randomly generated and changes each time you are challenged by MFA to verify your identity.

- What is an MFA device? An MFA device is an electronic device (such as a mobile phone or another device) on which you have installed the one-time password application.

- At the Verify Your Identity page, choose from these options:

- Recommended. Type your secret code in the Enter Your One-Time Code box.

OR - Click Try Another Method. Then select one of the available options. Typically, you can choose between using one of the listed authenticator apps or you can enter the recovery code that you recorded in Set Up MFA for Procore Pay on Your Device.

Tip

Why are my options different? The options that appear for you depend on the authenticator app that you installed.

- Recommended. Type your secret code in the Enter Your One-Time Code box.

- Click Continue.

If you successfully pass the login challenge, you are logged in to the Procore web application.Important

If your company has implemented its own Single Sign-On (SSO) or MFA requirements, you may be required to enter additional login credentials to access Procore Pay. For assistance with those steps, contact your IT department.Tip

Seeing a blocked account message? To safeguard your company's sensitive information, your account is automatically blocked after multiple consecutive login attempts. For assistance with resetting or recovering your account access, contact your company's Procore Administrator. Your administrator can submit an MFA reset request with Procore's Payments Operations team. See Contact Support.

About the Subcontractor Invoices Tab

- Subcontractor Invoices Table

- Default Columns

- Create Disbursement

- Manage Rows & Columns

- Apply Search & Filter Options

- Export a List

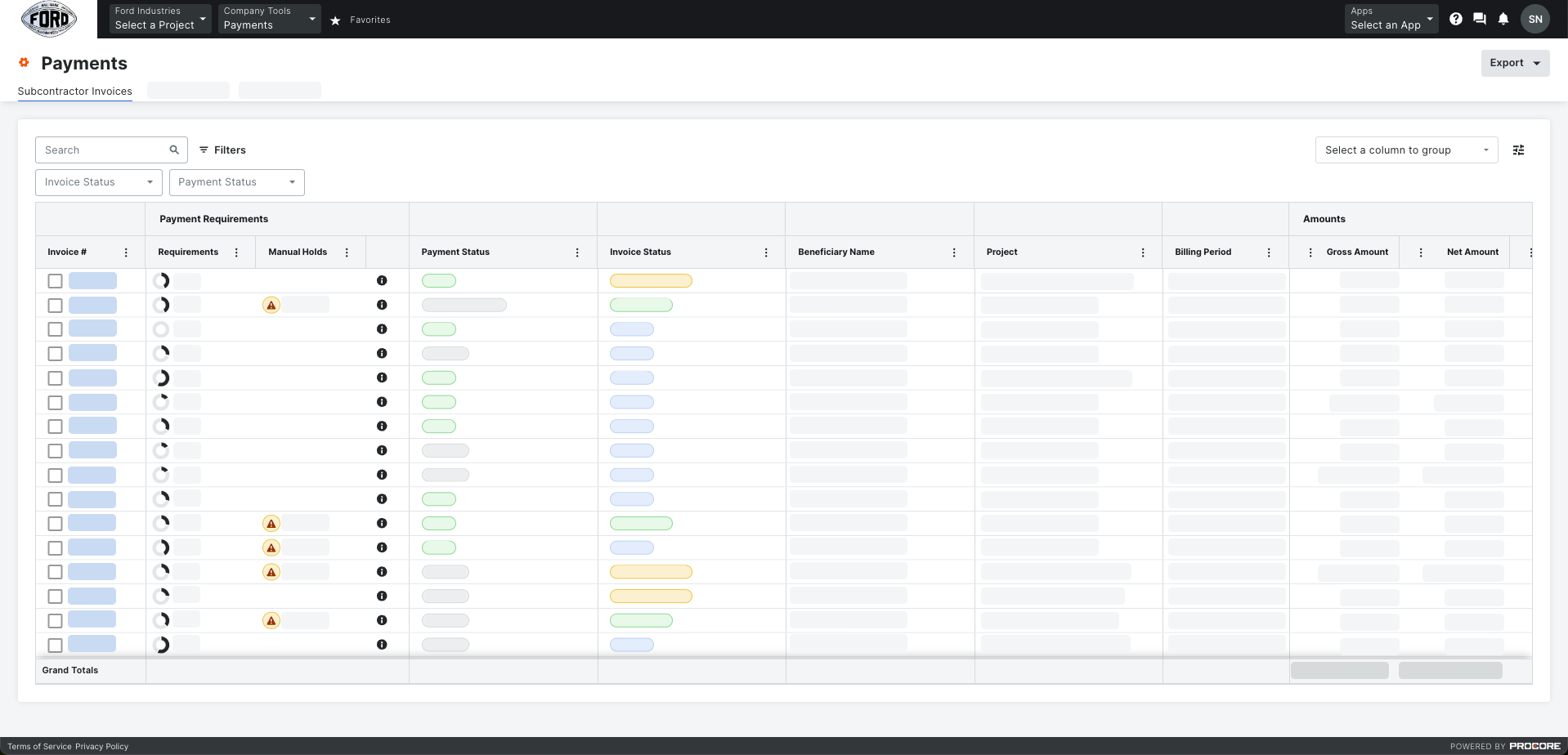

Subcontractor Invoices Table

The key feature in the Subcontractor Invoices tab is the table, which lets you view all of the invoices in your Procore projects that you have been granted permission to see. To learn about the recommended permissions, see What is a Payments Admin? and What is a Payments Disburser?

Default Columns

This table details the default columns.

| Column | Description | Default Setting | Learn More |

|---|---|---|---|

| Invoice # | Click a hyperlink to open the corresponding invoice number at the Project level. Procore assigns an Invoice # at creation. | ON | Create Subcontractor Invoices |

| Pie Chart Icon | Shows the current state of the invoice's payment requirements as a pie chart. When BLACK, requirements are met. When GRAY, requirements are incomplete. | ON | Manage Payment Requirements |

| Requirements | A unit fraction shows how many active payment requirements are complete for each invoice. | ||

| Manual Holds | Shows the number of holds applied to an invoice. See What is a manual payment hold on a project invoice? | ON | Manage Payment Holds |

| Information Icon | Click |

||

| Payment Status | Shows the current payment status of each invoice. The status options include: Paid, Partially Paid, or Unpaid | ON | - |

| Invoice Status | Shows the current status of each invoice. Use the Project level Invoicing tool to change status. See What are the default statuses for Procore invoices? | ON | Bulk Edit the Status of Subcontractor Invoices with the Invoicing Tool |

| Beneficiary Name | Shows the name of the payee. This corresponds to the 'Contract Company' set on the invoice's commitment contract. To change the company name, edit the Name field under the company's account profile in the Company level Directory tool. | OFF | Edit a Company in the Company Directory |

| Project | Shows the name of the Procore project associated with each invoice. | ON | Change the Name of a Procore Project |

| Billing Period | Shows the invoice billing period. An invoice administrator creates billing periods. | ON | Manage Billing Periods |

| Amounts Group | Groups the 'Amount' columns in the table | ON | - |

| Gross Amount | Shows the total amount of the invoice before subtracting retainage. | ON | Create a Commitment |

| Net Amount | Shows the actual cost of the invoice after subtracting retainage. | ON | Create a Commitment |

| Paid Amount | Shows the amount paid against the invoice to date. | ON | Create Subcontractor Invoices |

| Invoice Dates | Shows the dates entered as the Period Start and Period End on the invoice. These show the Billing Period Dates by default. You can change the dates. | ON | Create Subcontractor Invoices |

| Payment Date | Shows the Payment Date entered on the invoice. | ON | Create Subcontractor Invoices |

| Submitted Date | Shows the Submitted Date entered on the invoice. | ON | Create Subcontractor Invoices |

| Contract | Click the hyperlink to launch the Project level Commitments tool and open the commitment. | ON | View Commitments |

| Total Contract Amount | Shows the commitment contract's total amount. | ON | Create a Commitment |

| % Complete | Shows the percentage of Total Completed and Stored to Date as a % of the Total Amount of the Commitment Contract for the invoice. | ON | Create Subcontractor Invoices |

Create Disbursement

When you select more than one (1) checkbox as pictured above, the Create Disbursement button appears. To learn more, see Create Disbursements.

Manage Rows & Columns

To learn how to manage the rows and columns, see Manage Rows & Columns on the Subcontractor Invoices Tab.

Apply Search & Filter Options

To learn how to apply the search and filter options, see Search for and Apply Filters on the Subcontractor Invoices Tab.

Export a List

To learn how to export a list of subcontractor invoices, see Export Subcontractor Invoices from the Payments Tool.

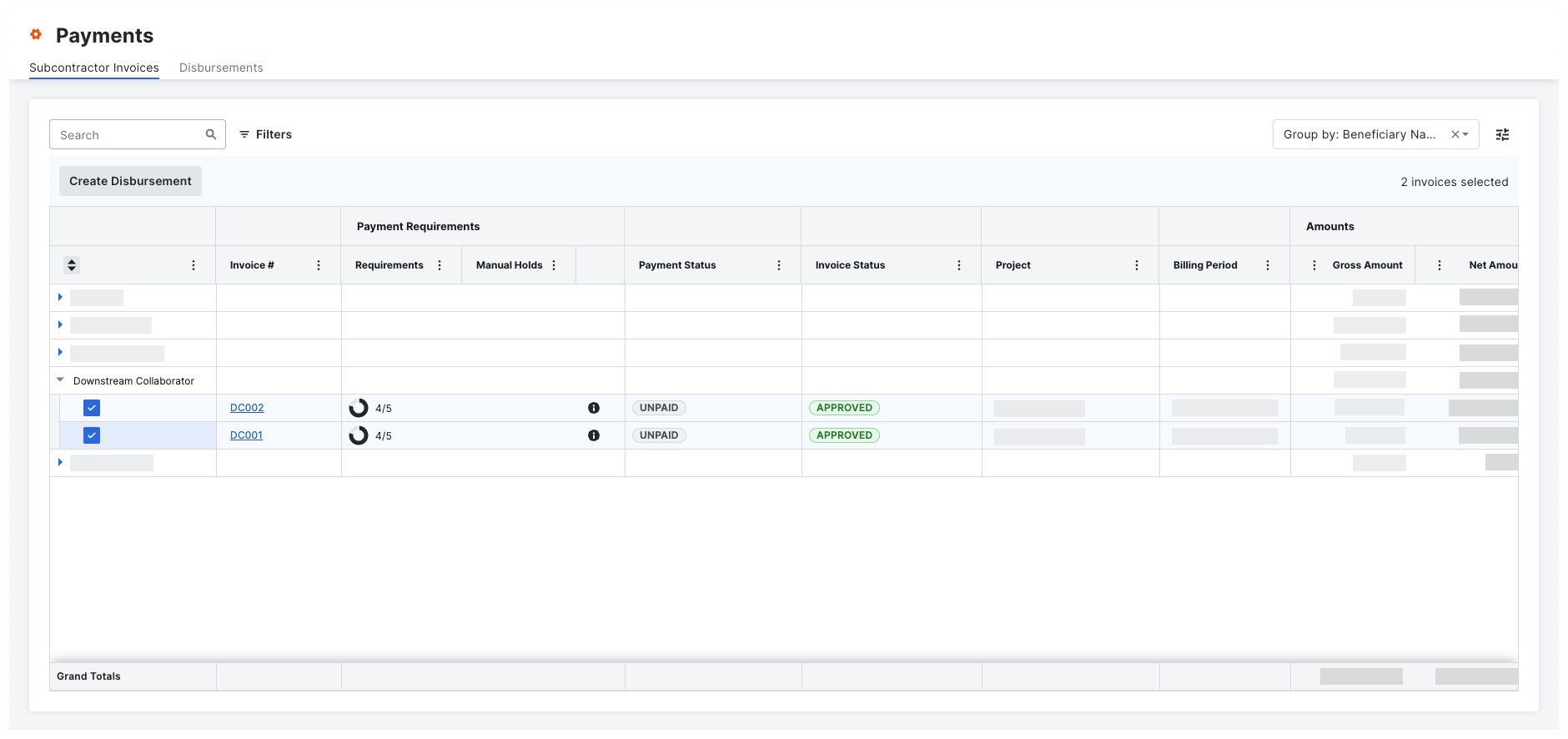

Create a Disbursement

Important

Payment Admins and Disbursers are not permitted to create a disbursement if they were the last approver on any subcontractor invoice in that disbursement.- Navigate to the Company level Payments tool.

- Click the Subcontractor Invoices tab.

- Mark one (1) or more checkboxes to select the unpaid invoices to pay with your disbursement. You can add up to 150 invoice payouts to a disbursement.

Tip

Not sure if an invoice is ready to pay? Use these tips to find out:

- Use the Search, Filter, and Group By options to narrow the items in the list. See Manage Rows & Columns on the Subcontractor Invoices Tab and Search for and Apply Filters on the Subcontractor Invoices Tab.

- Under Payment Requirements, a unit fraction in the Requirements column shows when an invoice has met your company's payment requirements and an icon appears in the Manual Holds column if a hold has been applied. Payments Admins define your company's Payment Requirements (see Manage Payment Requirements as a Payor) and invoice administrators can apply manual holds (see Create and Apply a Manual Hold on an Invoice). Only authorized users can View Payment Requirements.

- Click Create Disbursement.

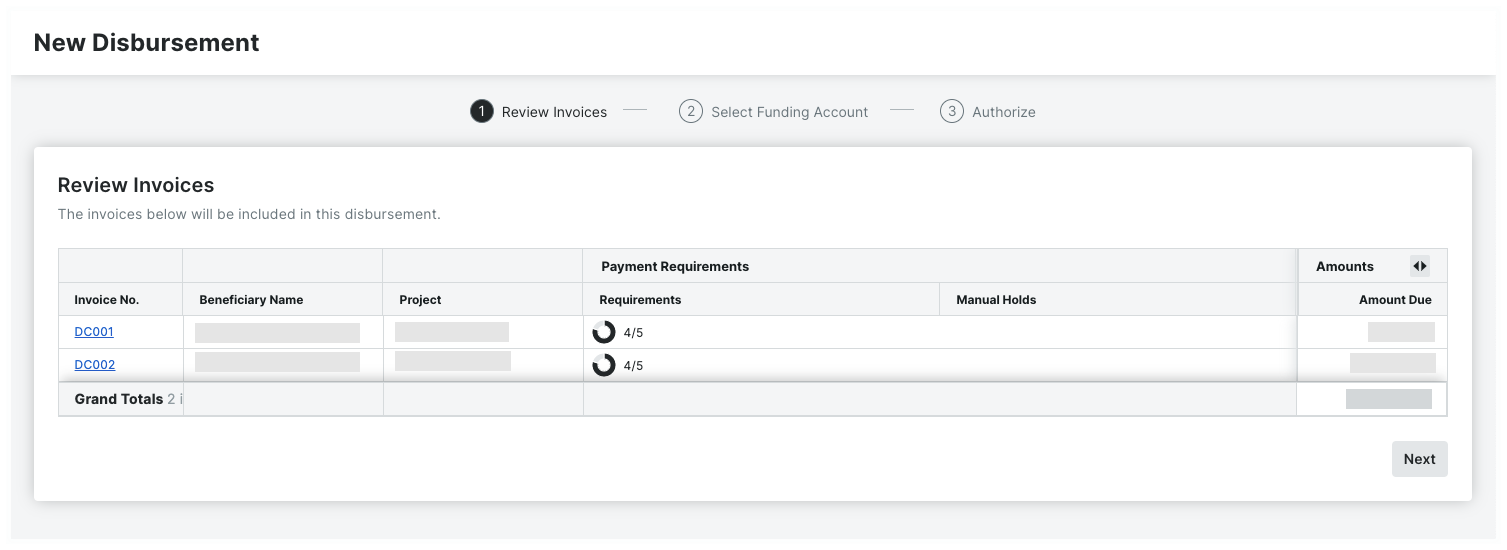

This opens the New Disbursement panel on the right side of the page. - Confirm the invoices and amounts in the Review Invoices list.

Tips

- Want to remove an invoice from the disbursement? To learn how, see Remove Subcontrator Invoices from Disbursements as a Payor.

- Has the invoice met the payment requirements? To see if your company's payment requirements have been met, review the Requirements and Manual Holds under Payment Requirements.

- Where is the #3 Authorize step in my new disbursement? If your Procore Pay environment is configured to use a Payments Workflow, the New Disbursement page does not include the #3 Authorize step or a Next button pictured below. To learn about the difference when authorizing disbursements with and without the Workflows tool, see Authorize Disbursements.

- If you are ready to proceed, click Next.

The Select Funding Account page appears. - Under Select Funding Account, select the funding account from the drop-down list.

Caution

Before clicking the Next or Create Disbursement button to proceed, review the information about authorizing a disbursement. Once authorized, the drawdown request and the payment orders cannot be canceled.

Authorize a Disbursment with a Payments Workflow

If the Workflows tool is enabled, the default Payments Workflow configured for your environment starts automatically. An email notification is sent to the workflow step's assignee who must review the disbursement and all associated payments.

Important

Payment processing for a disbursement cannot be canceled after a disbursement is authorized. To learn how to cancel a disbursement before authorization, see Cancel Disbursements Before Authorization as a Payor.Complete the Payments Workflow

Assignee(s) must complete all steps in your Payments Workflow before a Payments Admin or Payments Disburser can authorize the disbursement.

Tips

- Need to remove a subcontractor invoice before authorizing the disbursement? To learn how, see Remove Subcontrator Invoices from Disbursements as a Payor.

- How do assignees on a Payments Workflow step respond to a workflow step? See Approve or Reject a Disbursement with a Custom Payments Workflow.

- Want to set up a Payments Workflow to use on your disbursements? See Best Practices for Creating a Payments Workflow

Authorize the Disbursement

Once the custom workflow steps are approved, you can continue the authorization as follows.

Important

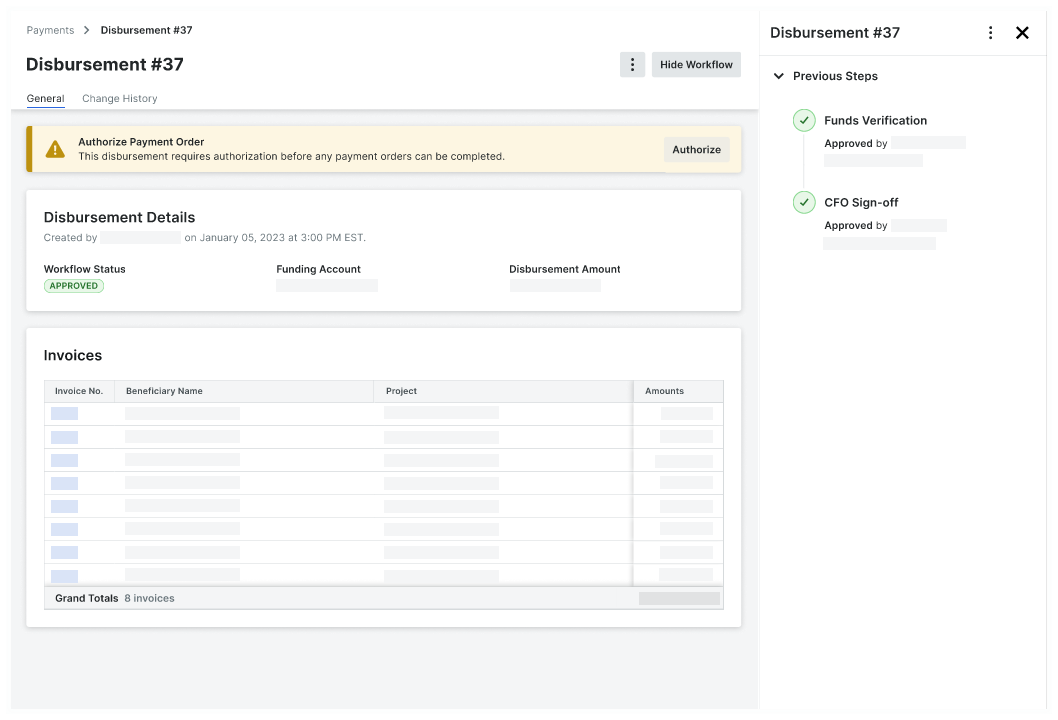

Payment Admins and Disbursers are not permitted to create a disbursement if they were the last approver on any subcontractor invoice in that disbursement.- In the General tab of the disbursement, the Authorize Payment Order banner if a Payments Workflow has been configured.

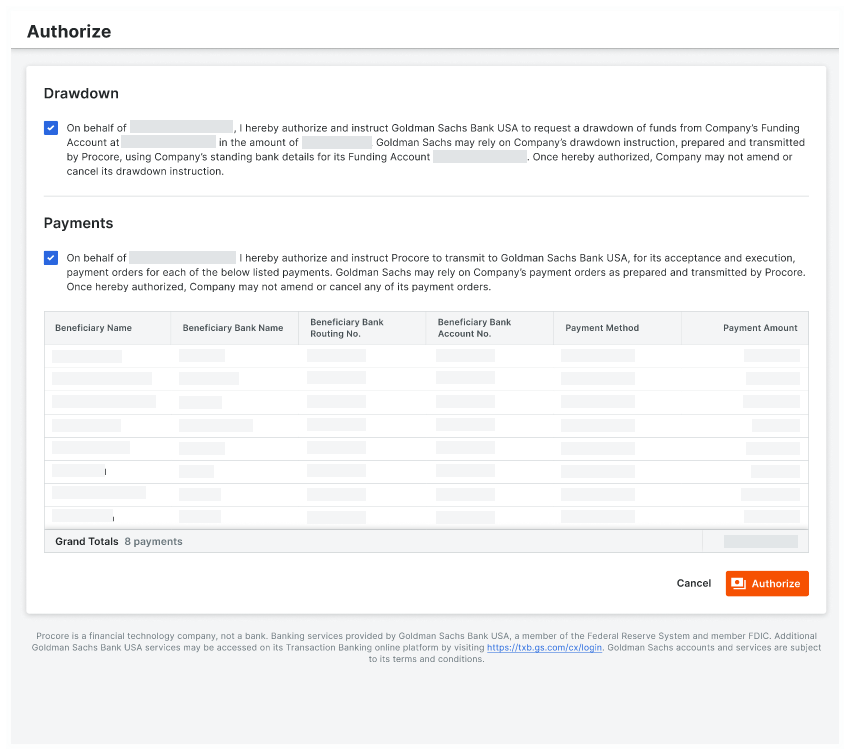

- Optional. Depending on your role, start the authorization process as follows:

- If you are the assignee on the last custom workflow step, the authorization step opens automatically.

OR - If you are not the assignee on the last custom workflow step, you must click Authorize.

This opens the Authorize page.Tip

Don't see the Authorize button? If your company's custom Payments Workflow has not been configured, users with the appropriate permissions will see a banner with an option to configure it. See Best Practices for Creating a Payments Workflow and Configure the Settings for a Payments Workflow Template.

- If you are the assignee on the last custom workflow step, the authorization step opens automatically.

- Under Drawdown, mark the checkbox to authorize the drawdown instructions.

- Under Payments, mark the checkbox to authorize the payment orders.

- Click Authorize.

Procore Pay issues a required Multi-Factor Authentication challenge to verify the identity of the Payment Disburser authorizing the disbursement. See How does MFA work with Procore Pay and why is it required?

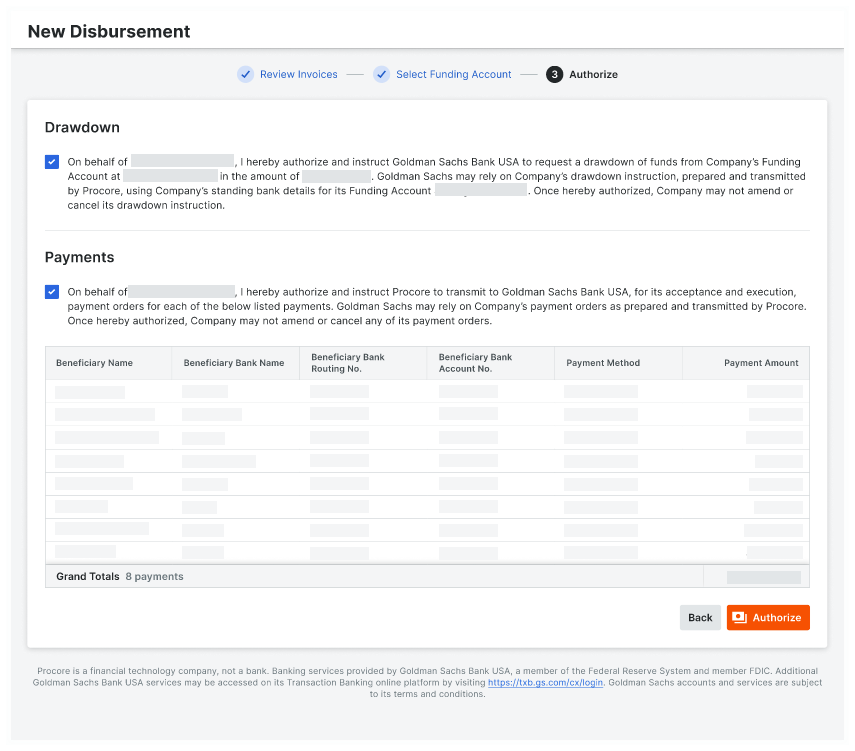

Authorize a Disbursement without a Payments Workflow

If the Workflows tool is disabled, a third 'Authorize' step appears on the New Disbursement page. Only a Payments Admin or Payments Disburser can acknowledge the Drawdown and Payments for the disbursement.

Important

Payment processing for a disbursement cannot be canceled after a disbursement is authorized. To learn how to cancel a disbursement before authorization, see Cancel Disbursements Before Authorization as a Payor.Important

Payment Admins and Disbursers are not permitted to create a disbursement if they were the last approver on any subcontractor invoice in that disbursement.- Under Drawdown, mark the checkbox to authorize the drawdown instructions.

- Under Payments, mark the checkbox to authorize the payment orders.

- Click Authorize.

Procore Pay issues a required Multi-Factor Authentication challenge to verify the identity of the Payment Disburser authorizing the disbursement. See How does MFA work with Procore Pay and why is it required?

Complete the Transactional MFA Challenge

- At the Verify Your Identity page, open your Authenticator app on your mobile device to retrieve your one-time-code.

Tip

Don't have an Authenticator app on your device? To learn more, see Set Up MFA for Procore Pay on Your Device. - In the Enter your one-time code box, enter the code provided by the Authenticator app.

Note: After 10 failed attempts at completing the MFA challenge, you will be logged out of Procore. You must log in again and successfully pass the MFA challenge at login to be able to navigate back to the disbursement and re-try authorization. - Click Confirm.

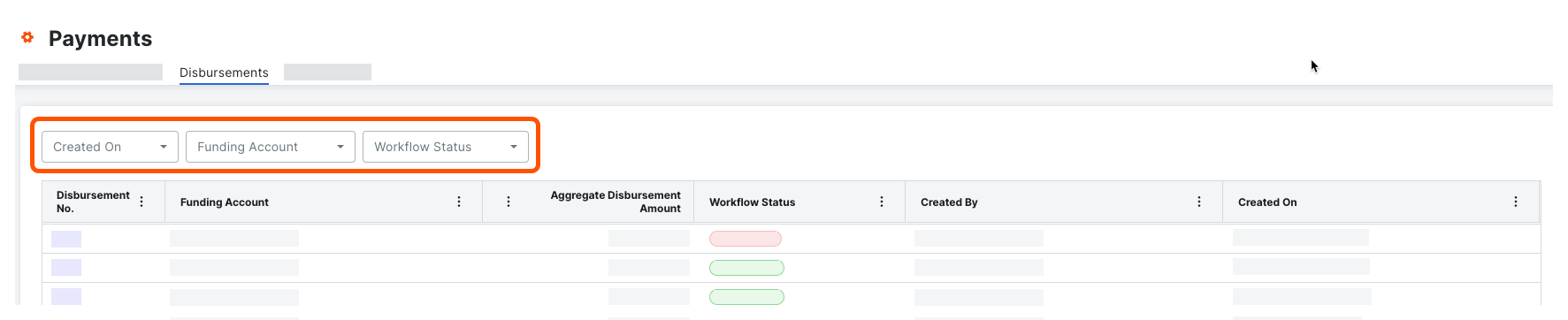

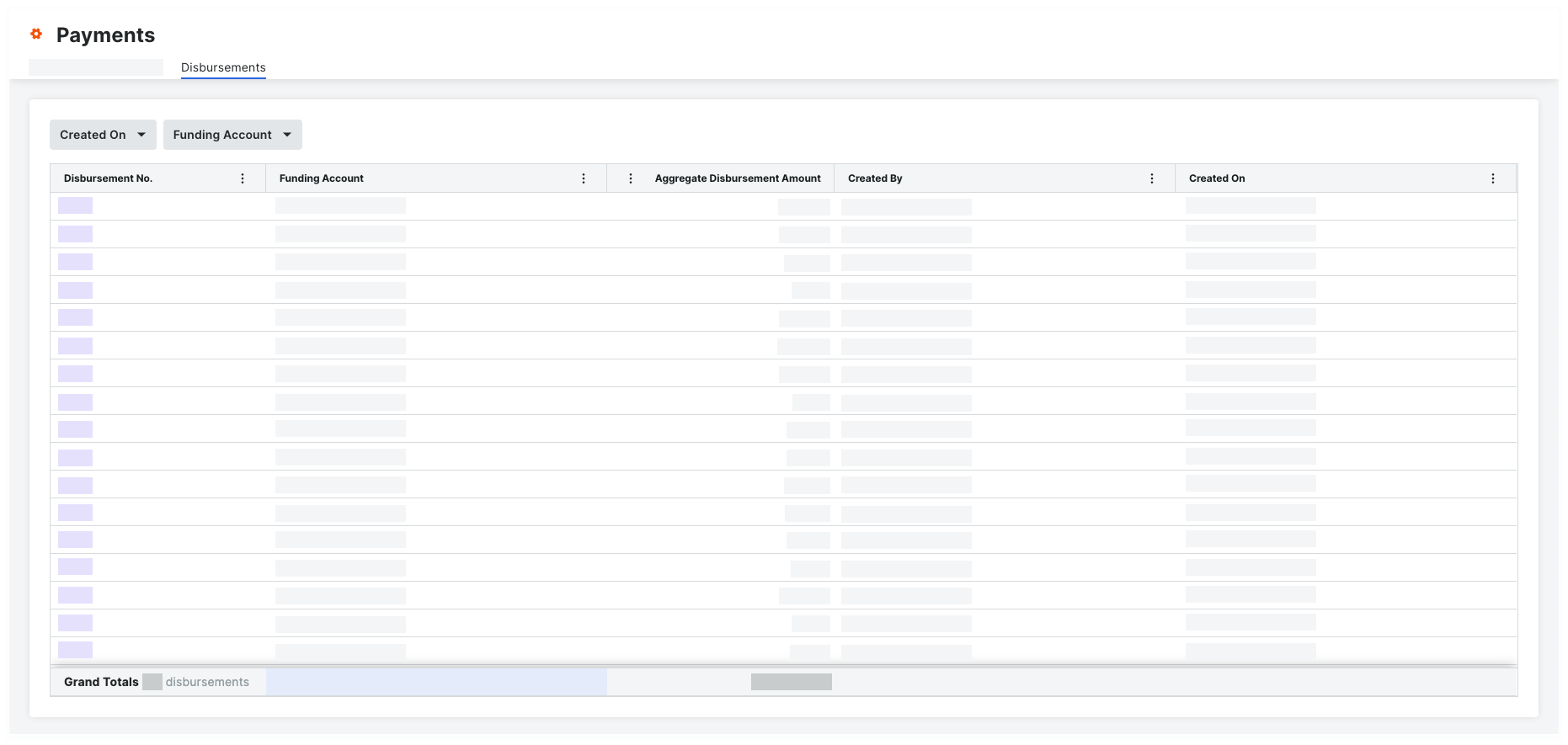

About the Disbursements Tab

- Navigate to the Company level Payments tool.

The Subcontractor Invoices tab is active by default. - Click the Disbursements tab.

The key features and controls in the Disbursements tab include:

Tip

Don't see the Disbursements tab? Only a Payments Admin or Payments Disburser can view this tab. Your company's Payments Admin can assign users to the Payments Disburser role. See Add Payments Disbursers as a Payor.

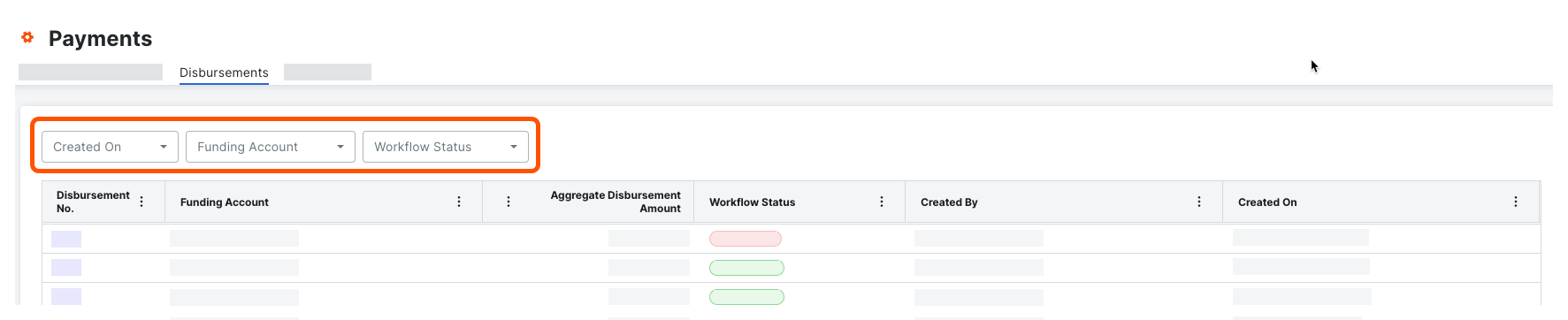

Filters

You can filter the table data using these options.

An asterisk (*) in the table below indicates this is a default filter. Optional filters are also noted.

| Element | Type | Description | Learn More |

|---|---|---|---|

| Created On * | Drop-down list | Apply one of these filters to show only those invoices on the list: Last 30 Days, Last 60 Days, Year to Date. | Create Disbursements |

| Funding Account * | Drop-down list | Apply one of these filters to show only those invoices related to the selected funding account. Accounts are managed by a Payments Admin. | Manage Bank Accounts |

| Workflow Status | Drop-down list | This list only appears if your team has enabled the Payments tool to configure a Payments workflow. Apply one of these filters to show only those invoices in the corresponding workflow status. To learn about statuses, see What are the default statuses for a disbursement in a Payments Workflow for Procore Pay? | Best Practices for Creating a Payments Workflow |

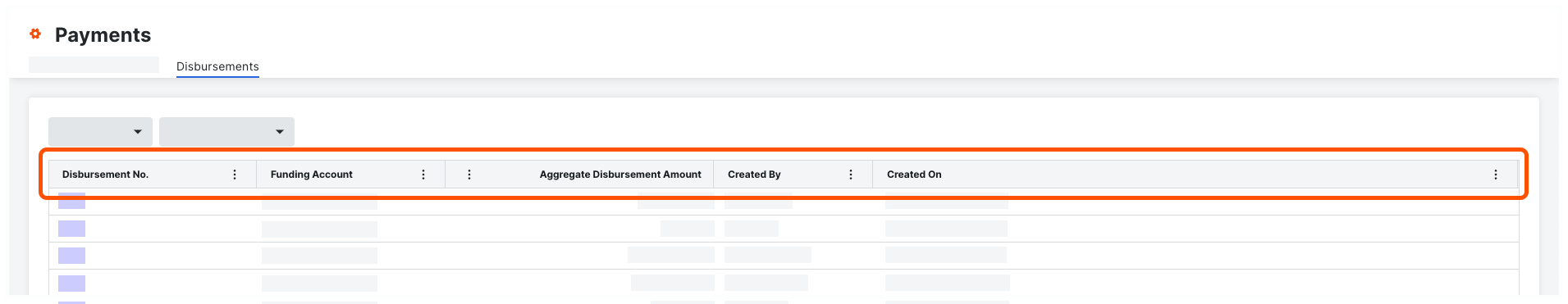

Default Columns

This illustration below shows you the location of the columns in the Disbursements tab. To learn more, see Create Disbursements.

This table details the default columns in the disbursements table.

| Element | Type | Description | Learn More... |

|---|---|---|---|

| Disbursement No. | Column | Shows the number assigned to a disbursement. | Create Disbursements |

| Funding Account | Column | Shows the name of the funding bank account that funded the disbursement. | Manage Bank Accounts |

| Aggregate Disbursement Amount | Column | Show the aggregate disbursement amount. This shows the grand total of all the payment amounts in a single disbursement. | Create Disbursements |

| Created By | Column | Shows the name of the Payments Admin who created the disbursement. | Create Disbursements |

| Created On | Column | Shows the date the disbursement was created. | Create Disbursements |

Optional Columns

This illustration below shows you the location of the optional columns in the Disbursements tab.

This table details the optional columns in the disbursements table.

| Element | Type | Description | Learn More... |

|---|---|---|---|

| Workflow Status | Column | For customers who have enabled the Workflows tool and configured a custom Payments workflow, this column reflects the current workflow status of each disbursement. To learn about statuses, see What are the default statuses for a disbursement in a Payments Workflow for Procore Pay? | Best Practices for Creating a Payments Workflow |

View a Disbursement

- Navigate to the Company level Payments tool.

- Click the Disbursements tab.

Tip

Don't see the Disbursements tab? To view this tab, your Procore user account must be assigned the Payments Disburser or Payments Admin role. - In the Disbursements tab, the table lists all the disbursements.

- In the Disbursement ID column, click a link to open a specific disbursement.

Tip

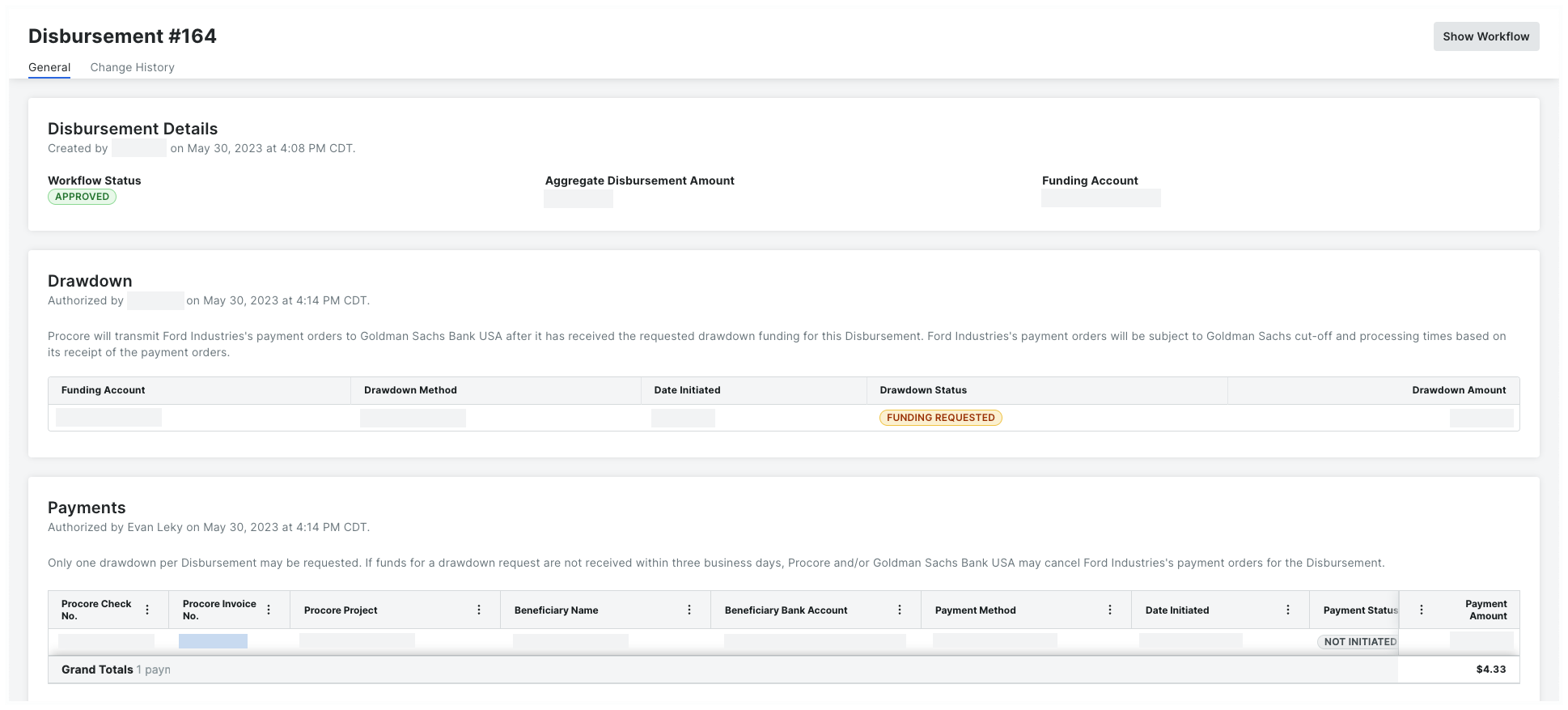

Why do our disbursements have different page layouts? When viewing a disbursement, the information that appears depends on whether the disbursement has been authorized or not.

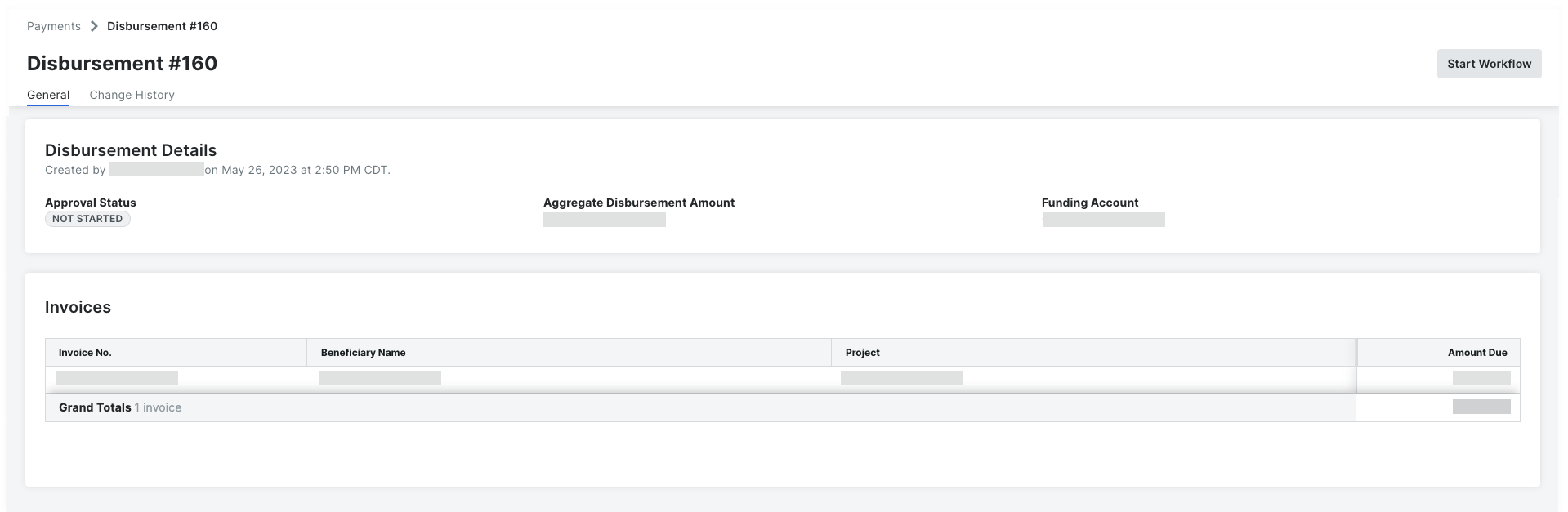

- Before it is authorized, the disbursement page includes the Disbursement Details and Invoices cards.

- After it is authorized, the disbursement page includes the Disbursement Details, Drawdown, and Payments cards.

Examples

The examples below show you the differences between authorized and unauthorized disbursements. To learn more, see Authorize Disbursements.

Examples

In the examples below, the Start Workflow and Show/Hide Workflow buttons only appear if your company has implemented a Payments Workflow. See Best Practices for Creating a Payments Workflow.

Before a Disbursement is Authorized

Before a disbursement is authorized, the General tab contains the Disbursement Details and Invoices cards.

Disbursement Details

The Disbursement Details card includes this information:

| Field | Description |

|---|---|

| Workflow Status | Shows the current approval status of the disbursement. This field only appears when the Company level Workflows tool is enabled in your company's Procore account. To learn about statuses, see What are the default statuses for a disbursement in a Payments Workflow for Procore Pay? |

| Aggregate Disbursement Amount | Shows the total sum of all invoice payments for the disbursement. |

| Funding Account | Shows the bank account funding the disbursement. |

Invoices

The Invoices card includes this information:

| Field | Description |

|---|---|

| Invoice No. | Click the hyperlink to open each invoice in the Project level Invoicing tool. |

| Beneficiary Name | Shows the beneficiary's name for each invoice. |

| Project | Shows the project name for each invoice. |

| Amount Due | Shows the amount due for each invoice. |

After a Disbursement is Authorized

After a disbursement is authorized, the General tab contains the Disbursement Details, Drawdown, and Payments cards.

Disbursement Details

The Disbursement Details card includes this information:

| Field | Description |

|---|---|

| Workflow Status | Shows the current workflow status of the disbursement. This field only appears when the Company level Workflows tool is enabled in your company's Procore account. To learn about statuses, see What are the default statuses for a disbursement in a Payments Workflow for Procore Pay? |

| Aggregate Disbursement Amount | Shows the total amount of the disbursement. This is the full sum of all invoice amounts included in the disbursement. |

| Funding Account | Shows the account that funded the disbursement. |

Drawdown

The Drawdown card includes this information:

| Field | Description |

|---|---|

| Funding Account | Shows the funding account for the drawdown. |

| Drawdown Method | Shows the method used to obtain the drawdown. |

| Date Initiated | Shows the date the drawdown request was started. |

| Drawdown Status | Shows the status of the drawdown request. See What are the default drawdown statuses in Procore Pay? |

| Drawdown Amount | Shows the total dollar amount of the drawdown. |

Payments

The Payments card includes this information:

| Field | Description |

|---|---|

| Procore Check No. | Shows the check number for the invoice payments. |

| Procore Invoice No. | Shows the Procore project's invoice number associated with the payment. |

| Procore Project | Shows the name of the Procore project associated with the invoice. |

| Beneficiary Name | Shows the beneficiary of the payment. This is the 'Contract Company' named in the commitment. |

| Beneficiary Bank Account | Shows the beneficiary's bank account information. |

| Payment Method | Shows the payment method. |

| Date Initiated | Shows the date the payment order was started. |

| Payment Status | Shows the status of the payment order. See What are the default payment statuses in Procore Pay? |

| Payment Amount | Shows the total dollar amount of the invoice payment. |

View Change History

Optional. To view user and system actions related to the disbursement, click the Change History tab. The Change History tab keeps track of this information.

| Field | Description |

|---|---|

| Date | Shows the date the action occurred. |

| Action By | Shows the name of the user who performed the action. |

| Changed | Describes the action. |

| From | Shows the From value of the action, if applicable. |

| To | Shows the To value of the action, if applicable. |

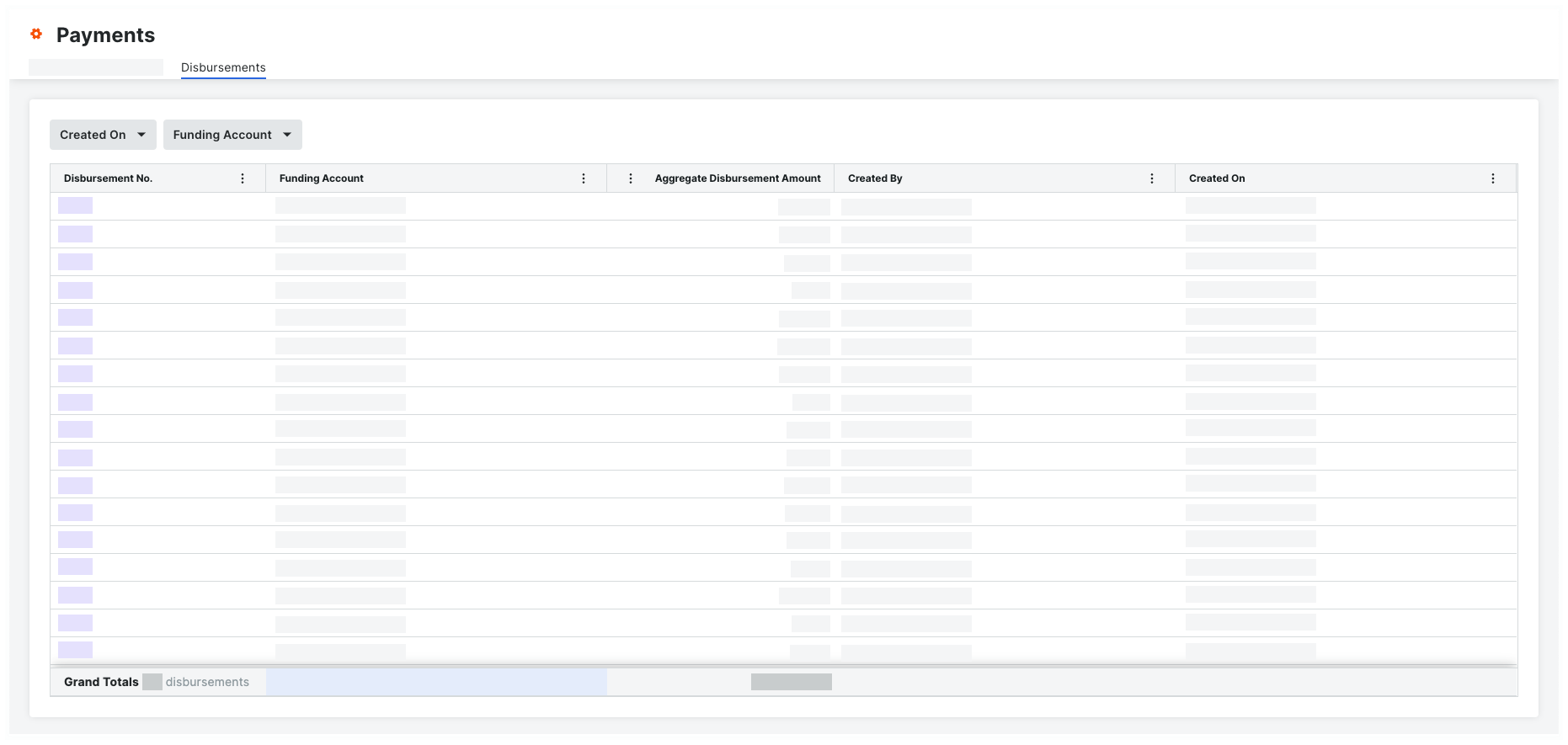

View a Disbursements List

- Navigate to the Company level Payments tool.

- Click the Disbursements tab.

Tip

Don't see the Disbursements tab? To view this tab, your Procore user account must be assigned the Payments Disburser or Payments Admin role. - In the Disbursements tab, the table lists all the disbursements.

- Optional. Change the sort order using these options:

- Created On. Click the button and select one of these options from the drop-down menu:

- Last 30 days. Shows only the disbursements created in the last thirty (30) days.

- Last 60 days. Shows only the disbursements created in the last sixty (60) days.

- Year to Date. Shows all of the disbursements created in the past year.

- Funding Account. Click the button and select one of your company's funding account options from the drop-down menu.

Tip

- How do you add a funding account to the drop-down menu? See Add Funding Accounts.

- Created On. Click the button and select one of these options from the drop-down menu:

Enable Lien Waivers

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Payment Processing tab is active by default. - Click the Payment Requirements tab.

The Lien Waivers page is active by default. - Under Lien Waiver Settings, move the Allow Lien Waivers to be Enabled on All Projects toggle to the ON or OFF setting:

Option Setting Description

ON - Invoice administrators can complete the steps in Enable Lien Waivers & Set Default Templates on Projects, Preview Lien Waivers on Project Invoices, and View Lien Waivers on Project Invoices.

- Invoice contacts in the payee environment can complete the steps in Sign Lien Waivers on Project Invoices and View Signed Lien Waivers on a Project.

OFF - Invoice administrators cannot perform the above steps.

- Turning the setting OFF does:

- NOT remove any existing lien waiver data from Procore.

- NOT hide the 'Lien Waiver Templates' table in the Company level Payments tool.

- NOT hide any lien waivers that were signed on project invoices before this setting was disabled.

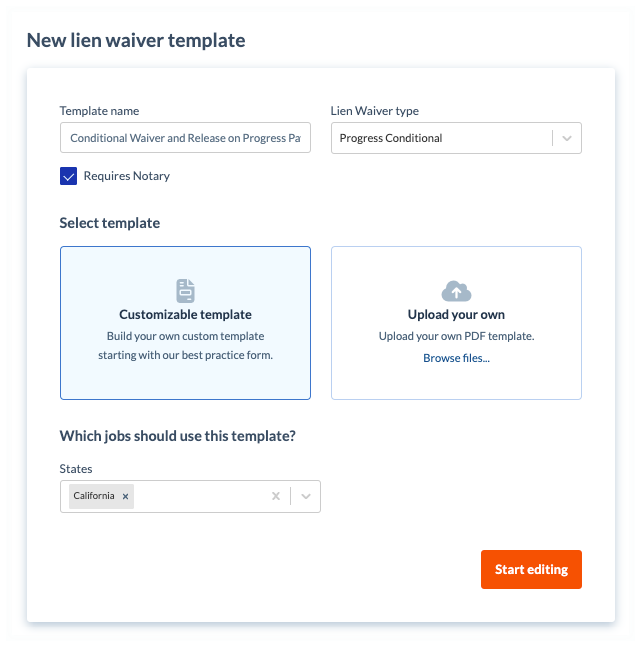

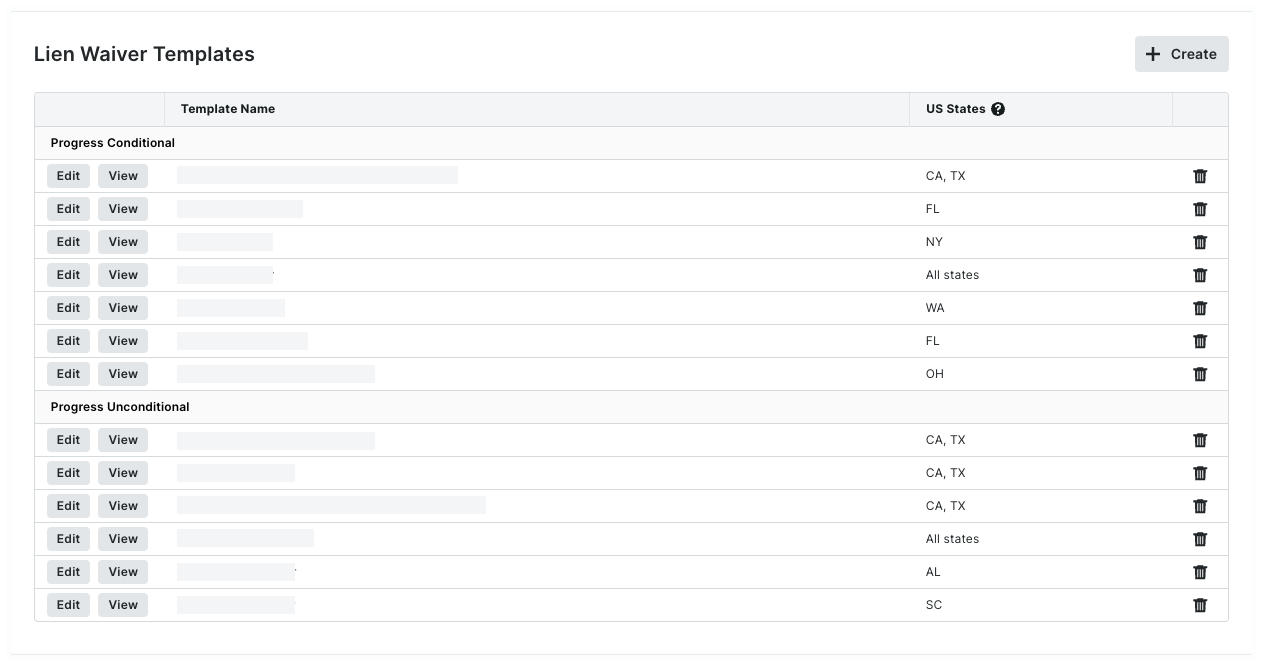

Create Lien Waiver Templates

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payment Settings page. The External Bank Accounts tab is active by default. - Click the Payment Requirements tab.

- Click the Lien Waivers page.

- Click Create.

This opens the Create Lien Waiver Template panel. - Under New Lien Waiver Template, do the following:

Note

An asterisk (*) below indicates a required field.- Template Name*

Type a name for the template. - Lien Waiver Type*

Select the type of lien waiver.Tip

What does each type mean? To learn about each option, see What types of lien waiver templates can you create? - Optional: Requires Notary.

Mark the checkbox to include space for a notary public's signature and legal seal. Clear the checkbox to omit this space.

- Template Name*

- In the Select Template area, choose one of these options:

- Customizable Template

Click this option to build your own custom template using our best practice form. - Upload Your Own

Click this option and then click the Browse Files button to select a PDF file to upload from your computer or network.Note

If your PDF file contains pre-built form fields, the placeholders for those form fields are NOT imported.

- Customizable Template

- Under Which jobs should use this template? do the following:

- States. Choose from these options in the drop-down list:

- To apply the template to all states and territories, select All States. This is the default setting.

- Select the applicable options to apply the template to specific states and territories. You can select one (1) or multiple options.

Tip

Does the list of states include all of the states and territories of the United States? Procore's States list includes all 50 states, the Federal District (Washington D.C.), and three (3) major territories (Guam, Puerto Rico, and the U.S. Virgin Islands).

- States. Choose from these options in the drop-down list:

- Click Start Editing.

- In the template, use the controls in the text editor to add content and adjust the formatting and layout of the template.

- Optional: Under Variables, click and drag any variable into the appropriate position on the template.

- Optional: To preview the template, click Preview.

Note

As you build your template, Procore recommends previewing it to ensure that the finished template provides you with the desired result. To quit the Preview Template window, click the Close button. - Click Create.

Procore adds your template to the Lien Waiver Templates table.

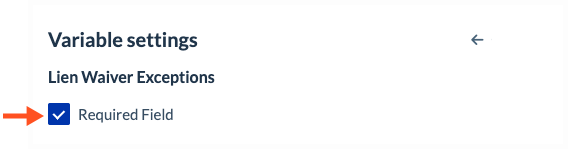

Edit Lien Waiver Templates

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Payment Processing tab is active by default. - Click the Payment Requirements tab.

The Lien Waivers page is active by default. - In the Lien Waiver Templates table, locate the template to update. Then click Edit.

This opens the Edit Lien Waiver Template panel. - Review the template and make the desired changes.

- To change the copy, update the body of the template as needed.

- To remove a variable placeholder, click the placeholder in the body of the template and press DELETE.

- To add a variable placeholder, click a field in the Variables list and use a drag-and-drop operation to move the variable into the desired placeholder position.

Tip

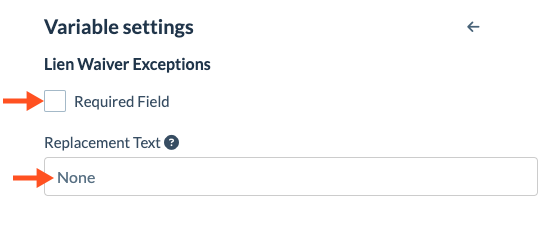

Want to make a field required or include replacement text for blank values? Certain variable placeholders have these options:

- To make the field required, place a mark in the Required Field checkbox as shown below.

- To make a field optional, remove the mark from the Required Field checkbox. For optional fields, you can also enter a word or phrase, so the text you enter appears when a value isn't available. For example, if there are no Lien Waiver Exceptions to include, the word 'None' will appear on the lien waiver instead of a blank field.

- To make the field required, place a mark in the Required Field checkbox as shown below.

- Optional. To preview your changes, click Preview.

- Click Save.

Any updates that you make go into effect only go into effect on the next project lien waiver. Updates have no effect on existing lien waivers.

Delete Lien Waiver Templates

- Navigate to the Company level Payments tool.

- Click the Payments Settings

icon.

icon.

This opens the Payments Settings page. The Payment Processing tab is active by default. - Click the Payment Requirements tab.

The Lien Waivers page is active by default. - Locate the template to delete in the table.

Tip

How is the data grouped? By default, Procore groups lien waiver templates by type. To learn more, see What types of lien waiver templates can you create in Procore? - Click the

trash can icon to delete the template.

trash can icon to delete the template.

- In the Delete Lien Waiver Template? message, choose an option:

- To keep the template, click Cancel.

- To permanently remove the template, click Delete.

Once deleted, the template no longer appears as a selection in the Invoice Settings. See Enable Lien Waivers & Set Default Templates on Projects. Any previous lien waivers generated from the template on the project's existing invoices can continue to be previewed, signed, and viewed.