| HOW TO SET UP JOB COST |

|

|

First Steps

- Once the project is bought out, a profit expectation meeting should be held with the entire team to determine and updated goal for Gross Profit projection. A mutually agreed upon contingency should be established between the PM and the PD. This contingency must be shown under phase code 17250.

General Set Up

- Summary Page:

- General Project Data

- Financial SUmmary of the Project

- 1000's Phase Codes

- General Conditions

- Special Conditions

- 2000's - 16000's Phase Codes

- 17000's

- 17050 - Performance and Payment Bond Cost

- 17150 - General Liability Insurance

- 17155 - Builder's Risk Insurance

- 17250 - Contingency (this value is reported on summary page)

- 17400 - A/E Fees

|

- 18000's

- Un-Subcontracted Work

- Cost that potentially will be spent based on history or items specific to this project.

- Here is the most opportunity for Profit Gain or Profit Fade

- If cost is spent with subcontractor's, perform internal change order to move money to subcontractor phase code as change orders are processed.

- 19000's Phase Codes

- Owner Allowances as defined by AIA

- This means that it is truly defined as an Owner Allowance in our contract.

- If the cost ends up more than the allowance, we get a change order to increase for the difference.

- If the cost ends up less than the allowance, we issue a credit change order in the amount that is less than the allowance.

- As defined, we CANNOT make or lose profit on allowances

- Ensure your projections on these phase codes reflect this.

|

| PHASE CODES |

|

|

SUBCONTRACT PHASE CODES:

Phase Codes 2000's through 16000's - General

- Generally reserved for subcontracted work

- An "S" next to the Phase Code indicates a subcontract has been interfaces in Vista

- Only assign 1 phase code per Subcontract Agreement

- Be consistent with the Phase Codes for scopes of work

- i.e. Drywall should always be 9250

- Standard Phase Codes - Vista Report

2000's - 16000's PHASE CODES

The following scopes of work have Phase Codes in the 1000's and 2000's. Set up depending on how your contract for this scope of work (ie if it is or is not included in GC's)

- Surveying: 1050 or 2000

- Man & Material Hoist: 1540 or 2005

- Temporary Stairs: 1542 or 2010

- Cranes: 1545 or 2015

- Trash Chute: 1552 or 2020

- Temp Fencing: 1562 or 2025

- Final Cleaning: 1570 or 2030

- Barricades & Traffic Control: 1030 or 2035

17000's PHASE CODES

- 17050: Payment and Performance Bond

- Actual cost from Assured Partners

- 17150: General Liability Insurance

- 0.85% of Contract Amount

- Will also be charged to the job on additive change orders as well

- 17155: Builders Risk Insurance

- Actual Cost from Assured Partners

- 17250 - Contingency (see further info)

- This is is Brinkmann Contingency

- 17400 - Architects/Engineers/3rd Party Consultants Fee

- Utilize 17400-1, 17400-2, etc. (If you have multiple contracts with different parties)

17250 - Contingency

- Unknown Exists on all projects ---> RISK!!

- Amount of contingency to carry has many factors:

- Product Type

- Subcontractor Risk

- Quantity of new subs that we haven't worked with before

- Were any of the subs that we hired substantially lower than the 2nd bidder? (i.e. greater than 20%)

- Will weather be a factor?

- New client and/or history with existing client

- Incomplete drawings --> incomplete buyout

- New market we are working in

- New product we are building

- Some of the above items can be accounted for the in 18000 phase codes

- Finalization of Contingency

- Profit Expectation Meeting (at about 85% buyout)

- Input and Risk discussion with entire team inclusive of Director and Vice President responsible for overseeing the project

|

18000 Phase Codes: Unsubcontracted Work

- Cost that potentially will be spent based on the project type, history, or items specific to this project.

- The most opportunity for Profit Gain or Profit Fade

- If costs are spent with subcontractors from 18000 phase codes, perform internal change order to move money to subcontractor phase code as change orders are processed.

- Payroll Charged to 18000 phase codes

- If you are going to charge payroll (Brinkmann Labor0 to an 18000 phase code, it MUST be 18000-1 through 18000-9.

- UltiPro is limited to 6-digits for payroll

- Don't set up an 18000 phase code for a scope of work that you will eventually subcontract for.

- Set up in the 2000's through 16000's

- General Number Recommendation:

- 18000-1 through 18000-9 for those that you want to charge payroll

- 18000-5, 18000-10...

- Determining Projected Cost for 18000 Phase Codes

- Review other similar projects job costs

- Discuss with other PM's or Directors

- Perform an Estimate

- Collaborate with your Superintendent.

19000 Phase Codes

- Owner Allowances as defined by AIA

- This means that it is truly defined as an owner allowance in our contract

- If the costs end up more than the allowance, we get a change order to increase for the difference.

- If the costs end up less than the allowance, we issue a credit change order in the amount that is less than the allowance.

- As defined, we CANNOT make or lose profit on allowances

- Ensure your projections on these phase codes reflect this.

|

| READING A JOB COST REPORT |

|

|

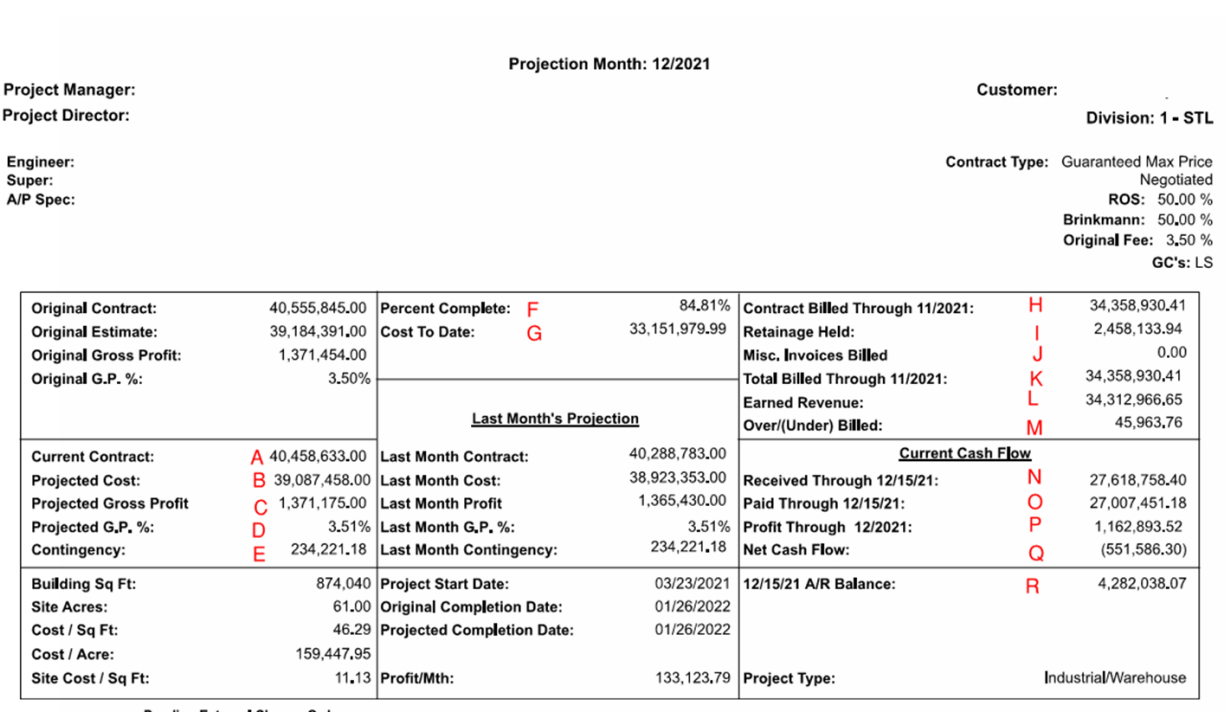

| A |

Current Contract |

Original Contract + Owner Change Orders (that have been interfaced) |

| B |

Projected Cost |

Total Projected Cost for all Phase Codes. Will match the total project cost summary at the end of the job cost report. |

| C |

Projected Gross Profit |

Current contract minus Projected Cost (C = A - B) |

| D |

Projected Gross Profit % |

Projected Gross Profit divided by Projected Cost (D = C / B) |

| E |

Contingency |

Projected Cost indicated in Phase Code 17250 |

| F |

Percent Complete |

Cost to Date divided by Projected Cost (F = G / B) |

| G |

Cost to Date |

Total subcontracts billed to date (inclusive of retention), internal allocations, payroll, and other non-subcontract invoices that have been approved. |

| H |

Contract Billed to Date |

Amounts that have been billed to the owner via AIA Pay Application |

| I |

Retainage Held |

Total amount of retainage that has been withheld - matches total on most recent pay application |

| J |

Misc. Invoices Billed |

Non-AIA Pay Application invoices submitted (i.e.) direct reimbursibles - such as permit fees - ENSURE ACCOUNTING GETS COPIED ON THESE INVOICES) |

| K |

Total Billed |

Contract Billed to date plus Misc. Invoices Billed (K = H + J) |

| L |

Earned Revenue |

Cost to Date plus (Projected Gross Profit Times Percent Complete) (L = G + (C*F)) |

| M |

Overbilled / Underbilled |

Total billed minus Earned Revenue

(M = K - L)

|

| N |

Received Through |

Total payments received |

| O |

Paid Through |

All paid invoices, internal allocations, and payroll |

| P |

Profit Through |

Projected Gross Profit times Percent Complete (P = C * A) |

| Q |

Net Cash Flow |

Received minus Paid minus Profit (Q = N-O-P) |

| R |

A/R Balance |

Accounts Recived (Projected Gross Profit times Percent Complete) (L = G + (C*F)) |

|

| GENERAL CONDITIONS |

|

|

What are they?

- General Conditions are.....

Lump Sum vs. Cost of Work

- Have a clear understanding of what your owner contract says in regards to how General Conditions are to be evaluated.

- Can’t project over or under the Contract Amount without adding the 1700 – Lump Sum GC Reconciliation Phase Code or you have to adjust your Projected Gross Profit up or down

- Projecting GC’s Over Contract Amount

- Need to understand if you have enough contingency/return owner savings to compensate for the overage (see example on following pages)

- Cost of Work General Conditions

- Costs are generally no different than any other cost such as drywall or concrete when it comes to determining return owner savings and contingencies.

|

- GC Forecast Spreadsheets

- Vist Reports

- BC JC Detail New

- BC JC Detail PM

- BC JC Detail PR

| Phase Code 1025 - Trucks |

$900/Bi-Weekly Payroll |

| Phase Code 1047 - Mobile Equipment |

$125/Bi-Weekly Payroll |

| Phase Code 1048 - Procore/Tech Fee |

0.25% of Original Contract Amount |

| Phase Code 1600 - Safety Fee |

0.18% of Original Contract Amount |

|

| BALANCING A JOB COST |

|

INTERNAL BUDGET REALLOCATIONS

Why do Budget Reallocations?

- Reflect the true line-item story within job cost of how we performed on each scope of work

How to do Budget Reallocations

NEGATIVE ESTIMATE REMAINING

What actually is this?

- Estimate Remaining = Projected Cost - Actual Cost to Date

- A negative value means you have already spent more than you are projecting to spend

How to Solve This?

Reasons They Exist

-

Direct Reimbursable/Refundable Deposit

-

Lump Sum General Conditions Reconciliation - discussed previously

-

Legal Dispute/Insurance Claim

-

Sub is overbilled:

-

Since GC Pay does NOT allow subs to bill for change orders that aren't approved, this should only occur after the sub has billed 100% and you have approved it.

-

The negative estimated remaining occurs if you enter a deduct change order to the sub after they are 100% billed and then project the reduced contract amount.

-

Vista DOES NOT adjust the actual cost to date automatically - this is an accounting function.

|

- (Continued)

- Option A (Preferred Method): Sub needs to submit new bill reflecting the credit change order and reduced contract amount and once it flows through GP Pay and Vista, the actual cost to date will be reduced -

- OR

- Option B: If the sub isn't going to submit a new bill, and you are just going to take the deduct out of their retention, you will need to get with accounting and have them adjust the final bill in Vista, which will then reduce the actual cost to date.

- Decrease the amount of the Actual Cost

- Non-Subcontract Phase Code:

- Generally if a negative estimated remaining exists on a non-subcontract phase code, this is a result of not performing a thorough review of your job cost before turning it in.

- Pending Owner Change Order

- Should only occur if we have incurred some costs and you haven't finalized the amount of the owner change order yet and you don't want to inaccurately reflect a loss.

- If ou have contingency left of cover the amount, in lieu of a Pending Owner Change Order amount, an option is to reduce the contingency to cover this amount.

- If negative estimated remaining for Pending Owner Change Orders exists for greater than 1 projection cycle, this has the appearance of an inherent risk - need to resolve them monthly with the client and if not, elevate the issue to Director or above.

- When to "approve" a change order in Vista and reflect it in your Job Cost:

- When YOU are comfortable enough that the Owner is going to pay us for it!

- Timing!

- May happen depending on the dates that you entered in change order for subs or owners.

- I.E. if you have performed a December 2021 projection and you interface a change order in January 2022

- Best Practice: Date and interface all change orders for the month you want them reflected in that projection.

How to Report Them

-

Tracked and reviewed monthly at a Company Level to review potential Risk that exists

-

Need to have your Director approve negative estimated remaining before you turn in your Job Cost Projection

-

When turning in projections, identify the following for each negative estimating remaining:

-

Job #, Phase Code, Phase Code Description, Amount of Neg Est Remaining, Reason for it, Anticipated Resolution Date

|

| |

|

| |

|